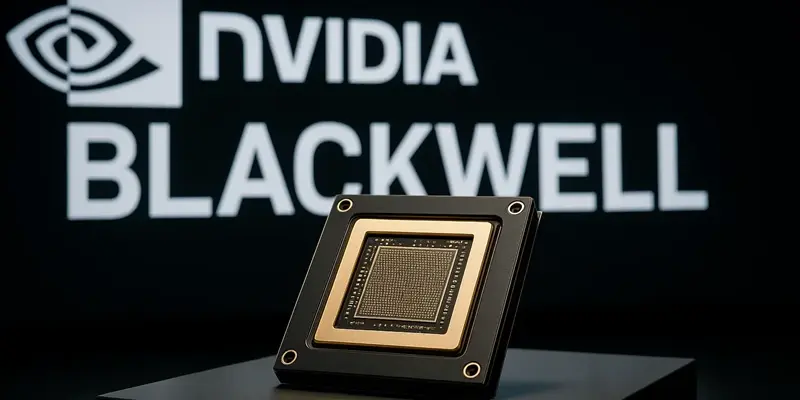

NVIDIA stands at a critical juncture as it prepares to introduce the Blackwell chip into China’s competitive AI market, aiming to recover lost market share from firms like Huawei. The landscape is markedly different following stringent US-China geopolitical maneuvers that have reshaped tech collaborations. A pivotal move for NVIDIA, the Blackwell chip’s production is slated for completion by midyear. At an enticing price point—half that of the ##0 AI accelerator—this chip strategically appeals to price-sensitive clients. However, a closer look reveals performance sacrifices; the Blackwell employs GDDR7 memory rather than the high-bandwidth HBM and sidesteps TSMC’s CoWoS technology. These are conscious omissions in line with US policy restrictions, inevitably leading to performance compromises compared to more mainstream Western AI solutions like Huawei’s Ascend 910C chip.

Navigating Market Challenges

The Blackwell chip’s market entry is crucial as NVIDIA aims to counterbalance the sharp revenue dip experienced in recent years due to increasing restrictions. Before these developments, NVIDIA enjoyed robust sales of its advanced AI GPUs, including flagship models such as the #00 and A100. Despite a challenging market and diminished foothold, NVIDIA views China as a potential $50 billion opportunity, indicating the country’s allure despite the geopolitical constraints. Central to NVIDIA’s strategy is leveraging its comprehensive software ecosystem, CUDA, which is poised to act as a unique differentiator. CUDA’s robust capabilities and extensive application support provide NVIDIA with a competitive edge. This approach reflects a longer-term vision of creating value beyond hardware, laying groundwork for growth through technological synergies and partnerships that transcend immediate geopolitical limitations.

Strategic Maneuvering for Growth

NVIDIA’s approach with the Blackwell chip highlights a strategic shift focusing on affordability, compliance, and maintaining a strong market presence in China. This strategy contrasts with NVIDIA’s historic focus on high-performance, high-cost solutions, balancing affordability with adherence to policies. The primary goal is to stay relevant in China’s dynamic AI market by offering a competitively priced chip that meets regulatory standards without sacrificing NVIDIA’s reputation for quality and innovation. While the Blackwell chip may not outshine its competitors in pure performance, NVIDIA’s extensive ecosystem and strategic pricing offer significant value. This move signals NVIDIA’s intent to rebuild its market share by understanding market dynamics and consumer requirements within a complex geopolitical context.

In a broader perspective, the Blackwell initiative illustrates how tech companies might navigate global markets amid shifting policies. NVIDIA’s emphasis on adaptability and compliance could serve as a model for other tech firms facing similar challenges, particularly in leveraging pricing strategies and extensive software resources to regain market share.