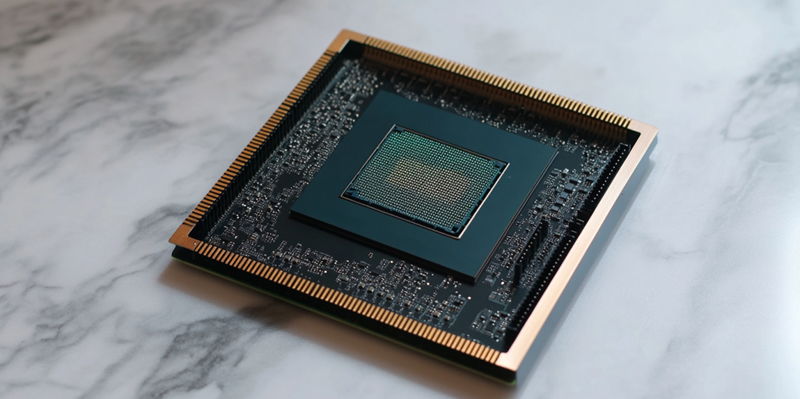

Intel’s recent launch of the third-generation Gaudi AI accelerators, paired with the Xeon 6 CPUs, represents a strategic maneuver to solidify its position within the AI and data center market. Instead of engaging in a high-stakes rivalry against Nvidia’s top-tier #00 accelerators or AMD’s MI325X, Intel has taken a distinctive path. The company is targeting its new AI technology towards businesses that do not necessarily demand the highest performance metrics but do require cost-effective and flexible solutions. According to Intel CEO Pat Gelsinger, the focus is on offering maximum value through efficient costs and adaptable use cases.

Targeting Moderate AI Needs

Emphasizing Cost Efficiency and Flexibility

As the head of Intel’s AI business, Anil Nanduri recently highlighted a noticeable shift in enterprise priorities. Many companies are starting to weigh factors beyond just raw performance. They are increasingly considering aspects like return on investment (ROI) and power consumption costs. This trend plays directly into Intel’s strategic objectives with the Gaudi 3 accelerators. By stressing overall value and cost savings, Intel aims to appeal to enterprises keen on optimizing their AI budgets. The Gaudi 3’s architecture specifically caters to these requirements, designed with enterprise customers in mind who need more flexibility.

One of the pivotal selling points for Gaudi 3 lies in its open ecosystem approach. Unlike Nvidia, which offers more proprietary AI systems, Intel has opted to support standards like Ethernet and PCI Express. This choice significantly simplifies scalability and inferencing solutions for businesses, allowing them to adapt and expand their AI infrastructure without getting locked into a single vendor’s ecosystem. This approach aligns with broader industry movements towards improving interoperability and modularity in data center environments.

Responding to Enterprise Feedback

Justin Hotard, another executive at Intel, emphasized that the design considerations for Gaudi 3 were heavily influenced by enterprise client feedback. Companies today are increasingly looking for customizable solutions that can be tailored to their unique AI workloads and operational needs. Intel’s Gaudi 3 has been developed with this flexibility in mind, enabling businesses to craft bespoke AI strategies that don’t necessarily rely on the highest possible performance but offer meaningful ROI and reduced operational costs.

Looking ahead, Intel has bold financial expectations for its newest AI accelerator. The company aims to generate approximately $500 million in revenue from Gaudi 3 by 2024. While this figure pales in comparison to Nvidia’s staggering $26 billion quarterly earnings from its data center business and even falls short of AMD’s Q2 revenue of $2.8 billion, it reflects a calculated and strategic move to capture a specific slice of the AI market. Intel is betting that there is ample demand for more affordable and flexible AI solutions, even if they don’t match the high-end capabilities of market leaders.

A Niche Market Focus

Alternative to High-End AI Training

The general sentiment emerging from Intel’s strategy points to an understanding that sheer performance is not the be-all and end-all for many businesses. Intel’s third-generation Gaudi accelerators offer a viable alternative for companies that prioritize cost and adaptability over extreme performance. While Nvidia and AMD continue to dominate the high-performance end of the spectrum, Intel’s approach opens doors for enterprises evaluating AI investments through a different lens. In many cases, the decision to choose an AI solution hinges on operational cost-effectiveness and flexibility rather than outright performance.

This clear deviation from competing in the high-end performance arena signifies a broader shift in Intel’s strategic direction. By aligning its business model with the needs of cost-conscious enterprises, Intel hopes to carve out a sustainable niche in the AI market. This strategy not only diversifies its revenue streams but also strengthens its position as a provider of comprehensive and scalable AI solutions that go beyond mere performance metrics. The emphasis on ROI and adaptability could prove to be a winning formula in an industry constantly seeking the balance between cutting-edge performance and operational feasibility.

Strategic Pivot Towards Cost-Effectiveness

Intel’s bold move to focus on cost-effective, flexible AI solutions aligns perfectly with the growing trend among enterprises to seek more than just raw computing power. As companies grapple with rising operational costs and the need for sustainable investments, Intel’s Gaudi 3 accelerators present an appealing proposition. The company’s strategy to promote an open ecosystem further enhances its attractiveness, offering businesses the freedom to scale and adapt their AI infrastructure as needed, without being tied down by proprietary systems.

While Intel’s financial targets for Gaudi 3 may be modest compared to its giants in the industry, the long-term advantages of this approach are significant. By solidifying its position in a niche market, Intel could potentially capture a loyal client base that values cost-effectiveness and operational flexibility. In a technology landscape where adaptability often trumps sheer power, this strategic pivot could well position Intel as a key player in the evolving AI and data center market.

Conclusion

Intel has recently introduced its third-generation Gaudi AI accelerators, combined with Xeon 6 CPUs, in a strategic effort to enhance its status in the AI and data center industry. Unlike competing fiercely with Nvidia’s high-end #00 accelerators or AMD’s MI325X, Intel has opted for a unique strategy. The company is focusing its latest AI technology on enterprises that don’t necessarily need top-tier performance but do require budget-friendly and versatile solutions. This move aims to provide these businesses with the most value by offering efficient cost structures and flexible applications. Intel CEO Pat Gelsinger highlighted that the primary objective is to deliver maximum value through affordable options and adaptable use cases. Rather than chasing after peak performance, Intel is carving out a niche by addressing the broader market that demands practicality and economic efficiency. This approach underscores Intel’s commitment to meeting diverse business needs, ensuring that companies of various sizes can benefit from reliable and economically feasible AI solutions.