In an era where online interactions dominate daily life, ensuring the authenticity of digital identities has become a pressing challenge, with over half of UK adults expressing distrust in technologies designed to protect them. Imagine a scenario where a simple age check for accessing restricted content or purchasing goods online could either safeguard vulnerable users or inadvertently block legitimate access due to technological errors. This dichotomy lies at the heart of AI-driven identity verification, a rapidly evolving solution that promises to enhance online safety and combat fraud. This review delves into the intricacies of this technology, exploring its capabilities, public perceptions, and real-world implications within the UK’s stringent regulatory framework.

Understanding AI Identity Verification

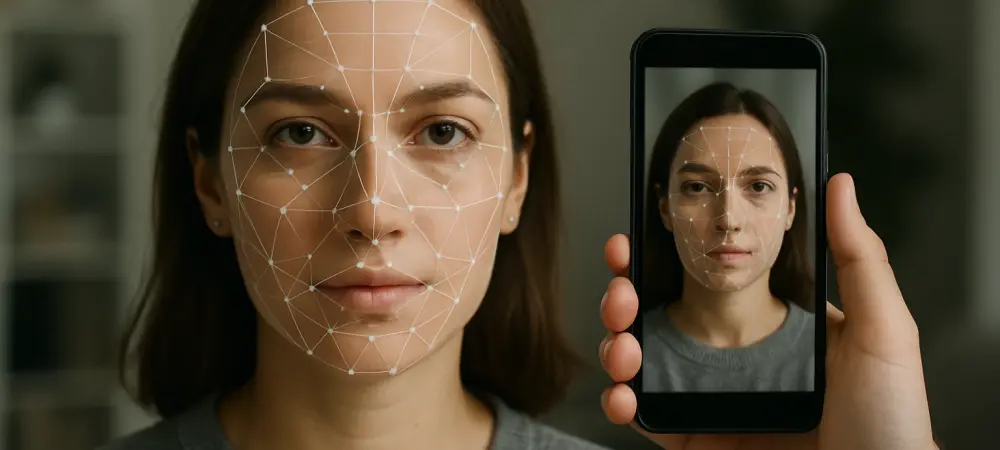

AI identity verification represents a transformative approach to securing online spaces by automating processes like age checks and fraud detection. At its core, this technology leverages sophisticated algorithms to analyze a range of data points, ensuring that users are who they claim to be. Its emergence aligns with growing concerns over online safety, particularly as digital platforms expand access to sensitive content and services. The relevance of this technology is underscored by regulatory mandates such as the UK’s Online Safety Act, enforced by OFCOM, which requires robust identity checks to protect younger users from inappropriate material. As these regulations tighten, with broader implications expected over the next few years, AI verification stands as a critical tool for compliance. This review aims to unpack how the technology functions within this evolving landscape and addresses the challenges it faces in gaining widespread acceptance.

Technical Features and Performance Metrics

Cutting-Edge Authentication Techniques

AI identity verification systems rely on a blend of traditional and digital identity attributes to confirm user authenticity. These include personal details like name, address, and date of birth, alongside digital markers such as email addresses and device information. By cross-referencing this data, the systems create a comprehensive profile that minimizes the risk of unauthorized access. Performance metrics for these tools are notably high, with industry reports indicating an average accuracy rate of 97%. This precision is crucial for applications requiring strict age verification or identity confirmation, ensuring that most legitimate users are granted access without issue. Such reliability positions AI verification as a cornerstone for secure digital interactions.

However, the effectiveness of these authentication methods hinges on continuous updates to counter evolving threats. As fraudsters adapt their tactics, the technology must refine its algorithms to maintain this high accuracy, particularly in high-stakes environments like financial transactions or restricted content access.

Robust Anti-Fraud Mechanisms

Beyond basic authentication, AI verification incorporates advanced anti-fraud technologies to tackle sophisticated threats. Techniques like proxy piercing detect attempts to mask a user’s true location, a common tactic used by malicious actors. Additionally, systems scan for subtle signs of humanity, such as blood flow under the skin, to distinguish real users from deepfake or synthetic identities. These mechanisms are vital in an age where digital deception, including the creation of counterfeit identity documents, poses a significant risk. By integrating such cutting-edge tools, AI verification enhances the reliability of online platforms, reducing the likelihood of fraudulent access. This is particularly important for maintaining trust in sectors where security is paramount.

The ongoing development of these anti-fraud capabilities reflects a proactive stance against emerging risks. As threats like deepfake technology become more prevalent, the ability of verification systems to adapt and innovate will determine their long-term success in safeguarding digital ecosystems.

Trends and Public Sentiment

Public perception of AI identity verification reveals a significant trust gap, with a recent study showing that 58% of UK adults lack confidence in mobile apps’ ability to accurately verify ages, especially for individuals aged 16 to 21. This skepticism stems from broader concerns about technology’s role in personal security and its potential for error or misuse. The disconnect between technological capability and user trust remains a critical barrier to adoption. Demographic differences further complicate the landscape, with younger users showing slightly more openness—36% of 16-24-year-olds trust the technology compared to just 6% of those aged 55 and older. These variations highlight the influence of familiarity and comfort with digital tools on acceptance rates. Older adults, often less accustomed to such innovations, exhibit greater caution, reflecting a generational divide in attitudes.

Emerging trends also indicate shifting user behaviors, with many expressing frustration over verification processes perceived as intrusive or inconvenient. As platforms integrate these systems to comply with regulations, addressing these sentiments through streamlined designs and transparent communication will be essential to improving public reception and fostering confidence.

Applications and Real-World Effects

AI identity verification finds extensive application in online platforms, particularly for enforcing age restrictions on content and goods under the UK’s Online Safety Act. Social media sites, gaming platforms, and e-commerce outlets increasingly rely on these tools to ensure compliance while protecting vulnerable users from harmful material. This deployment marks a significant step toward safer digital environments.

However, the impact on online commerce reveals a challenging balance between compliance and user experience. Research indicates that 52% of users are likely to abandon purchases if faced with verification steps like selfies or liveness tests. This statistic underscores the friction that such processes can introduce, potentially affecting business revenue and customer retention.

Notable use cases demonstrate attempts to mitigate these issues, with some platforms adopting less invasive verification methods to maintain engagement. Striking the right balance remains a key focus, as businesses and regulators collaborate to refine systems that prioritize both security and convenience in an increasingly regulated online space.

Obstacles and Constraints

Despite its promise, AI identity verification faces substantial hurdles, including public apprehension about deepfake manipulation, with 47% of individuals concerned about fraudsters bypassing systems using advanced fakery. Such fears are compounded by the risk of false negatives, where legitimate users are denied access due to technological inaccuracies, further undermining confidence in the technology.

User reluctance to engage with verification processes also poses a significant challenge, as many view these steps as cumbersome or privacy-invasive. This resistance is evident in the high drop-off rates during online transactions, highlighting the need for solutions that minimize disruption while maintaining robust security standards. Efforts to overcome these barriers include educational initiatives to demystify the technology and transparency in how data is handled. Privacy-first approaches are gaining traction as a means to reassure users, emphasizing minimal data collection and clear consent protocols. Addressing these concerns will be pivotal in shifting public opinion and ensuring broader adoption.

Prospects for AI Verification

Looking ahead, AI identity verification is poised for advancements in user-friendly design, with developers focusing on seamless integration into everyday digital interactions. Anticipated improvements aim to reduce the friction associated with verification, making processes faster and less intrusive while adhering to evolving regulatory standards over the coming years.

The long-term impact on online safety and commerce appears promising, as these systems could redefine how trust is established in digital spaces. Enhanced accuracy and anti-fraud measures will likely bolster security, while streamlined experiences may alleviate user frustrations, potentially increasing acceptance across diverse demographics.

Public familiarity will play a crucial role in shaping the future of this technology. As exposure to AI verification grows, alongside efforts to educate users on its benefits and safeguards, confidence is expected to rise. This gradual shift could pave the way for a more secure and trusted online environment, aligning technological innovation with societal needs.

Final Thoughts and Verdict

Reflecting on the exploration of AI identity verification, a stark contrast emerges between its impressive technical efficacy and the pervasive public distrust that hinders its acceptance. The technology showcases remarkable accuracy and anti-fraud capabilities, yet struggles against widespread skepticism fueled by fears of deepfake manipulation and inconvenient processes. Moving forward, actionable steps include prioritizing user education to clarify how these systems function and protect data. Industry stakeholders need to invest in transparent, privacy-first designs that reduce user friction while maintaining compliance with stringent regulations. Collaboration between developers, businesses, and regulators also proves essential in crafting solutions that address generational trust gaps. Ultimately, the verdict recognizes AI identity verification as a powerful tool with immense potential to enhance online safety, provided that efforts focus on bridging the trust divide. By innovating with user experience at the forefront and fostering greater public understanding, the path is cleared for this technology to achieve broader acceptance and redefine secure digital interactions.