The rise of Artificial Intelligence (AI) has sparked massive demand for advanced semiconductors, with industry leaders Taiwan Semiconductor (TSM), ASML, and Siltronic AG at the forefront. Driving the charge, TSM is a key player in manufacturing, ASML excels in lithography systems vital for chip production, and Siltronic AG supplies essential silicon wafers. The rapid progression of AI into arenas ranging from self-driving cars to medical diagnostics has thrust these giants into the center of an evolving technological narrative. As AI technology spreads, the need for more sophisticated semiconductors amplifies, placing these three companies in critical positions within the supply chain. Their concurrent strides propel not just their own growth but also invigorate the entire semiconductor industry with fresh vitality. This symbiotic relationship underscores the importance of these companies in a future powered increasingly by AI advancements.

TSM’s Specialized Chip Manufacturing Advantage

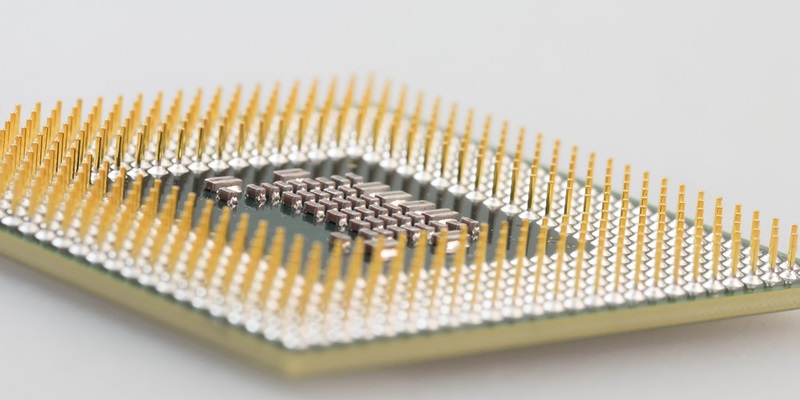

Taiwan Semiconductor, a name synonymous with state-of-the-art chip production, leverages its formidable expertise in crafting the sophisticated semiconductors that AI technologies crave. TSM’s advanced chips, while only a fragment of their product mix, command a substantial share of the company’s revenue stream, underscoring the heightened significance such specialized manufacturing holds in today’s tech landscape. The surge in AI-driven devices necessitates an escalating supply of these complex components, fueling TSM’s upward trajectory. Even as the market for standard chips sees fluctuations, the bespoke requirements of AI applications ensure a resilient demand for TSM’s specialized offerings.

The company’s prowess extends beyond mere production capabilities; TSM’s relentless pursuit of innovation ensures that their process nodes remain at the cutting edge. Their facilities are among a select few globally capable of producing the ultra-advanced chips that AI specifically demands. This positions TSM not just as a manufacturer but as an indispensable enabler of AI’s progressive march. With each AI breakthrough, the reliance on TSM’s chip mastery intensifies, carving for them a lucrative niche in this technological epoch.

ASML’s Unique EUV Lithography Systems

ASML stands as the unparalleled supplier of extreme ultraviolet (EUV) lithography systems, vital for creating intricate circuits on silicon wafers for high-end semiconductors pivotal to AI advancements. This unique position ensures ASML’s critical role in the semiconductor industry, securing long-term deals and sustaining its market leadership.

The company’s exclusivity, however, leads to lofty earnings multiples due to market excitement over its unique tech offerings, potentially leading to overvaluation and susceptibility to market adjustments. Despite this, the continuous evolution of AI tech implies a steady demand for ASML’s EUV systems, promising ongoing company growth amid possible market fluctuations. The balance between ASML’s vital tech contributions and market sensitivities makes it a key, yet volatile, player in the semiconductor space.

Siltronic AG: A Value Prospect in Silicon Wafers

Trading at a lower price-to-earnings ratio compared to its industry peers, Siltronic AG underscores the significance of silicon wafers in the semiconductor sector. While it doesn’t boast the market dominance of giants like TSM and ASML, Siltronic’s role in the semiconductor supply chain is essential, particularly as AI technologies surge the demand for chips. These wafers are the foundation for all semiconductors, meaning Siltronic’s success is tied to the quality and performance of AI-driven devices.

Siltronic may not have the same market allure as the larger industry players, but its specialization in silicon wafer manufacturing is crucial. The company’s products are vital for high-functioning semiconductor devices, making Siltronic a potentially stable and undervalued investment opportunity. As AI continues to necessitate advanced chips, Siltronic’s position in the market could see a favorable trajectory, offering investors a chance to tap into a key resource within the tech wave.