The global technology landscape is experiencing a monumental shift, driven by the relentless expansion of Artificial Intelligence. This AI revolution is not just reshaping software and services; it is fundamentally reordering the hardware supply chain, creating an insatiable appetite for one critical component: memory chips. The ripple effects are triggering a market supercycle, with global memory revenue soaring to an unprecedented $551.6 billion this year—a staggering 134% year-on-year increase. This article explores the powerful forces behind this surge, analyzes the stark contrast with other semiconductor sectors, and unpacks the tangible consequences for both corporations and consumers as the industry grapples with a new era of scarcity and soaring prices.

A Fundamental Shift in Market Dynamics

The semiconductor industry is no stranger to cyclical booms and busts. The most recent major upswing, between 2017 and 2019, was largely fueled by the build-out of massive cloud data centers, which required vast quantities of DRAM and NAND flash to store and process the world’s rapidly growing digital footprint. While significant, that cycle pales in comparison to the current AI-driven demand. The previous boom was about capacity; the current one is about performance and speed at an unprecedented scale. Unlike the broad-based demand from cloud infrastructure, the AI boom is driven by highly specialized, computationally intensive workloads that place extreme pressure on specific types of high-performance memory, creating a far more acute and volatile market environment.

The Underpinnings of the Memory Bottleneck

From Training to Deployment

The primary catalyst for the memory boom is a strategic evolution within the AI industry: the pivot from model training to large-scale inference. While training large language models is a one-time, computationally intensive task, inference—the process of using a trained model to make real-time predictions or generate content—is an ongoing, continuous workload that must be deployed at a global scale. This requires AI systems to have instant access to massive datasets, making high-capacity and high-bandwidth memory indispensable for responsiveness. Advanced hardware platforms, such as Nvidia’s Vera Rubin architecture, are further amplifying this trend by integrating next-generation processors with high-performance enterprise SSDs, solidifying memory’s role as a critical enabler of AI performance.

Diverging Fortunes in the Semiconductor Space

While the entire semiconductor industry is benefiting from the AI wave, the impact is far from uniform. The memory market’s projected 134% growth starkly contrasts with the more measured trajectory of the wafer foundry sector, which grew a modest 25% to $218.7 billion over the same period. This disparity stems from fundamental differences in their business models. The memory market is notoriously volatile, with prices fluctuating dramatically based on supply and demand. In contrast, foundries operate on long-term contracts and more predictable pricing structures. Furthermore, AI development currently favors a limited number of advanced-node manufacturing processes, concentrating foundry demand rather than lifting the entire sector equally.

The Consumer Cost of Enterprise Demand

The consequences of this enterprise-level demand crunch are now rippling outward and hitting the consumer market directly. With memory manufacturers prioritizing lucrative AI contracts, supply for consumer electronics is tightening, and prices are climbing. This forces device makers into a difficult position: either absorb the increased costs and sacrifice margins, pass the price hikes on to customers, or delay product launches altogether. The real-world impact of this squeeze has been evident, with examples like Valve attributing delays for its Steam Deck to component shortages, the price of the Raspberry Pi nearly doubling, and industry analysts forecasting significant price increases for upcoming generations of PCs and smartphones.

The Path Forward Through Innovation and Scarcity

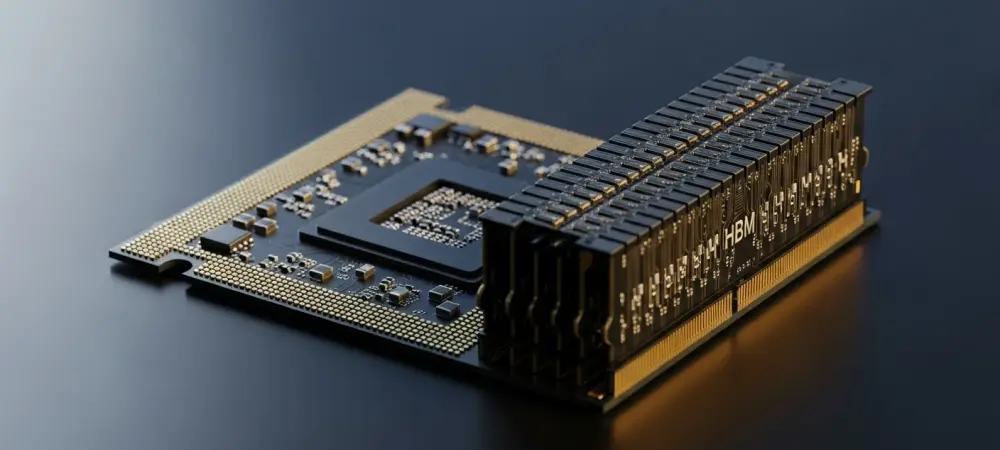

Looking ahead, the intense demand for high-performance memory shows no signs of slowing down. As AI models become more complex and their applications more widespread, the pressure on the supply chain will only intensify. This environment is accelerating innovation in memory technology, with a focus on next-generation High-Bandwidth Memory (HBM) and new interconnect standards designed to feed data to power-hungry AI processors more efficiently. However, building new fabrication plants is a multi-year, multi-billion-dollar endeavor, suggesting that supply will struggle to keep pace with demand for the foreseeable future. This imbalance indicates that elevated prices and supply constraints may become the new normal, reshaping product design and purchasing strategies across the tech industry.

Actionable Insights for a Volatile Market

The analysis reveals several critical takeaways. First, the shift to AI inference has permanently elevated the strategic importance of high-performance memory, making it a key bottleneck in technological progress. Second, the memory market’s inherent volatility means it will experience more dramatic price swings from the AI boom than the more stable foundry sector. Finally, the direct link between enterprise demand and consumer pricing is undeniable, meaning everyday tech will become more expensive. For businesses, this new reality necessitates proactive supply chain management and securing long-term contracts. For consumers, it may be wise to time major electronics purchases strategically or budget for higher costs on the next generation of devices.

Memory as the New Cornerstone of Innovation

In conclusion, the AI boom proved to be more than just another cyclical upswing for the semiconductor industry; it was a fundamental realignment that placed memory chips at the very center of the new digital economy. The staggering revenue growth underscored a simple truth: memory was no longer a simple commodity but the critical resource fueling the next wave of innovation. As AI continued its relentless advance, the ability to produce and procure high-performance memory dictated the pace of progress, separating the leaders from the laggards. In this new era, memory became the new digital gold, and the rush to secure it had only just begun.