The Unseen Engine of AI and Its Burgeoning Cost

The explosive growth of artificial intelligence is reshaping our world, but beneath the surface of sophisticated algorithms and powerful processors lies a critical bottleneck threatening to slow its momentum. The tech industry is grappling with a severe and escalating global shortage of memory chips, a crisis fueled directly by the AI sector’s insatiable demand for high-performance computing. This is not merely a challenge for data center operators; it is a shockwave poised to drive up the cost and limit the availability of a wide range of consumer electronics, from high-end PCs to budget smartphones. This analysis explores the origins of this supply crunch, its far-reaching consequences, and the long-term implications for both the AI industry and the everyday consumer.

From Cyclical Supply to Structural Scarcity

The memory chip market has historically been defined by its cyclical nature, with periods of oversupply and price drops followed by tightening inventory and price hikes. The current situation, however, represents a fundamental structural shift rather than a temporary market fluctuation. In the past, supply and demand were primarily driven by the PC and smartphone markets. Today, the relentless expansion of AI has introduced a new, voracious consumer of memory that operates on a different scale. The foundational components required for AI—specialized, high-bandwidth memory (HBM) and the latest generations of DRAM—demand a different manufacturing focus, creating a schism in the supply chain that has left traditional markets vulnerable. Understanding this pivot is essential to grasping why the current shortage is not a temporary inconvenience but a multi-year constraint on the entire technology ecosystem.

The Great Reallocation: How AI is Reshaping Manufacturing Priorities

The Strategic Pivot to High-Bandwidth Memory

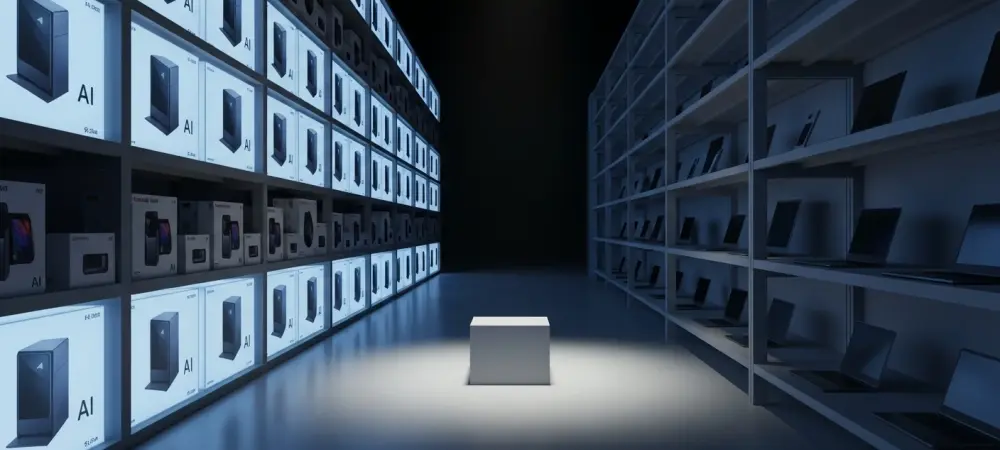

At the heart of the shortage is a strategic pivot by the world’s leading memory producers, including Samsung, SK hynix, and Micron. To capitalize on the lucrative AI market, these giants are reallocating significant wafer production capacity toward HBM and other advanced DRAM modules. These components are essential for powering the AI accelerators, such as GPUs, that train and run large language models. While a logical business move, this reallocation has inadvertently squeezed the supply of older but still ubiquitous memory types, such as DDR4 and LPDDR4. These chips remain the workhorses for the vast majority of personal computers, laptops, and mainstream smartphones, creating a production deficit that is now reaching a critical point.

Big Tech’s Stockpiling and the Squeezed Middle Market

The supply crunch is being dangerously exacerbated by the aggressive procurement strategies of major technology companies. Giants like Microsoft, Google, and ByteDance are placing massive, long-term, and sometimes open-ended orders to secure their supply chains for years to come. This practice allows them to effectively leapfrog smaller buyers, consuming a disproportionate share of available inventory and leaving little flexibility in the spot market. Industry investigations describe the resulting shortage as “acute,” with inventories hitting multi-year lows. As a result, prices for some conventional memory types have already doubled compared to levels seen at the start of the year, creating a two-tiered market where smaller device manufacturers are left to compete for the scraps.

The Ripple Effect on Consumer Electronics

The consequences of this manufacturing imbalance are no longer theoretical; they are rippling through the consumer technology sector with alarming speed. PC vendors and custom system builders are already warning of imminent price hikes, particularly for systems configured with higher amounts of RAM. The smartphone market is also under significant pressure, with industry analysts forecasting a decline in global shipments as rising memory costs disproportionately impact budget-friendly models. The bill-of-materials for a sub-$200 handset, for instance, is projected to rise by 20–30% due to memory costs alone—an increase that brands like Xiaomi and Realme will almost certainly be forced to pass on to consumers, threatening affordability in key growth markets.

A Multi-Year Bottleneck: The Road Ahead for Memory Supply

The consensus among industry experts is that this is not a short-term disruption but a prolonged constraint that will define the tech landscape for years. The lead time for building new memory fabrication plants and qualifying new process nodes is a multi-year endeavor requiring immense capital investment. Consequently, a meaningful increase in global supply capacity is not expected to stabilize the market until 2027 or 2028 at the earliest. This timeline establishes a new reality: the availability of high-performance memory, not just cutting-edge GPUs, has become the primary factor setting the pace for AI capacity expansion and, by extension, the broader technology industry’s growth.

Navigating the Crisis: Winners, Losers, and Strategic Imperatives

The key takeaway from this analysis is that the AI-driven demand shock has created a new competitive paradigm in the technology sector. The winners will be the large, cash-rich corporations with the foresight and financial leverage to secure long-term supply contracts, ensuring their product roadmaps remain on track. The losers, however, will be the smaller original equipment manufacturers and budget-focused brands that lack such leverage. For these businesses, the immediate future involves navigating painful choices between absorbing lower margins, raising prices, or compromising on device specifications. For consumers, the practical advice is to anticipate price increases on memory-intensive products and to be aware that the performance-per-dollar ratio of new devices may stagnate or even decline in the short term.

The New Currency of the Digital Age: Memory

The AI boom fundamentally and permanently altered the global semiconductor landscape, transforming memory chips from a simple commodity into a strategic asset. The crisis detailed here was more than just a supply chain issue; it was a clear indicator that memory availability would dictate the pace of innovation across nearly every technology sector for the foreseeable future. As AI continued its relentless march forward, access to this once-abundant resource became the new currency of the digital age, and its scarcity defined the next chapter of technological progress.