January’s private sector employment report delivered a stark and unexpected reality check to economists and job seekers alike, revealing a near-stagnant growth that fell dramatically short of already modest expectations. The health of private sector hiring serves as a primary barometer of the nation’s economic vitality, directly influencing the financial stability of workers, the confidence of consumers, and the strategic direction of businesses. This analysis will dissect the latest employment data, explore the underlying causes of the slowdown, situate the trend within the broader economic context, and project its potential implications for the path ahead.

The Data Behind the Downturn

By the Numbers A Multi-Year Trend Emerges

The most recent ADP report painted a concerning picture, with private employers adding a mere 22,000 jobs—less than half of the 45,000 anticipated by analysts. This figure, while a single data point, is not an anomaly but rather the latest signal in a persistent pattern of deceleration.

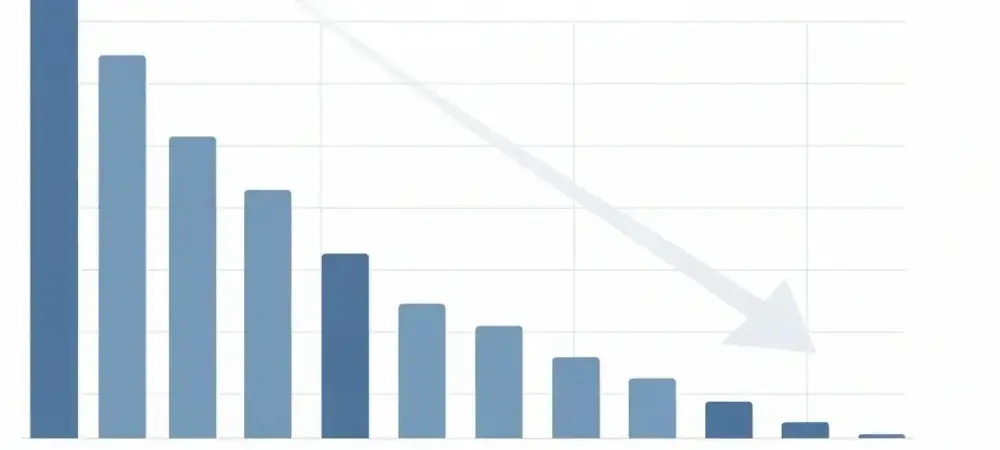

This slowdown becomes even more apparent when viewed through a wider lens. The annual pace of job creation has seen a sharp decline, plummeting from 771,000 new positions in 2024 to just 398,000 in 2025. This pattern has been described as a “continuous and dramatic slowdown,” a narrative that awaits confirmation or contradiction from the official Bureau of Labor Statistics (BLS) data, the release of which has been delayed.

A Tale of Two Sectors Growth vs Decline

The overall weakness in hiring masks a divergent reality across different industries. The U.S. manufacturing sector, for instance, has been a significant drag on growth, losing 8,000 positions in January and consistently shedding jobs since March 2024. This reflects ongoing structural challenges and shifting global demand.

In contrast, some sectors have demonstrated notable resilience. Fields like education and health services continued to add jobs, providing a partial buffer against the broader decline. However, these gains were not substantial enough to offset the losses and lethargy seen elsewhere, highlighting an uneven and fragile labor market.

Unpacking the Causes and Economic Response

The “Low-Hire, Low-Fire” Conundrum

Economists are increasingly pointing to an emerging “low-hire, low-fire” labor market. In this environment, companies are hesitant to commit to new hires amid economic uncertainty, yet they are equally reluctant to lay off existing staff, possibly due to prior difficulties in finding skilled labor.

This corporate caution is driven by several complex factors. The lingering economic effects of import tariffs have introduced unpredictability into supply chains and costs, while the rapid integration of artificial intelligence is forcing a strategic reassessment of long-term workforce needs, leading many businesses to pause significant hiring initiatives.

The Federal Reserve’s Position and Market Dynamics

Despite the cooling hiring numbers, the Federal Reserve has suggested the labor market may be stabilizing after a period of intentional softening aimed at curbing inflation. In line with this assessment, the central bank has decided to maintain its benchmark interest rate in the 3.50%-3.75% range, signaling a wait-and-see approach to monetary policy.

This has created a peculiar economic paradox where a significant slowdown in job creation is occurring alongside reports of steady wage growth. This dynamic suggests that while the competition for new roles has diminished, the value placed on retaining current employees remains high.

Future Outlook Navigating Economic Uncertainty

Potential Trajectories Stabilization or Further Slowdown

The path forward for the labor market remains unclear, with plausible arguments for both managed stabilization and a more pronounced downturn. A soft landing, where hiring levels off without triggering a recession, is still possible, but the risk of further contraction looms if business confidence continues to erode. The forthcoming BLS report will be a critical piece of this puzzle, heavily influencing the Federal Reserve’s future policy decisions.

Broader Implications for Businesses and Job Seekers

This shifting landscape presents distinct challenges and opportunities. For job seekers, the environment has become more competitive, demanding greater skill differentiation and adaptability. For businesses, the focus shifts from aggressive recruitment to strategic workforce planning, talent retention, and navigating the technological disruption brought by AI. Ultimately, this hiring trend directly impacts consumer spending and corporate investment, the twin engines of overall economic growth.

Conclusion Adapting to a New Labor Reality

The evidence clearly indicated that the U.S. private sector was navigating a significant hiring slowdown, a trend shaped by sectoral weaknesses, technological disruption, and cautious economic sentiment. This cooling period reflected a complex interplay of post-pandemic adjustments and new structural forces reshaping the world of work. As a critical barometer of the nation’s economic health, the trajectory of private employment required close monitoring. The situation underscored the need for workers, business leaders, and policymakers to cultivate agility and foresight in adapting to a labor market defined by increasing uncertainty and continuous evolution.