Payroll

- Payroll

The modern corporate landscape has undergone a silent but profound metamorphosis where the back-office ledger has been replaced by sophisticated neural networks capable of predicting financial outcomes with uncanny precision. For decades, the payroll department functioned as a reactive entity,

- Payroll

The modern corporate landscape has undergone a silent but profound metamorphosis where the back-office ledger has been replaced by sophisticated neural networks capable of predicting financial outcomes with uncanny precision. For decades, the payroll department functioned as a reactive entity,

Popular Stories

- Payroll

The modern financial landscape has reached a tipping point where waiting two weeks for a paycheck feels like an outdated relic of a pre-digital civilization. As instant gratification becomes the standard for every other aspect of consumer life, the rigid

Deeper Sections Await

- Payroll

In today’s rapidly evolving business landscape, companies are increasingly expanding their operations across international borders, necessitating a comprehensive approach to payroll management. This globalization trend, while opening up new markets and opportunities, has introduced a myriad of challenges, particularly in

- Payroll

In today’s fast-paced work environment, the importance of holistic employee health benefits cannot be overstated. Employers are increasingly recognizing the need to adopt comprehensive weight health coverage and support, driven by the understanding that a healthy workforce is crucial for

Browse Different Divisions

- Payroll

In today’s rapidly evolving business landscape, companies are increasingly expanding their operations across international borders, necessitating a comprehensive approach to payroll management. This globalization trend, while opening up new markets and opportunities, has introduced a myriad of challenges, particularly in

- Payroll

In a significant move to streamline payroll processing for private sector organizations, Ciphr, a provider of HR, payroll, and benefits software, has introduced a cutting-edge real-time payroll system. This new software builds upon Shape Payroll, which Ciphr acquired in June

- Payroll

In today’s rapidly evolving labor market, compensation teams are constantly challenged to keep pace with the latest trends and data, which is especially true for highly sought-after positions like artificial intelligence engineers and computer vision researchers. These roles often require

- Payroll

Deel, a leading payroll and HR company, recently made headlines with the announcement of new anchor investors, General Catalyst and a sovereign investor, who have purchased nearly $300 million in secondaries from early investors. This significant move highlights the company’s

- Payroll

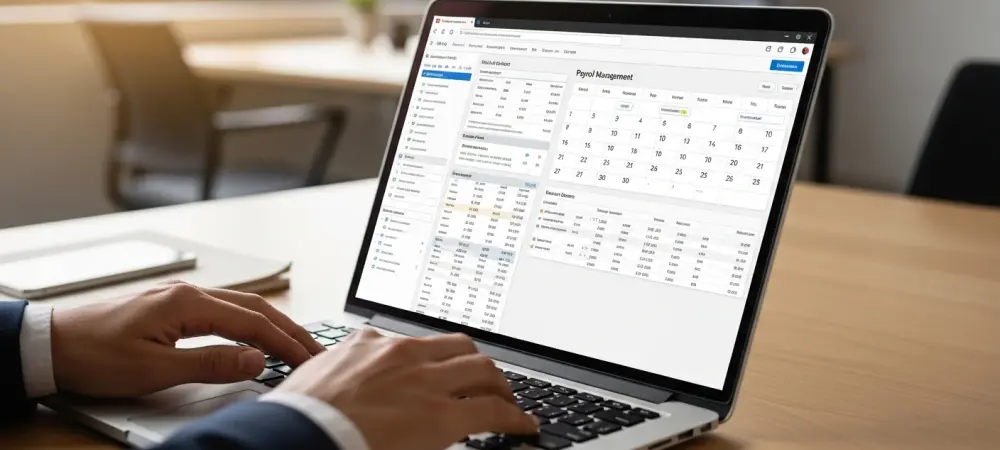

Modern companies often face considerable challenges when handling payroll processing, involving extensive administrative work, numerous calculations, and ensuring compliance with regulations. As businesses scale, these tasks become increasingly complex and prone to errors. Ciphr has responded to these challenges by

- Payroll

In today’s fast-paced work environment, the importance of holistic employee health benefits cannot be overstated. Employers are increasingly recognizing the need to adopt comprehensive weight health coverage and support, driven by the understanding that a healthy workforce is crucial for

Browse Different Divisions

Popular Stories

Uncover What’s Next