Payroll

- Payroll

A multinational corporation can orchestrate complex global supply chains with pinpoint precision, yet the seemingly simple act of paying its international employees on time remains one of its most significant and unpredictable financial challenges. This fundamental disconnect between operational capability

- Payroll

A multinational corporation can orchestrate complex global supply chains with pinpoint precision, yet the seemingly simple act of paying its international employees on time remains one of its most significant and unpredictable financial challenges. This fundamental disconnect between operational capability

Popular Stories

- Payroll

Employers today face a myriad of challenges in providing benefits that support and engage their workforce. With healthcare costs continuously rising and an evolving regulatory environment, there are additional layers of complexity to maintaining and enhancing benefits programs. Despite these

Deeper Sections Await

- Payroll

In an era of increasing globalization, managing human resources (HR) and payroll for multinational companies can be a complex and time-consuming task. Recognizing this challenge, HiBob, a leading HR software provider, and Papaya Global, a pioneer in global payroll and

- Payroll

Small businesses face numerous challenges when it comes to managing payroll and cash flow. To address these issues, Zil Money has introduced an innovative Payroll By Credit Card feature. This feature aims to help small businesses maintain a steady cash

Browse Different Divisions

- Payroll

In an era of increasing globalization, managing human resources (HR) and payroll for multinational companies can be a complex and time-consuming task. Recognizing this challenge, HiBob, a leading HR software provider, and Papaya Global, a pioneer in global payroll and

- Payroll

Small businesses often struggle with the complexities of payroll management. This is where Patriot Payroll comes to the rescue with its user-friendly payment system designed specifically for small businesses. Additionally, Remote.com offers specialized payroll software that simplifies payroll procedures for

- Payroll

In today’s globalized business landscape, organizations often operate across multiple countries, necessitating effective management of their global payroll processes. To navigate the complex world of global payroll, understanding key terms and concepts is essential. This comprehensive guide aims to provide

- Payroll

Managing payroll can be a complex and time-consuming task for small businesses. That’s where payroll service providers come in. With their expertise and cutting-edge software solutions, these providers offer customized and scalable options for businesses of all sizes. In this

- Payroll

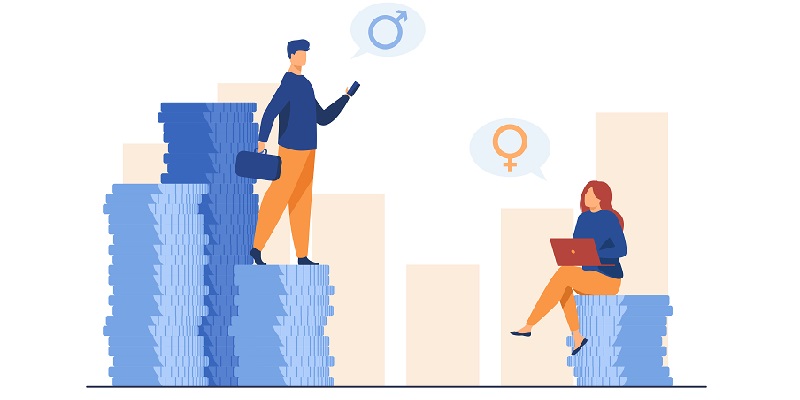

The disparity in salary increases between Australian men and women continued this year, according to a new report. Despite ongoing discussions regarding the gender pay gap, this data demonstrates that the disparity continues. A survey from ADP revealed that pay

- Payroll

Small businesses face numerous challenges when it comes to managing payroll and cash flow. To address these issues, Zil Money has introduced an innovative Payroll By Credit Card feature. This feature aims to help small businesses maintain a steady cash

Browse Different Divisions

Popular Stories

Uncover What’s Next