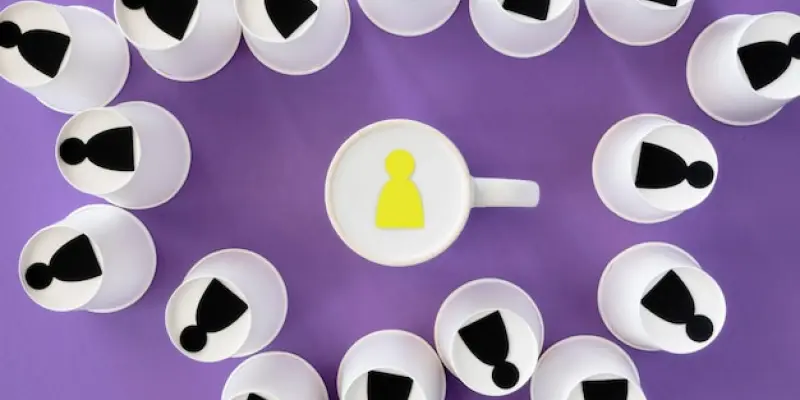

Amid the ongoing discourse surrounding workplace dynamics, a pressing issue has captured the attention of organizations worldwide: the noticeable decline in employee engagement. Recent findings by Gallup highlight a concerning drop from 23% to 21% in employee engagement in 2025, marking only the second such decline in over a decade. This reduction equates to a staggering $438 billion loss in global productivity, prompting a reevaluation of current engagement strategies. Alarmingly, the decline is particularly evident among managers, specifically those under the age of 35 and women. The engagement levels for managers fell from 30% to 27%, which raises red flags given the significant influence managers wield over team performance and morale. With 70% of team engagement linked to managerial influence, the reverberating effects of disengagement can drastically undermine organizational health and operational efficacy.

Managerial Role and Training Imperatives

The notable drop in manager engagement highlights the critical need for companies to prioritize leadership development and managerial training to counteract the ripple effects of disengaged employees. Managers are crucial to organizational success, yet only 44% have received the formal training essential for their growth and effectiveness. This deficiency signals a pressing need for strategic educational initiatives grounded in behavioral science to halt and reverse the trend of disengagement. Focusing on manager development deepens their understanding of their responsibilities, enabling them to create a nurturing and inspiring atmosphere for their teams. Additionally, prioritizing employee well-being through meaningful work, growth opportunities, and balanced work-life dynamics can boost engagement levels. By cultivating these areas and fostering a robust feedback culture, companies can improve productivity, lower attrition rates, and minimize economic losses. A comprehensive approach to these challenges promises lasting enhancements in employee engagement, fortifying and making organizational structures more resilient.