The long-standing factors that determine auto insurance rates, such as age, location, and credit history, are rapidly becoming relics of a bygone era, making way for a more precise and dynamic approach to risk assessment. The auto insurance industry is on the verge of a data-driven revolution, moving beyond outdated metrics. A new trend—embedding sophisticated AI directly into vehicles—is poised to redefine how risk is measured and priced. This analysis explores the rise of embedded vehicle analytics, examining the technology, its real-world applications, and its transformative potential for drivers and insurers alike.

The Shift to Onboard Intelligence

Moving Beyond Traditional Telematics

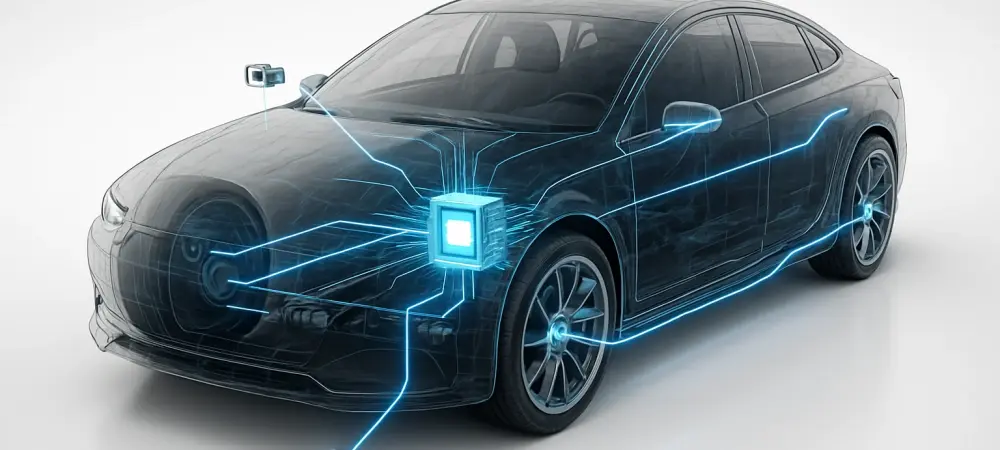

The current telematics market, largely dependent on smartphone applications and plug-in dongles, faces significant challenges related to data reliability, operational cost, and driver privacy. These external devices often produce inconsistent data streams and can be easily disabled, creating gaps in risk assessment. Consequently, insurers have struggled to gain widespread adoption and trust from consumers who are wary of how their data is collected and used. In contrast, the emerging trend is a direct integration of AI into a vehicle’s native computing systems. This embedded approach enables the real-time analysis of situational driving behavior—such as following distance, driver attention, and pedestrian interaction—offering a far more accurate risk profile than traditional proxy-based models. By processing information directly on the vehicle, this shift reduces reliance on constant cloud connectivity, which in turn lowers operational costs and enhances data security by keeping sensitive information localized.

A Partnership Driving Market Adoption

A prime example of this trend is the strategic partnership between MOTER Technologies and Sonatus. This collaboration serves as a powerful catalyst for market-wide adoption by addressing the critical challenge of fragmentation in the automotive industry. By embedding MOTER’s driver risk analytics into the Sonatus Vehicle Platform, the collaboration creates a standardized, scalable solution that can be deployed across multiple vehicle manufacturers without requiring bespoke, time-consuming integrations. This model is making embedded insurance, large-scale fleet risk monitoring, and real-time driver coaching commercially viable for the first time. It provides a seamless and cost-effective pathway for automakers to offer advanced, data-driven services. A practical application is already underway, with Clear Blue Insurance Group filing to launch a new auto program in California that utilizes MOTER’s models to align rates with precise risk metrics, notably for upcoming vehicles like the 2026 Sony Honda AFEELA EV.

Expert Insights on a Standardized Framework

Industry leaders from MOTER and Sonatus emphasize that the key to unlocking the full potential of vehicle data lies in standardization. For years, the lack of a common framework has created a significant barrier, forcing insurers to develop costly and inefficient one-off solutions for each automaker. This fragmentation has stalled progress and prevented the industry from fully capitalizing on the rich data modern vehicles can provide.

Their collaborative framework directly addresses this long-standing issue by providing insurers with a single, reliable pipeline for accessing rich, contextual driving data. This unified approach eliminates the need for redundant development efforts and creates a clear, scalable path toward industry-wide adoption. The result is a more efficient ecosystem that enables more precise and equitable insurance underwriting based on actual driving behavior rather than indirect proxies.

The Future of Data-Driven Insurance

The evolution toward embedded analytics signals a future where insurance premiums are dynamically aligned with actual, on-road behavior. This trend promises significant benefits for consumers, including fairer pricing for safe drivers and proactive risk mitigation through in-vehicle driver coaching. For insurers, it means more accurate risk modeling and streamlined claims processing based on verifiable vehicle data.

However, this transition is not without its challenges. Widespread adoption will require navigating complex issues related to consumer data privacy and gaining regulatory acceptance for these new underwriting models. Despite these hurdles, the broader implications extend far beyond insurance. The insights gained have the potential to influence vehicle design, enhance fleet management operations, and accelerate the development of autonomous systems, ultimately creating a safer and more efficient transportation ecosystem for everyone.

Conclusion A New Paradigm for Vehicle and Insurance Integration

The move toward embedded vehicle analytics represents a fundamental change in how the automotive and insurance industries interact with data. By processing analytics directly on the vehicle, companies like MOTER and Sonatus are overcoming the core limitations of traditional telematics that have hindered progress for over a decade. This shift empowers a more direct and transparent relationship between risk and cost.

This trend is not just an incremental improvement; it is a new paradigm that promises more accurate risk assessment, enhanced driver safety, and a more personalized connection between insurers and their customers. As this technology becomes standard in new vehicles, it is set to permanently reshape the landscape of mobility and risk, creating a system where safer driving is directly and immediately rewarded.