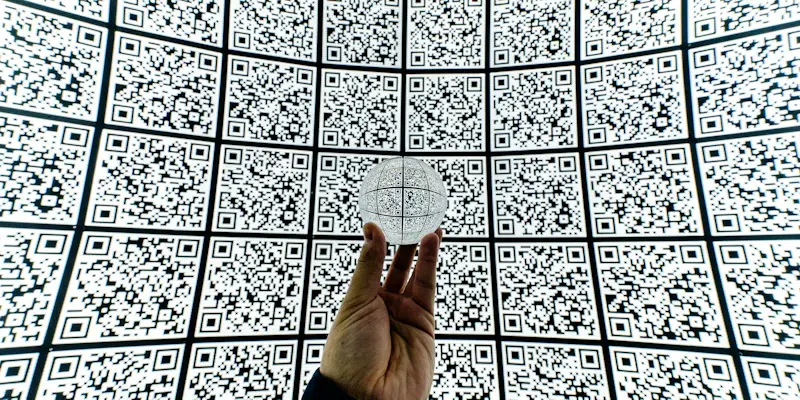

The adoption of QR code-based instant payments has witnessed considerable enthusiasm, addressing the demand for swift and seamless transactions. Despite this interest, significant hurdles still impede widespread acceptance. A recent report by the U.S. Faster Payments Council (FPC) examines these obstacles and offers insights into overcoming them. By evaluating factors like legacy point-of-sale (POS) systems, integration complexities, and scanning device compatibility, the report provides a roadmap for enhancing the usability of QR code-based payments. Addressing these challenges is essential as the U.S. lags in this technology’s adoption compared to other regions.

The fragmentation of QR code presentation formats significantly contributes to the usability issues, creating a stumbling block for both merchants and customers. While regions like Asia have standardized solutions that facilitate smoother implementation, the U.S. faces the challenge of multiple formats, which confuses consumers and complicates merchant operations. Standardizing QR code formats could alleviate these issues, making it easier for merchants to adopt and for customers to use QR code-based payments. Furthermore, improvements in scanning device compatibility and network reliability are pivotal in ensuring a seamless payment experience.

Key Obstacles in QR Code Payment Adoption

One of the primary issues identified in the FPC report is the limitation of legacy POS systems. Many existing POS systems are not equipped to handle new QR code technology efficiently, resulting in cumbersome and time-consuming updates for merchants. This technological shortfall presents a significant barrier to the broader adoption of instant payments. Modernizing these systems is a crucial step toward overcoming this obstacle and enhancing transaction efficiency. In addition, the complexities inherent in integrating QR code payment solutions with existing systems further compound the problem, making the process arduous for merchants.

Compatibility issues with scanning devices also pose a substantial challenge. Not all scanning devices are designed to read QR codes effectively, resulting in frequent transaction failures and frustrating customer experiences. Addressing these compatibility challenges is essential to ensuring a smooth and reliable payment process. Technological advancements such as SoftPOS, which enables contactless payments through software applications on mobile devices, present promising solutions. SoftPOS eliminates the need for traditional hardware upgrades, offering a cost-effective and easily deployable alternative for merchants.

The reliance on network connections for QR code-based payments introduces another layer of complexity. Network interruptions can disrupt transactions, leading to dissatisfaction among customers and merchants alike. This dependency underscores the need for robust and reliable network infrastructure to support the seamless operation of QR code payments. Ensuring high-speed and stable internet connections at POS locations can mitigate this issue, providing a more consistent and dependable payment experience.

Improving User Experience and Standardization

Ensuring a positive user experience is fundamental to the success of QR code-based instant payments. A fragmented QR code presentation system, where different providers use various formats, confuses consumers and complicates the payment process. This inconsistency stands in stark contrast to regions with standardized formats, which significantly streamline the user experience. Implementing industry-wide standards in QR code presentation can simplify the process for both merchants and consumers, driving broader acceptance and usage of this payment method.

A seamless and intuitive user interface can further enhance customer experience. Efforts to educate consumers on how to use QR code payments effectively contribute to this goal. Simple, clear instructions and a user-friendly design are pivotal in ensuring that consumers can navigate the payment process with ease. Merchants, on the other hand, benefit from standardized procedures that reduce operational complexities and improve transaction efficiency.

Addressing these usability challenges requires collaboration across various sectors of the payment industry. Industry players, including technology providers, financial institutions, and regulatory bodies, must work together to establish best practices and technical recommendations for QR code payment systems. Continuous research and development are essential to keep pace with technological advancements and evolving consumer expectations.

The FPC’s commitment to fostering collaboration and innovation is crucial in advancing the adoption of QR code-based instant payments. The Council’s efforts to provide a platform for stakeholders to share insights and develop solutions are instrumental in overcoming the existing challenges. As the payment landscape continues to evolve, ongoing dialogue and cooperation among industry participants will be key to realizing the full potential of QR code-based payments.

Future Considerations for QR Code Payments

The enthusiasm for QR code-based instant payments is evident, addressing the need for fast and smooth transactions. However, there are notable barriers to widespread adoption. The U.S. Faster Payments Council (FPC) recently released a report delving into these obstacles and providing solutions to enhance QR code-based payments. The report assesses factors such as outdated point-of-sale (POS) systems, integration hurdles, and scanning device compatibility, offering strategies to boost their usability. Addressing these issues is crucial as the U.S. trails behind other regions in adopting this technology.

One significant problem is the fragmentation of QR code formats, which hampers usability for both merchants and consumers. Unlike regions like Asia, which have standardized formats for easy implementation, the U.S. struggles with multiple formats, causing confusion and complicating merchant operations. Standardizing QR code formats could simplify adoption for merchants and use for customers. Additionally, improving scanning device compatibility and network reliability is crucial for ensuring a smooth payment experience.