The once-dismissed realm of meme coins, born from internet jokes and speculative frenzy, is undergoing a profound transformation that is forcing even the most skeptical investors to pay attention. From digital currencies sustained by little more than viral marketing and community sentiment, a new class of asset is emerging—one that embeds tangible function into its very code. This article analyzes the critical shift from pure hype to integrated utility, exploring why this trend is reshaping the crypto landscape and what it signifies for the market. By delving into on-chain data, examining pioneering projects, and forecasting the future of this evolving sector, a clear picture of a maturing market segment comes into focus.

The Rise of the Utility Meme: A Data-Driven Overview

The transition from speculative assets to functional ecosystem tokens is not merely anecdotal; it is a quantifiable trend reshaping capital flows and investor expectations within the cryptocurrency market. Data reveals a clear divergence in performance and investor sentiment between meme coins that offer concrete use cases and those that continue to rely solely on cultural relevance. This shift marks a pivotal maturation point for a sector previously defined by its volatility and lack of intrinsic value.

From Hype to Substance: Tracking the Growth

An analysis of market capitalization trends reveals a significant pattern: meme coins incorporating utility, such as decentralized finance (DeFi) primitives, gaming integrations, or proprietary infrastructure, are demonstrating more resilient growth trajectories. While hype-driven tokens experience sharp, often unsustainable peaks, utility-backed projects tend to build value more steadily. This is largely because their utility creates a foundational demand for the token beyond speculative trading, cushioning it against the market’s emotional whims. The immense weight of a legacy asset like Dogecoin, with its multi-billion dollar market cap, mathematically limits its potential for exponential returns, making smaller, more functional tokens a more logical destination for capital seeking high growth.

This is further corroborated by investor behavior observed on-chain. Analytics from leading platforms show a discernible rotation of capital away from first-generation meme coins toward newer projects with clearly articulated roadmaps and functional ecosystems. This movement of “smart money” often precedes wider market recognition, as it did with early ecosystem tokens like BONK in late 2023. Furthermore, a growing percentage of new meme coin launches now include a detailed whitepaper outlining a utility-focused ecosystem from day one. This proactive approach signals a fundamental change in developer strategy, prioritizing long-term value creation over short-term speculative appeal.

Pioneers of the New Wave: Real-World Applications

The theoretical appeal of utility finds its proof in a new generation of projects that are successfully deploying real-world applications. These pioneers are not just tokens with a vague promise of future function; they are building and delivering the infrastructure that justifies their existence and creates a self-sustaining economic loop.

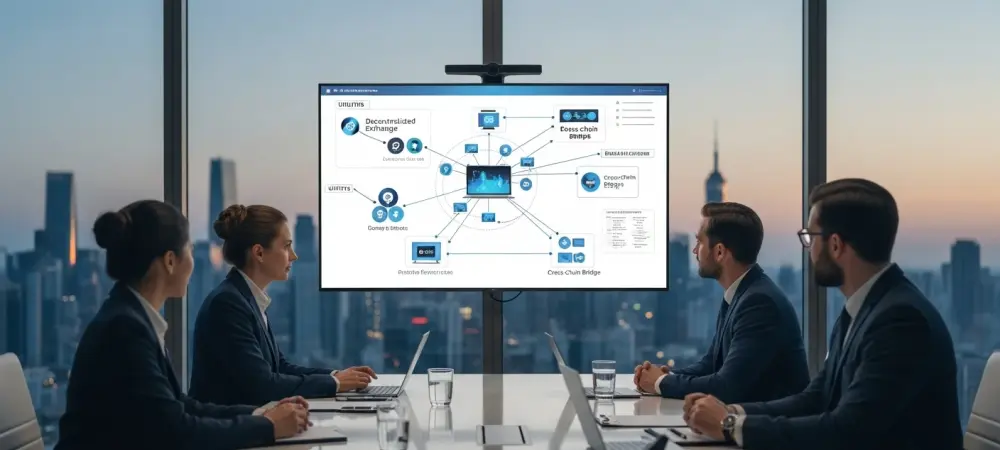

One prominent approach is the development of integrated DeFi hubs. Projects like Pepeto are prime examples, constructing native utility stacks to address common pain points in the crypto space. By launching platforms such as PepetoSwap, a decentralized exchange designed with zero transaction fees, and Pepeto Bridge, a tool for seamless cross-chain asset transfers, these projects solve genuine problems like high trading costs and liquidity fragmentation. This utility provides a compelling reason for users to acquire and hold the token, moving its value proposition far beyond simple speculation.

Simultaneously, other projects are carving out a niche in the rapidly expanding gaming and metaverse sectors. Tokens such as Floki Inu have transcended their meme origins by developing a comprehensive ecosystem that includes a play-to-earn (P2E) game, Valhalla, alongside educational platforms. This strategy creates a vibrant, self-contained economy where the token is used for in-game transactions, rewards, and governance, fostering a dedicated user base that is invested in the project’s long-term success. Perhaps the most ambitious evolution is the transition from a simple token to a foundational technology layer. Shiba Inu’s launch of Shibarium, a Layer-2 scaling solution, exemplifies this trend. By creating its own blockchain environment designed to host decentralized applications (dApps), the project has fundamentally altered its identity. It is no longer just a meme but a platform for innovation, demonstrating a strategic pivot toward becoming a core piece of Web3 infrastructure.

Expert Perspectives: Is Utility the Key to Survival

The growing consensus among market observers is that utility is no longer a bonus feature but a prerequisite for long-term viability in the meme coin space. This sentiment is shared across the spectrum of market participants, from independent analysts to institutional investors, who all recognize that tangible value is the ultimate defense against market volatility.

Insights from Crypto Analysts

Market analysts increasingly argue that tangible utility provides a “price floor” for a token, creating a valuation model that extends beyond mere speculation. When a token is integral to a functioning DeFi protocol, a popular game, or a Layer-2 network, its demand is tied to the usage of that ecosystem. This intrinsic demand can help stabilize the price during market downturns and attract more sophisticated, long-term investors who are focused on fundamentals rather than short-lived trends. This shift is critical, as it moves the valuation conversation from “how much hype is there?” to “how much value does this ecosystem generate?”.

Opinions from Venture Capitalists

The perspective of venture capitalists has also evolved significantly. In the early days, VCs largely avoided the meme coin sector due to its perceived lack of substance. Now, however, they are beginning to evaluate these projects with a more discerning eye. The new criteria for investment prioritize teams with demonstrable technical expertise, a clear set of deliverables, and a sustainable tokenomic model built around the project’s utility. A project that has undergone rigorous security audits and structured its launch to reward early supporters is viewed far more favorably than one relying on viral marketing alone.

Commentary from Project Developers

Founders of utility-backed meme coins consistently emphasize the strategic choice to build functional ecosystems. Their commentary reflects a desire to move beyond the ephemeral nature of hype cycles and create lasting value for their communities. By embedding utility, they aim to foster a loyal user base that is engaged with the project for its services, not just its potential for a quick profit. This development path, while more challenging, is seen as essential for establishing legitimacy and ensuring the project’s survival in an increasingly competitive market.

The Future of Meme Coins: What Lies Ahead

As the integration of utility becomes the new standard, the boundaries of what a meme coin can achieve are expanding. The next wave of innovation is poised to push these projects even further into the mainstream, blurring the lines between meme culture and sophisticated blockchain technology.

Potential Developments

The next frontier for utility will likely involve deeper connections to the off-chain world. This could include integrations with real-world assets (RWAs), allowing meme-branded platforms to facilitate the tokenization of physical goods or financial instruments. Another promising avenue is decentralized physical infrastructure networks (DePIN), where tokens could incentivize the development of real-world infrastructure like wireless networks or data storage. Additionally, as these ecosystems mature, their tokens are naturally positioned to become the governance tokens for decentralized autonomous organizations (DAOs), giving community members a direct say in the project’s future.

Benefits and Challenges

This evolutionary trend presents both significant opportunities and formidable challenges. On one hand, the integration of utility brings greater market stability, enhances mainstream legitimacy, and provides clearer valuation metrics. It transforms meme coins from a purely speculative gamble into a more investable asset class. On the other hand, the challenges are steep. These projects face intense competition not only from each other but also from established, non-meme utility tokens that have a significant head start. Moreover, there is a considerable execution risk; promising an ambitious technological roadmap is far easier than delivering a secure, scalable, and user-friendly product.

Broader Market Implications

Ultimately, the evolution of meme coins has profound implications for the entire cryptocurrency market. By wrapping complex technologies like DeFi and Layer-2 scaling in the accessible and engaging packaging of meme culture, these projects serve as a powerful onboarding tool for a wider retail audience. They lower the barrier to entry, making intimidating concepts feel more approachable. This fusion of culture and technology could accelerate the mainstream adoption of Web3, demonstrating that serious innovation does not have to come in a somber package.

The Evolution from Meme to Mainstay

The analysis of the meme coin sector pointed to an unmistakable and data-supported trend: the pivot from speculative hype to integrated, real-world utility. This shift was not a fleeting fad but a fundamental maturation of the market, driven by changing investor expectations and a new wave of ambitious developers. The success of early pioneers, who built everything from DeFi hubs to gaming metaverses, provided a clear blueprint for survival and growth. Expert consensus solidified around the idea that utility had become the key differentiator for long-term viability. While the viral power of a meme would always play a role in a project’s initial launch, it was the underlying ecosystem that determined whether it would endure. The long-term survivors in the meme coin space were those that successfully built and delivered functional, value-adding platforms.

For investors, the conclusion was clear. The focus had shifted from simply identifying the next viral sensation to critically evaluating the substance behind the meme. The market had evolved, and the most significant and sustainable gains were found at the convergence of culture and utility, where an engaging brand was backed by a robust and indispensable product.