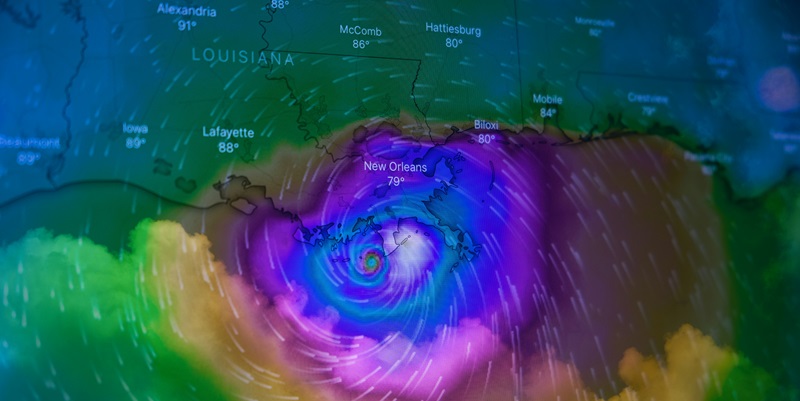

The landscape of the insurance industry is undergoing a transformation fueled by increasing consumer expectations for technological advancements. As severe weather events become more frequent and destructive, policyholders are prioritizing technological efficiency in their insurance providers over cost, reshaping the competitive dynamics within the sector. This shift highlights the evolving preferences of consumers who now view advanced technology as a critical component of their insurance coverage, especially in the wake of natural disasters that demand swift responses.

Shifting Consumer Preferences in the Insurance Industry

From Cost-Focused to Tech-Driven Decisions

Traditionally, cost has been the main criterion for selecting insurance policies, but recent surveys indicate a significant shift. Consumers now value technological capabilities as much, if not more, than affordability. This evolution is driven by the need for efficient claims processing and better customer experiences, particularly important during severe weather incidents. The findings of Insurity’s 2024 Severe Weather Consumer Pulse Survey reveal that 52% of consumers would prefer to buy from insurers who actively invest in new technologies. These new technologies are designed to streamline the claims process and enhance the overall customer experience, showcasing a clear shift from traditional cost-centered decision-making towards embracing innovative solutions.

Severe weather events are increasingly frequent and devastating, underscoring the necessity for technologically savvy insurance providers. Consumers expect their insurers to leverage advanced technologies such as artificial intelligence (AI) and predictive analytics to handle claims quickly and accurately. This expectation is not just about mitigating financial losses but also about providing a responsive and reliable service when policyholders need it the most. The shift in consumer preferences reflects a broader trend where technology becomes a decisive factor in customer satisfaction and loyalty, pushing insurance companies to rethink their investment strategies and operational processes to remain competitive in a changing market.

The Role of Severe Weather Events

Frequent and severe weather conditions have highlighted the importance of responsive and efficient claims processes. Consumers have realized that the immediate aftermath of such events requires a swift, technologically aided response from their insurers, ensuring they receive the help they need without unnecessary delays. The increased frequency and intensity of weather-related incidents have made it clear that the traditional methods of claims processing are no longer sufficient. Advanced technologies provide the tools needed for insurers to meet these new demands, offering quick resolutions that can significantly improve customer satisfaction during critical times.

The role of severe weather incidents in reshaping consumer preferences cannot be overstated. As storms, floods, and other natural disasters become more common, the ability of insurance companies to respond rapidly and effectively becomes a key differentiator. Consumers are no longer willing to wait through lengthy and cumbersome claims processes. Instead, they are looking for insurers who utilize predictive analytics to assess risks accurately and AI to streamline claims processing, ensuring prompt payouts and support. This trend emphasizes the crucial role that technology plays in modernizing the insurance sector and meeting the high expectations of today’s consumers.

Survey Insights: Consumer Sentiments

Trust in Current Coverage

According to the 2024 Severe Weather Consumer Pulse Survey by Insurity, nearly half of Americans feel their current insurance provides adequate coverage for severe weather. However, there remains a significant portion who doubt their policies’ robustness and are willing to seek better alternatives. This presents a critical insight into the existing gaps in consumer confidence and the opportunity for insurers to bridge these gaps through technological advancements. Many policyholders are content with their current coverage but are increasingly aware of the enhanced benefits that technology-driven services can offer, particularly in the context of severe weather events that require immediate and efficient responses.

The survey results indicate a growing awareness among consumers about the limitations of their current insurance policies in handling severe weather claims. While 48% of Americans feel adequately covered, the remaining 52% see the potential for improvement through technological investments. This group of consumers is open to switching providers if it means obtaining better coverage and faster claims processing, even if it involves paying higher premiums. This sentiment signals an urgent need for insurers to invest in technologies that can address these demands, offering more comprehensive and responsive services to ensure customer satisfaction and retention.

Willingness to Pay for Better Coverage

An intriguing finding from the survey shows that 36% of respondents are open to paying higher premiums for better coverage and technologically enhanced services. This willingness highlights the increasing importance consumers place on reliable service during times of distress. As severe weather events continue to pose significant risks, the desire for better coverage is coupled with the expectation of advanced technology integration that ensures efficient and accurate claims processing. This denotes a willingness among consumers to prioritize quality and reliability over cost, reflecting an evolved understanding of the value that technology brings to insurance services.

This trend towards paying higher premiums for improved services underscores a significant shift in consumer priorities. In the past, affordability was the dominant factor, but now consumers recognize that higher premiums are justified if they ensure faster, more reliable service during critical times. The integration of technologies such as AI and predictive analytics in claims processing is seen as a valuable investment that can provide peace of mind and better outcomes. This shift encourages insurers to re-evaluate their pricing and service models, focusing on technological enhancements that meet the high expectations of modern consumers.

Technological Adoption and Its Impact

Investment in AI and Predictive Analytics

Insurance companies are increasingly investing in artificial intelligence (AI) and predictive analytics, and these technologies enable quicker and more accurate claims processing, crucial during severe weather events. Consumers view such investments as a marker of reliability and efficiency, enhancing their overall experience with the insurer. AI can simplify the claims process by automating routine tasks, reducing human error, and speeding up decision-making, while predictive analytics can anticipate potential claims and allow insurers to prepare and respond proactively. These advancements are transforming the insurance industry, enabling companies to handle a higher volume of claims more efficiently and accurately.

The adoption of AI and predictive analytics in insurance is not just about improving operational efficiency but also about building confidence among consumers. By leveraging these technologies, insurers can offer faster resolution of claims, which is particularly important during the chaotic aftermath of severe weather events. This not only improves customer satisfaction but also builds trust and loyalty, as policyholders feel supported and valued during their times of need. As a result, investment in AI and predictive analytics is becoming a critical strategy for insurers aiming to maintain a competitive edge in an increasingly technology-driven market.

Enhancing Customer Experience

By leveraging advanced technologies, insurers can significantly enhance customer satisfaction. Efficient claims processing facilitated by AI reduces waiting times and procedural hassles, offering consumers peace of mind during challenging times like severe weather incidents. The ability to file claims quickly and receive prompt responses ensures that policyholders feel taken care of when they need it the most. Advanced technologies can also provide personalized experiences, using data analytics to understand and anticipate individual policyholder needs, further enhancing the customer experience.

The enhancement of customer experience through technology-driven processes extends beyond just claims processing. Insurers can use AI and predictive analytics to offer better risk management advice, customized policy recommendations, and proactive support services. This level of personalized service not only meets but exceeds consumer expectations, turning potentially stressful situations into more manageable experiences. As the demand for such technologically enhanced services grows, insurers that invest in these capabilities are likely to see higher customer retention rates and increased market share, making technological adoption a key differentiator in the competitive insurance landscape.

Competitive Edge Through Innovation

Meeting Modern Consumer Expectations

As consumer preferences evolve, insurers must adapt to maintain competitiveness. Companies that invest in cutting-edge technologies can meet modern consumer expectations more effectively, ensuring higher satisfaction and loyalty. By understanding and responding to the technological demands of their customers, insurers can position themselves as leaders in the industry. This involves not only implementing advanced claims processing systems but also enhancing overall service delivery through technology. Insurers who embrace innovation are better equipped to provide the seamless, responsive experience that today’s consumers expect, particularly in handling claims arising from severe weather incidents.

Modern consumers are well-informed and have high expectations for service quality, particularly when it comes to managing the aftermath of severe weather events. Insurers that fail to meet these expectations risk losing business to more tech-savvy competitors. The strategic adoption of AI, predictive analytics, and other advanced technologies allows insurers to offer more robust and efficient services, ultimately leading to improved customer satisfaction and loyalty. This proactive approach to technology integration is essential for insurers aiming to stay relevant and competitive in a rapidly evolving market.

Proactive Approach by Insurers

Chris Lafond, CEO of Insurity, emphasizes the need for a proactive approach in integrating technology to improve the claims process. Insurers that are quick to adopt sophisticated technologies are likely to see substantial benefits in customer trust and market share. By proactively investing in technology, insurers can ensure that they are prepared to handle the demands of modern consumers who expect quick and effective responses to their claims, particularly during severe weather events. This proactive stance involves not just implementing new technologies but continuously evolving and innovating to stay ahead of consumer expectations and market trends.

A proactive approach to technology integration also involves educating consumers on the benefits of these advancements. By demonstrating how AI and predictive analytics can enhance their insurance experience, insurers can build stronger relationships with their policyholders. This educational effort can help consumers understand the value of higher premiums for better coverage and faster claims processing. Proactively investing in and communicating about technological advancements can position insurers as forward-thinking and customer-centric, further enhancing their reputation and market position in the competitive insurance landscape.

Broader Implications for the Insurance Sector

A Strategic Shift

The survey illustrates a strategic shift within the insurance industry, where technological innovation is becoming integral to business models. This shift influences customer acquisition and retention strategies, as insurers recognize the necessity of adopting advanced technologies to meet evolving consumer demands. The integration of AI, predictive analytics, and other technological tools is no longer optional but a critical component of a successful insurance strategy. This shift requires insurers to rethink their operational and strategic priorities, focusing on technology as a core element of their offerings to attract and retain customers in a highly competitive market.

This strategic shift also has implications for how insurers approach risk management and policy development. With advanced technologies, insurers can offer more tailored and accurate risk assessments, leading to better policy recommendations and pricing models. This enhances the overall value proposition for consumers, who are looking for personalized and reliable insurance solutions. The emphasis on technology-driven strategies underscores the need for insurers to continuously innovate and adapt to remain competitive, ensuring that they can meet the high expectations of modern consumers and navigate the challenges posed by increasing severe weather events.

Future Trends and Predictions

The insurance industry is experiencing significant changes due to rising consumer demands for technological innovation. As severe weather events become increasingly common and destructive, policyholders are placing a higher value on the technological capabilities of their insurance providers rather than purely focusing on cost. This is reshaping the competitive landscape within the sector. Today, consumers see advanced technology as an essential aspect of their insurance coverage, particularly in the face of natural catastrophes that necessitate rapid action. This evolution underscores a broader trend where people expect their insurance companies to not only safeguard them financially but also to be technologically adept and responsive. The increasing frequency of natural disasters means that swift communication and efficient claims processing, facilitated by advanced technology, are now critical factors in consumer decisions. As a result, insurance companies that invest in cutting-edge technology are likely to gain a competitive edge, meet modern customer expectations, and foster loyalty in an ever-changing environment.