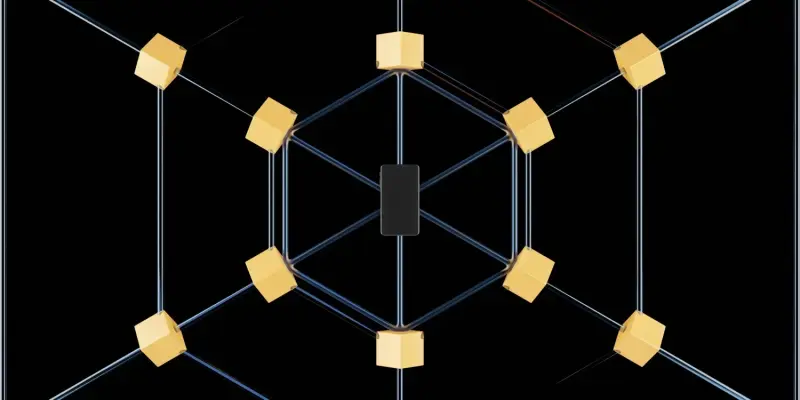

Decentralized finance, known as DeFi, is witnessing a noteworthy transformation as specialized blockchains emerge to address the deficiencies of traditional universal networks. These purpose-built infrastructures are reshaping the landscape by introducing platforms such as Berachain, Story (IPfi), Unichain, Monad, and MegaETH, each tailored to specific functionalities. This evolution marks a significant departure from the one-size-fits-all approach of previous blockchain technologies. By optimizing for security, scalability, and compliance, specialized blockchains are aligning with the stringent demands of financial institutions. As DeFi bridges with traditional finance, the need for platforms capable of complex asset management and rapid trading intensifies. These developments emphasize the growing synergy between competition and collaboration, propelling DeFi into a future characterized by a sophisticated and diverse ecosystem.

The Case for Specialization in DeFi

Within the evolving realm of DeFi, the shift from monolithic blockchains to specialized infrastructures is revolutionizing how decentralized finance operates. Unlike generalized networks that attempt to serve a broad spectrum of applications, specialized blockchains are optimized for distinct disciplinary areas. They offer enhanced security, scalability, and compliance features, catering specifically to the needs of financial institutions that are beginning to intersect traditional finance with DeFi. These institutions demand platforms that not only ensure high-speed trading but also facilitate intricate asset management processes. By focusing on specific financial applications, specialized blockchains meet these requirements, positioning themselves as pivotal components in enabling seamless interactions between capital markets and decentralized protocols. Their introduction into the DeFi arena symbolizes a pronounced shift towards a diversified technological landscape, where tailored solutions can efficiently address sector-specific challenges.

Overcoming Fragmentation and Inefficiency

While specialization within DeFi presents numerous benefits, the associated risk of liquidity fragmentation poses significant challenges to efficient asset movement across overlapping networks. Critics of specialized blockchains argue that their proliferation could result in a fragmented landscape, detrimental to the seamless flow of assets and operational efficiency. Nevertheless, innovations aiming to address these setbacks are underway. Solutions such as trust-minimized bridges, which facilitate secure asset transfers across chains, and universal liquidity layers designed to integrate disparate blockchain ecosystems, seek to counteract potential inefficiencies. These mechanisms ensure that the rise of specialized environments does not come at the expense of streamlined operations within the broader DeFi sector. As developers continue to refine these crucial cross-chain interoperability solutions, they embark on an effort to sustain specialization without compromising efficiency, promising a balanced integration of diverse and coordinated blockchain architectures.

Fragmentation as a Catalyst for Innovation

Contrary to conventional views that imply fragmentation hinders progress, within the DeFi ecosystem, it frequently serves as a beacon for innovation. The division of DeFi into specialized networks creates fertile grounds for developers to pioneer advancements in niche areas. Fields such as algorithmic credit scoring and intellectual property rights management benefit from this fragmentation, as they capitalize on blockchain specialization to explore new technological frontiers. Current real-world examples illustrate how specialized blockchains foster robust ecosystems, pushing the boundaries of feasibility within decentralized finance. By offering developers dedicated environments to work on, niche-oriented blockchains provide the necessary frameworks to innovate beyond traditional constraints. These successes highlight the potential for specialized blockchains to act as catalysts for creativity and expansion within DeFi, demonstrating compelling proof that fragmentation, when leveraged correctly, can serve as a powerful tool for technological growth and enhancement.

Institutional Influx and Compliance

The shift towards specialized blockchains is not limited to developers; financial institutions have increasingly gravitated toward these innovative platforms. This trend is underscored by a surge in venture capital investment, indicative of confidence in systems offering advanced data-validation methods and efficient asset mobility across chains. Institutions that traditionally operate within stringent regulatory frameworks demand compliance-friendly environments, a requirement met by these specialized blockchain networks. Such networks provide liquid staking solutions, facilitate tokenization of physical assets, and incorporate hybrid data verification processes, aligning perfectly with institutional needs. As these infrastructures evolve, they continue to attract institutional interest, fulfilling expectations for rigorous compliance and operational efficiency. The alignment between specialized blockchains and institutional prerequisites demonstrates a vital phase in the maturation of decentralized finance, highlighting their role in enabling financial organizations to engage seamlessly with the DeFi ecosystem.

Advancing Towards a Multi-Chain Future

The introduction of specialized blockchains signifies not just technical progress but a philosophical transformation from maximalist ideologies towards a diversified ecosystem. Platforms like Berachain and Unichain challenge traditional monopolistic architectures, presenting opportunities to redefine DeFi applications’ adoption and construction paradigms. This evolution reflects a maturing industry, acknowledging that risk diversification alongside competitive market dynamics enables coexistence and growth for both specialized and legacy blockchain networks. By fostering environments where different blockchain platforms thrive, this paradigm shift offers a comprehensive approach to risk management and technological development, empowering startups and established entities to innovate and expand freely. The emphasis on a multifaceted ecosystem illustrates a new era for DeFi, where competing infrastructures work collectively to enhance technological capabilities and financial methodologies.

Navigating Challenges in Asset Management

In the dynamic arena of DeFi, there’s a notable transition from universal blockchains to infrastructures tailored for specific sectors. Unlike general networks that try to accommodate a wide range of applications, specialized blockchains are fine-tuned for particular fields. They provide superior security, scalability, and compliance, meeting the unique demands of financial institutions looking to integrate traditional finance with DeFi. These institutions require platforms facilitating not just rapid trading but also complex asset management processes. Specialized blockchains are designed with these specific financial functions in mind, thus establishing themselves as crucial in linking capital markets with decentralized systems. Their emergence in the DeFi landscape signifies a significant move towards a technologically varied environment where customized solutions proficiently tackle sector-specific issues. This shift highlights the growing importance of customized approaches in ensuring that decentralized finance evolves efficiently alongside traditional financial systems.