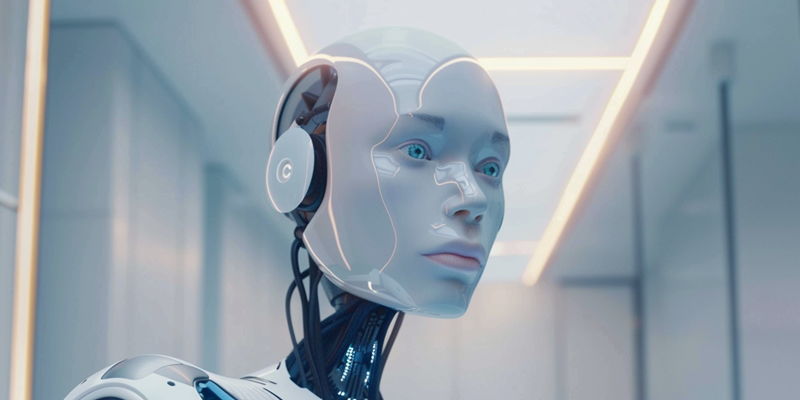

In the realm of insurance, effectively managing claims is crucial for customer satisfaction and operational efficiency. With the launch of its new product, Simplifai Claims Processing, the tech firm is poised to redefine the way insurance companies handle claims. By harnessing the power of InsuranceGPT, this generative AI technology offers a solution that is not only more efficient but also ensures compliance with stringent GDPR and EU AI regulations.

Elevating Efficiency in Insurance

Transforming the Claims Management Landscape

Simplifai Claims Processing is a game-changer because it promises to process up to 50% more claims without the need for additional personnel. This incredible leap in efficiency is made possible by AI’s capacity to analyze and process data at a speed no human can match. With systems designed to learn and improve from every interaction, the AI ensures that each claim is handled with the accuracy and attention to detail required, paving the way for a smoother claims journey for the customer. The reduction of time-consuming tasks frees up claims managers to focus on more complex cases and personalized customer service.

Making Strides in Operational Productivity

The novel approach goes beyond increasing the sheer number of claims processed. By reducing the bureaucratic workload, claims managers are now able to engage in more nuanced, interesting tasks. These high-level activities, such as managing complicated claim disputes or strategizing for customer retention, are where human insight is vital. The result is a workforce that is more engaged and a customer base that benefits from a higher quality of service. Simplifai’s innovation effectively reallocates human resources to areas where they can make the most impact, bridging the gap between quantitative efficiency and qualitative enhancement.

Financial Sector Collaborations and Innovations

The Collaborative Edge in Fintech

The fintech sector thrives on strategic partnerships, as exemplified by the collaboration between Finastra and OpenFin, aimed at pushing the boundaries of financial software. Likewise, Tyl by NatWest has joined forces with the Federation of Small Businesses to deliver improved payment solutions tailored to small enterprises. These partnerships underscore the pivotal role of collaboration in accelerating innovation, enhancing product offerings, and expanding market reach.

The Rise of Private Credit and Fintech Evolution

In the insurance sector, the handling of claims is a critical factor for ensuring customer contentment and operational efficiency. The technology firm’s latest innovation, Simplifai Claims Processing, is set to transform the way insurance claims are managed by leveraging InsuranceGPT, a cutting-edge generative AI technology. This state-of-the-art solution promises to not only streamline claim management processes but also maintain adherence to the strict regulations laid out by GDPR and EU AI laws. Insurance companies stand to benefit significantly from the increased speed and compliance afforded by Simplifai Claims Processing. The integration of this AI technology into their systems could lead to a transformative shift in the industry, providing faster resolutions to claims and bolstering the overall customer experience. Such advancements underline the constant evolution in the insurance industry through digital transformation and artificial intelligence.