Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

The shimmering promises of artificial intelligence often feel like a digital mirage, yet the global economy is finding that the “cloud” is actually anchored in massive data centers and microscopic circuits. While many view AI through the lens of intangible

- Robotic Process Automation In Fintech

The shimmering promises of artificial intelligence often feel like a digital mirage, yet the global economy is finding that the “cloud” is actually anchored in massive data centers and microscopic circuits. While many view AI through the lens of intangible

Popular Stories

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

The rapid integration of autonomous agency into corporate fiscal frameworks has fundamentally redefined the threshold between simple task automation and intelligent financial orchestration. While traditional Robotic Process Automation relied on rigid, “if-then” scripts, agentic AI utilizes a reasoning layer to

Deeper Sections Await

- Robotic Process Automation In Fintech

In the imperceptible moment it takes to tap a card or click “buy,” a complex web of intelligent systems evaluates risk, verifies identity, and authorizes the movement of capital across the globe. This silent, instantaneous process is the new standard

- Robotic Process Automation In Fintech

The insurance industry is navigating a critical juncture where the immense potential of artificial intelligence collides directly with non-negotiable demands for data security and regulatory compliance. The One Inc Model Context Protocol (MCP) emerges at this intersection, representing a significant

Browse Different Divisions

- Robotic Process Automation In Fintech

In the imperceptible moment it takes to tap a card or click “buy,” a complex web of intelligent systems evaluates risk, verifies identity, and authorizes the movement of capital across the globe. This silent, instantaneous process is the new standard

- Robotic Process Automation In Fintech

The financial industry is undergoing a profound transformation, driven not by gradual updates to existing software, but by a new class of intelligent systems capable of independent reasoning and action. Agentic AI represents a significant advancement in the financial services

- Robotic Process Automation In Fintech

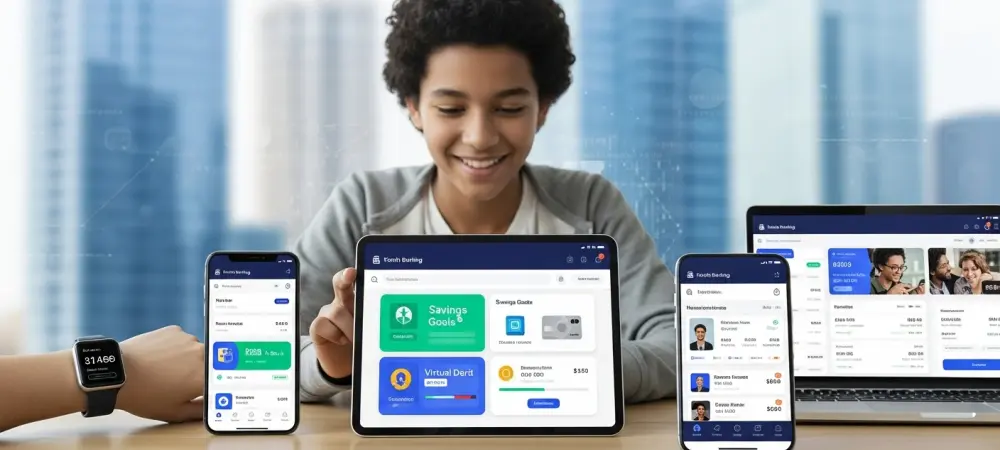

The challenge of instilling financial literacy in a generation that has never known a world without smartphones has forced a fundamental rethinking of how banking relationships are initiated and nurtured. This review explores the evolution of digital youth banking platforms,

- Robotic Process Automation In Fintech

A profound disconnect is quietly shaping the future of finance, with an overwhelming majority of institutions anticipating an AI-led revolution while only a fraction have successfully moved beyond small-scale experiments. This gap between ambition and reality is not just a

- Robotic Process Automation In Fintech

We’re joined by Nikolai Braiden, a distinguished FinTech expert and an early advocate for blockchain technology. With a deep understanding of how technology is reshaping digital finance, he provides invaluable insight into the innovations driving the industry forward. Today, our

- Robotic Process Automation In Fintech

The insurance industry is navigating a critical juncture where the immense potential of artificial intelligence collides directly with non-negotiable demands for data security and regulatory compliance. The One Inc Model Context Protocol (MCP) emerges at this intersection, representing a significant

Browse Different Divisions

Popular Stories

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

- Robotic Process Automation In Fintech

Uncover What’s Next