The landscape of financial transactions continues to evolve rapidly with the introduction of PayPal’s latest payment platform, positioning itself as a frontrunner in contactless payment solutions. Launched in Germany, this new system fundamentally alters both e-commerce and in-store transactions through the use of QR codes, eliminating the need for physical cash or card use. Germany serves as an optimal market for this venture given its vibrant retail environment and robust economic nature. The development illustrates a significant step forward for Germany and potentially the global market, reflecting current trends towards digital-first financial interactions and offering a more integrated, inclusive method of payment.

A New Era of Contactless Payment

Functionality and Integration of QR Code Technology

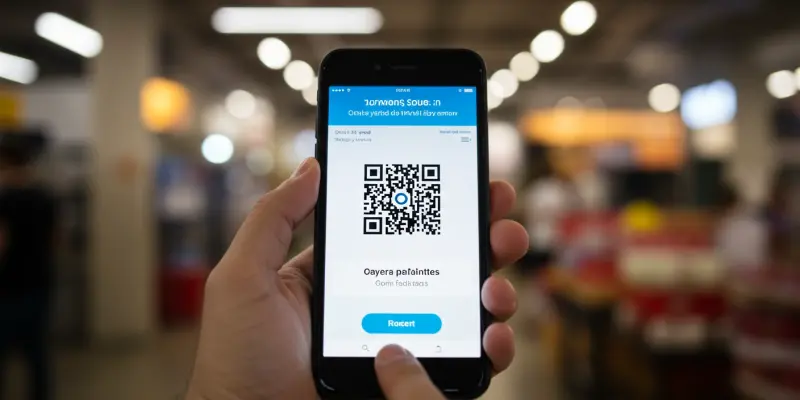

PayPal’s adoption of QR code technology paves the way for a seamlessly integrated digital payment experience, aligning with the broader movement towards cashless societies. By leveraging the simplicity of QR codes, which are easily generated and scanned using smartphones, transactions are made more straightforward and efficient. Consumers can now pay for goods and services using their PayPal app without the hassle of swiping cards or carrying cash. This development means that even those without access to traditional banking can make digital transactions, enhancing financial inclusivity. Merchants and businesses benefit significantly from this streamlined process. The setup for accepting payments via QR codes is straightforward and requires little investment, making it accessible even to small retailers. It’s a compelling proposition for merchants facing high transaction fees and delays associated with banks. Notably, this payment method simplifies logistics and enhances cash flow management as money is credited immediately to the PayPal account. This advancement opens new possibilities for merchants to cater to a broader audience, accommodating diverse consumer preferences and needs.

Addressing Security and Consumer Confidence

Security remains a top priority in the deployment of PayPal’s QR payment system. The company employs rigorous security measures to protect user data and financial information, critical in maintaining consumer confidence in this new system. PayPal’s long-standing reputation for securing online transactions serves as a solid foundation to assure users of the system’s reliability. Advanced encryption and fraud detection technologies are integrated into the platform, ensuring that transactions are processed securely and efficiently. Consumer response to the QR payment system has been notably positive, indicating a strong preference for its convenience and time-saving attributes. As more consumers gravitate towards digital transactions, PayPal’s system promises to reduce the friction ordinarily associated with traditional payment methods. Early adopters appreciate the ease of use and the ability to track spending directly through the app, allowing for better financial management. This positive reception indicates a readiness amongst consumers to embrace and trust mobile-centric financial solutions.

Potential Impact on Global Payment Norms

Expansion Beyond Germany

While currently available in Germany, the QR payment system has the potential to set a precedent for mobile transactions globally. If successful, the trial run in Germany could serve as a launching pad for widespread adoption across various international markets. Given the increasing acceptance of smartphone technology and mobile applications, this mode of payment is likely to experience rapid global uptake. The scalability and adaptability of this technology make it attractive for replication, suggesting a future where mobile payments may become the norm rather than the exception.

The success of this initiative may also stimulate further innovation in the financial sector. Other companies and financial institutions might be prompted to develop similar systems, increasing the variety of digital payment options available to consumers worldwide. As each region’s economic and technological landscape presents unique challenges and opportunities, adapting the system to local needs will be vital in ensuring its broader acceptance and success.

Future Considerations and Adaptations

The financial transaction landscape is undergoing a significant transformation with the advent of PayPal’s latest payment platform, which positions itself as a leader in the realm of contactless payment solutions. Recently launched in Germany, this innovative system introduces a fundamental shift in both e-commerce and in-store transactions by utilizing QR codes, thereby eliminating the traditional need for cash or card payments. Germany has been strategically chosen as the initial market for this rollout due to its dynamic retail environment and strong economic framework. This development marks a pivotal advancement for Germany and holds promise for influencing the global market, as it embodies the prevailing trends towards digital-first financial transactions. By offering a more integrated and inclusive payment method, PayPal’s new platform reflects the increasing demand for seamless, technology-driven payment solutions. It signifies a movement away from conventional methods towards a more modern and digitally cohesive financial future.