In a landmark move that blurs the lines between digital connectivity and financial security, Poland’s telecommunications giant Orange has stepped decisively into the insurance market. This strategic initiative, powered by a partnership with global insurtech leader bolttech, introduces a novel platform designed to radically simplify how consumers purchase protection for their most valuable assets. The launch of “Insure with Orange” is not merely a new service offering; it is a significant indicator of a broader industry trend where trusted consumer brands are leveraging their digital infrastructure to disrupt and improve adjacent markets, starting with the often-complex world of insurance.

Buying Insurance as Simply as Topping Up a Phone

For many, the process of acquiring insurance is synonymous with cumbersome paperwork, confusing jargon, and lengthy phone calls. The traditional model often leaves consumers feeling uncertain and overwhelmed. Orange Poland and bolttech aim to dismantle this legacy experience by introducing a process that mirrors the simplicity of modern digital transactions. The core promise is to transform a typically arduous task into a straightforward, transparent, and quick interaction.

The new platform is built around this principle of convenience. It allows users to compare, select, and purchase motor and home insurance policies from a panel of reputable insurers entirely online. This streamlined journey, which can be completed in a matter of minutes, is designed to feel as intuitive as managing a mobile phone plan or streaming a movie. By embedding this service within a familiar digital environment, the partnership seeks to lower the barrier to entry for obtaining essential coverage, making protection more accessible to a wider audience.

The Convergence of Connectivity and Coverage in a Digital World

The collaboration between a telecommunications operator and an insurtech firm is a powerful illustration of the ongoing convergence between disparate industries. Telcos are increasingly looking beyond their core offerings of calls, texts, and data to create comprehensive digital ecosystems that add tangible value to their customers’ daily lives. By leveraging their extensive customer bases, established brand trust, and sophisticated distribution channels, they are uniquely positioned to integrate services like banking, entertainment, and now, insurance.

This partnership is a prime example of this evolution in action. Orange Poland provides the market access and consumer trust, while bolttech delivers the specialized technology and insurance expertise required to build a seamless, scalable platform. Together, they are creating a new model where financial protection is not a separate, standalone purchase but an integrated component of a broader digital lifestyle. This move marks the first time a telecom operator in Poland has launched such a full-featured insurance comparison service, setting a new precedent for the market.

A Closer Look at the Insure with Orange Platform

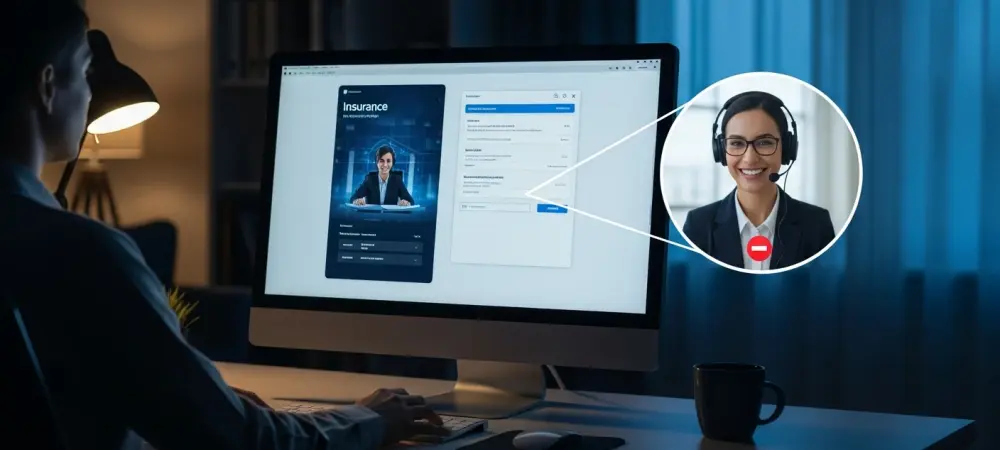

At its core, “Insure with Orange” is a digital marketplace designed for clarity and choice. Upon entering the platform, customers can access competitive quotes for motor and home insurance from a curated selection of providers. The interface is designed to facilitate easy comparison of policy features and prices, empowering users to make informed decisions without needing to navigate multiple different websites or consult with numerous brokers.

Recognizing that a one-size-fits-all approach does not suit every consumer, the platform incorporates a hybrid service model. While the primary user journey is digital-first, customers have the option to connect with a licensed insurance agent via phone for personalized advice or assistance. This blend of high-tech efficiency and human-touch support ensures that the service caters to a wide spectrum of customer preferences, from digitally native individuals to those who value expert guidance.

A Dual Strategy for Ecosystems and Embedded Protection

This initiative serves the strategic goals of both partners. For Orange Poland, the launch is a critical step in its strategy to expand beyond connectivity and become an indispensable part of its customers’ digital lives. By integrating value-added financial services, the company can deepen customer relationships, increase loyalty, and unlock new avenues for growth. It transforms the Orange brand from a utility provider into a trusted partner for a range of essential needs. For bolttech, the partnership is a textbook execution of its global mission to build the world’s largest technology-enabled insurance ecosystem. The company specializes in embedded insurance, a model where protection is offered at the point of need through non-insurance partners. By teaming up with Orange Poland, bolttech seamlessly integrates its platform into a high-traffic consumer channel, making insurance a natural and timely offering for millions of potential customers and helping to close the pervasive protection gap.

The platform was intentionally developed with scalability in mind, a forward-thinking approach that allows for future expansion. Plans are already in place to broaden the range of available insurance products and services over time. This will not only enhance consumer choice but also solidify the platform’s position as a comprehensive solution for personal protection needs. This vision for growth ensures the partnership can adapt to evolving market demands and continue to innovate within the Polish financial landscape.