Mastercard, a global leader in payment solutions, has joined forces with NEC Corporation, a renowned technology provider, to drive the adoption of facial recognition technology for in-store payments across the Asia Pacific region. This collaboration aims to combine NEC’s cutting-edge face recognition and liveness verification technology with Mastercard’s expertise in payment enablement and user experience, shaping the future of secure and convenient payment methods.

Partnership details

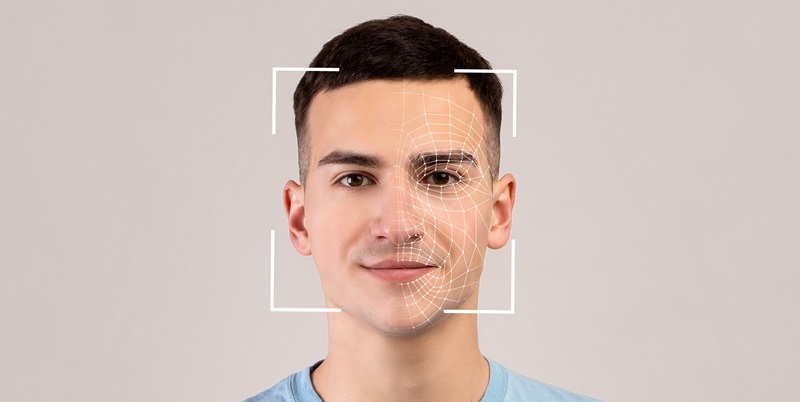

Under a memorandum of understanding, Mastercard and NEC will pool their resources to create a powerful synergy. By integrating NEC’s advanced facial recognition technology and Mastercard’s payment platform, the partnership seeks to deliver enhanced verification and user experiences. Together, they aim to establish the industry’s gold standard for security, biometric performance, data protection, and privacy requirements.

Mastercard’s Biometric Checkout Program

The collaboration with NEC marks the latest milestone in Mastercard’s Biometric Checkout Program, which commenced with a successful pilot in Brazil last year. This groundbreaking program offers a technology framework that enables merchants, banks, and technology firms to define and adhere to minimum standards for a secure, convenient, and seamless checkout experience. By setting these standards, Mastercard aims to safeguard customer data and privacy while ensuring the accuracy and reliability of biometric authentication.

Benefits of biometric solutions

Advantages such as a seamless, quick, and secure checkout process without the need to unlock a smartphone or enter a PIN have positioned biometric solutions as a game-changer in the payments industry. Ajay Bhalla, President of Cyber and Intelligence Solutions at Mastercard, highlights the significance of biometrics in the evolving retail landscape. He emphasizes how biometric solutions provide a frictionless customer experience, making payments faster, more secure, and hassle-free.

Expansion into the Asia Pacific region

Mastercard’s partnership with NEC is set to introduce exciting new biometric payment solutions to countries across the Asia Pacific region. With the aim of leading the world in safe and convenient checkout experiences, Mastercard is determined to enhance customer satisfaction and inspire widespread adoption of biometric payments. This collaboration demonstrates Mastercard’s dedication to providing cutting-edge solutions that streamline the payment process for consumers and businesses alike.

Leveraging NEC’s facial recognition technology

NEC’s facial recognition technology is renowned for its outstanding accuracy, speed, and security. Mastercard aims to leverage these capabilities to create a seamless and trustworthy payment experience for customers. By harnessing NEC’s advanced technology, Mastercard can ensure the highest levels of authentication and protect against fraudulent activities, reducing liabilities, and enhancing trust among customers, merchants, and financial institutions.

Global Traction of Biometric Payments

Around the world, companies and countries are actively exploring the potential of biometric technology for payments. The inherent convenience, security, and reliability of biometric authentication make it a promising solution for streamlining the checkout process. As the technology continues to advance, biometric solutions are poised to become increasingly prevalent, revolutionizing the way customers securely complete transactions.

Convenience and Security of Biometric Authentication

Biometric authentication provides a secure and convenient way for customers to verify their identities and complete transactions effortlessly. The unique biometric features, such as facial recognition, fingerprint scanning, and iris identification, ensure a high level of accuracy and protection against fraud. Through these authentication methods, consumers can enjoy peace of mind knowing that their sensitive data is safeguarded, offering a secure alternative to traditional security measures.

Mastercard’s commitment to advancing biometric payments and enhancing the overall payment experience in the Asia Pacific region, through its partnership with NEC, solidifies its position as a pioneer in the industry. With NEC’s cutting-edge facial recognition technology, Mastercard is well-positioned to redefine in-store payments, offering seamless, quick, and secure checkout experiences. As merchants, banks, and technology firms continue to embrace biometric solutions, it is clear that biometric-based payments will become the norm, transforming how customers interact with payment systems and ensuring a more secure and convenient future.