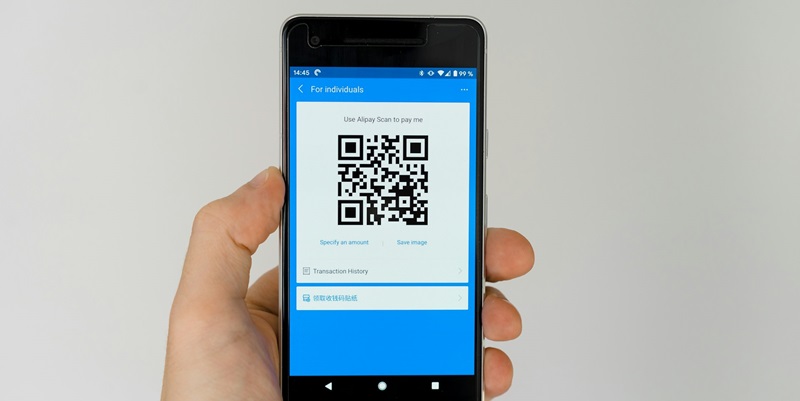

The Kerala State Electricity Board (KSEB) has recently announced the implementation of a QR code payment system for electricity bills. This new system, set to come into effect on March 1, aims to bring greater convenience to users by seamlessly integrating meter readings into the payment process. The collaboration with Canara Bank has facilitated the establishment of this innovative payment system, which is expected to simplify transactions and improve overall efficiency.

Implementation of the QR Code payment system

Starting from March 1, consumers in Kerala can take advantage of the QR code payment system for settling their electricity bills. By incorporating meter readings directly into the payment process, users will no longer need to manually input their meter readings when making payments. This streamlining of the process is designed to make bill payments quicker and more convenient for KSEB customers.

Convenience for users

The introduction of the QR code payment system is expected to significantly enhance convenience for users in multiple ways. Firstly, by eliminating the need for manual meter readings, customers will save time and effort, as their bills will automatically reflect accurate readings. Secondly, this system will enable users to make payments swiftly and securely using their preferred online platforms, such as GPay, Amazon Pay, Paytm, and other similar services. With the QR code payment system, settling electricity bills will be as simple as scanning a code from their smartphone.

Collaboration with Canara Bank

To establish this seamless payment system, the KSEB has collaborated with Canara Bank, a leading bank in India. This partnership has enabled the effective integration of meter readings into the bill payment process, ensuring accuracy and efficiency. By leveraging Canara Bank’s expertise and resources, the KSEB aims to provide its customers with a hassle-free payment experience.

Current methods of bill payment

Presently, KSEB consumers have the option to settle their electricity bills through various online platforms. With the popularity of digital payments on the rise, approximately 60 percent of users currently prefer online payment methods. Platforms like GPay, Amazon Pay, Paytm, and others have gained popularity due to their ease of use and the convenience they offer. However, with the implementation of the QR code payment system, users can expect an even simpler and more efficient payment process.

Simplifying the payment process

The introduction of the QR code payment system aims to simplify and streamline the transaction process for electricity bill payments. Instead of going through multiple steps and entering various details, customers can now make payments by scanning the QR code provided on their bill. This seamless integration of QR codes with the payment process eliminates the need for manual data entry and provides users with a hassle-free experience.

Establishment of Swap Machines

To facilitate payments through credit and debit cards, approximately 53,000 swapping machines have been installed at the meter readers’ locations in homes. This allows users to make payments directly through their preferred card, further contributing to the convenience and ease of bill settlement.

Reduction of physical bill counters

Recognizing the growing trend of online payments, the KSEB has made the decision to reduce the number of physical bill counters. With the majority of users opting for online payment methods, this move not only aligns with consumer preferences but also promotes the efficiency and expediency of digital transactions.

Finalized measures and upcoming rollout

The necessary measures for the implementation of the QR code payment system have been successfully finalized, and the KSEB is ready to roll out this innovative payment solution shortly. With its seamless integration of meter readings and various online platforms, the QR code payment system is set to transform the way consumers settle their electricity bills in Kerala.

In conclusion, the implementation of the QR code payment system by the Kerala State Electricity Board marks a significant step towards enhancing convenience for users. By streamlining the payment process and integrating meter readings, customers can expect an efficient, hassle-free experience when settling their electricity bills. With the support of Canara Bank and the establishment of swapping machines, the widespread adoption of this new payment system is well within reach. As the KSEB reduces physical bill counters in response to the growing trend of online payments, consumers in Kerala can embrace the digital era and enjoy the seamless, secure, and convenient transactions offered by the QR code payment system.