In recent years, digital payment ecosystems have rapidly evolved to address the demands of an increasingly globalized economy. UnionPay International (UPI), a leading China-based payment firm, has made significant strides in enhancing the convenience of cashless transactions worldwide. In a groundbreaking move, UPI has partnered with Thailand’s National ITMX Co., Ltd. (NITMX) to facilitate seamless QR code payments between China and Thailand. This partnership promises to revolutionize the digital payment landscape by providing a familiar and convenient payment method for tourists and enhancing the interoperability between different national payment systems.

Enhancing the Digital Payment Experience

The UnionPay-PromptPay Integration

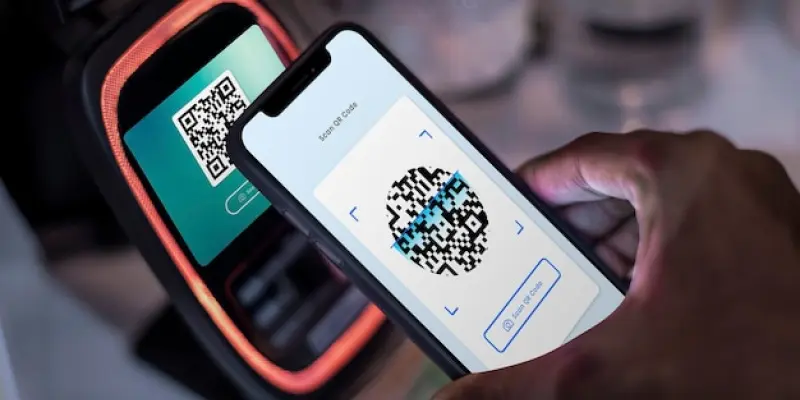

The core of the UnionPay-NITMX partnership lies in the integration of UnionPay payment information with Thailand’s PromptPay system. A significant outcome of this collaboration is the ability for UnionPay App users to scan PromptPay QR codes in popular Thai destinations such as Bangkok, Phuket, and Chiang Mai. This integration is designed to provide Chinese tourists with a familiar payment method that they can trust, thereby enhancing their travel experience and promoting ease of transactions. As many Chinese tourists prefer using mobile payments, having the option to use UnionPay QR codes in Thailand encourages more spending, benefiting local businesses and the tourism sector.

UnionPay’s strategic expansion into prolific markets such as Thailand is part of its broader mission to create a global QR payment network. The use of QR codes is appealing due to its simplicity and security. Just by scanning a QR code, tourists can seamlessly complete their transactions without the hassle of currency exchange, reducing the risk of carrying large amounts of cash. Moreover, the partnership contributes to the increased acceptance of the YunShanFu mobile payment system, thereby fortifying UnionPay’s position as a key player in the global digital payment ecosystem.

Boosting Tourism and the Local Economy

The utilization of UnionPay QR codes is anticipated to offer significant advantages to Thailand’s tourism sector, especially in assisting local businesses to capture more sales from international visitors. The convenience of being able to make payments using a trusted platform like UnionPay likely results in higher spending among tourists, directly benefiting shops, restaurants, and service providers. This added liquidity within the consumer market can stimulate the local economy, driving growth and opportunities within the retail and hospitality industries. Ultimately, the more seamless and secure payment options available, the more attractive Thailand becomes as a travel destination for Chinese tourists.

Additionally, Thai businesses using PromptPay will experience numerous benefits from being integrated into UnionPay’s international network. The system allows for faster, more reliable transactions, improving the overall efficiency in handling payments. This integrated approach demonstrates how digital innovations can significantly boost a country’s tourism appeal while concurrently supporting local economic growth. By ensuring a secure cashless payment experience, the UnionPay-NITMX partnership aligns with Thailand’s broader objective to transform into a more digitally savvy economy.

A Milestone in Cross-Border Digital Payments

Strategic Benefits for UnionPay and NITMX

The significance of the UnionPay-NITMX partnership extends beyond immediate functional benefits for tourists and local businesses. For UnionPay, this initiative aligns with its goal of broadening the acceptance and reach of its payment methods in new regions. The collaboration with NITMX serves not only to expand UnionPay’s QR code network but also to establish a solid foothold in Southeast Asia, a region with burgeoning digital payment adoption. By being the payment network of choice for Chinese tourists in Thailand, UnionPay strengthens its brand presence and cements user loyalty in an essential travel corridor.

On the other hand, for NITMX, this collaboration signifies a move in sync with Thailand’s National e-Payment Roadmap, a national initiative aimed at promoting digital payment technology. By integrating UnionPay’s robust system, NITMX can leverage advanced technology to provide diverse and innovative financial services to its users. This partnership marks a step forward in Thailand’s efforts to enhance financial inclusion and efficiency, reflecting the country’s commitment to modernizing its payment infrastructure to meet the demands of a globally connected economy.

Executives’ Perspectives on the Collaboration

The enthusiasm of executives from both organizations underscores the potential of this partnership. Larry Wang, an executive at UnionPay International, emphasized the alignment of this initiative with UnionPay’s vision of a global QR payment network. He highlighted that enabling Chinese tourists to use familiar payment methods abroad is the next step towards achieving a more connected, cashless world. By expanding the acceptance of UnionPay QR codes in Thailand, the company not only facilitates a more enjoyable travel experience for Chinese tourists but also showcases the capability of UnionPay’s technology in an international context.

Similarly, Chatchai Dusadenoad of NITMX expressed that the collaboration stands to significantly enhance Thailand’s financial services landscape. By working with UnionPay, NITMX can offer secure, innovative, and convenient payment solutions that cater to a wide range of users. This partnership demonstrates NITMX’s commitment to pushing the boundaries of traditional banking and payment systems, subsequently positioning Thailand as a leader in the adoption of advanced digital payment technologies. Together, both organizations illustrate how international collaboration and technological integration can pave the way for a more cohesive and efficient digital payment ecosystem.

Future Prospects and Broader Implications

Towards a Unified Digital Payment Ecosystem

The successful implementation of this partnership sets a precedent for future cross-border digital payment collaborations. By enhancing interoperability between different national payment systems, the UnionPay-NITMX partnership is paving the way for a more interconnected global financial network. The initiative is a critical step toward creating a cohesive, efficient, and secure international digital payment ecosystem that can handle diverse user needs with minimal friction. As more countries adopt and integrate similar systems, we can anticipate an era where the ease of cashless transactions becomes a universal standard, significantly reducing barriers to international commerce and travel.

Moreover, the increased adoption and acceptance of QR code payments will likely drive further innovations in financial technology. As user demand for seamless, secure, and quick transaction methods continues to rise, firms like UnionPay and entities like NITMX will need to innovate constantly to stay ahead of the curve. This continuous evolution promises to deliver more sophisticated, user-friendly digital payment solutions, further blurring the lines between traditional banking and emerging financial technologies.

Conclusion: Future Steps and Considerations

In recent years, the landscape of digital payment ecosystems has evolved rapidly to meet the demands of an increasingly globalized economy. UnionPay International (UPI), a prominent payment company based in China, has made notable advances in enhancing the ease of cashless transactions on a global scale. In a groundbreaking development, UPI has formed a partnership with Thailand’s National ITMX Co., Ltd. (NITMX) to enable seamless QR code payments between China and Thailand. This collaboration is poised to transform the digital payment sector by offering a familiar and user-friendly payment method for tourists while improving the interoperability between distinct national payment systems. This is particularly beneficial for Chinese tourists visiting Thailand, as they can use their preferred payment method, which in turn could boost tourism and spending. Additionally, this move sets a positive precedent for other countries to follow, fostering a more connected and efficient global payment infrastructure.