IBISA, a leader in the Climate InsurTech sector, has successfully raised $3 million in funding to expand its innovative parametric insurance solutions. This recent funding round will enable IBISA to enhance climate resilience in regions highly susceptible to weather-related risks, focusing primarily on Asia and Africa. The new injection of capital will help smallholder farmers, financial institutions, and other stakeholders to better manage the financial impact of extreme weather events.

The $3 million funding will support the company’s mission to provide efficient, low-cost insurance products specifically designed for vulnerable regions regularly plagued by climatic shocks. This round of funding is crucial for IBISA to scale up its operations, making it possible to offer even more comprehensive coverage through its parametric insurance models. This type of insurance, which triggers payouts based on predefined parameters rather than lengthy loss assessments, enables a faster and more reliable compensation process. It mitigates financial uncertainties that traditional insurance models often fail to address promptly.

IBISA’s Mission and Innovative Approach

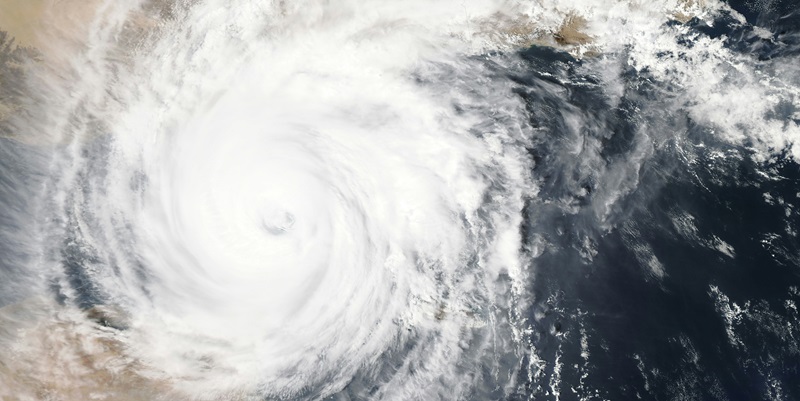

IBISA has distinguished itself in the Climate InsurTech space through its focus on parametric insurance products. Parametric insurance, unlike traditional models, offers payouts based on predefined parameters rather than loss assessments. This innovative approach allows IBISA to provide low-cost, efficient insurance mechanisms specifically designed to address the pressing needs of vulnerable regions. Leveraging advanced satellite and actuarial technologies, IBISA’s offerings include agricultural insurance, typhoon coverage, and loan protection for financial institutions.

IBISA utilizes real-time data from satellite and actuarial technologies to accurately assess climatic events. This tech-driven approach ensures timely and fair payout processes, enhancing both the efficacy and reliability of its insurance products. By innovating in this way, IBISA not only mitigates the risks associated with extreme weather conditions but also sets new benchmarks within the insurance sector. The effective pairing of technology with insurance is key to quick and transparent payouts, a critical component for regions that experience frequent weather-related disruptions.

Investors and Funding Round Dynamics

The $3 million funding round attracted substantial contributions from notable investors such as The Acumen Resilient Agriculture Fund (ARAF), Equator, and the Asian Development Bank Ventures (ADBV), alongside repeat investors like Ankur Capital. This investment underscores a significant commitment to advancing climate resilience through innovative financial solutions. The participation of these prestigious investors highlights a growing interest in and confidence toward parametric insurance as a viable means of protection against climate risks.

These investors are particularly drawn to IBISA’s mission of fostering climate resilience through sustainable InsurTech solutions. By allocating investment towards businesses that emphasize sustainability and resilience, these entities aim to contribute to a larger global agenda of combating climate change. The renewed financial support will assist IBISA in intensifying its market expansion and scaling its impact. This kind of backing reflects a larger trend in venture financing, where sustainability and financial stability are increasingly prioritized as key indicators of long-term viability.

Industrialization Phase and Strategic Expansion

Under the leadership of CEO Maria Mateo, IBISA is currently transitioning into an industrialization phase. This strategic shift marks a critical juncture in IBISA’s journey, enabling the company to scale up its product offerings and operational capabilities to meet growing market demands. With the newly secured funds, IBISA aims to develop groundbreaking insurance solutions that cater to specific regional needs, particularly in high-risk areas of Asia and Africa.

This industrialization phase not only involves product development but also strategic market penetration. IBISA is focused on creating region-specific insurance products that can address the unique challenges faced by stakeholders in various high-risk regions. By doing so, the company aims to provide more targeted and efficient solutions that elevate climate resilience for a broader spectrum of clients. This phase is not merely about increasing the volume of offerings but about enhancing the quality and relevance of insurance solutions to fit diverse environmental and socio-economic landscapes.

Impact on Smallholder Farmers in Vulnerable Regions

One of IBISA’s foremost goals is to support smallholder farmers in Africa and Asia, who are disproportionately affected by climate change. These farmers often lack access to affordable and efficient insurance products that can protect them against climatic shocks. IBISA’s parametric insurance solutions aim to fill this gap by providing accessible and low-cost products that enhance the financial stability of these farmers.

The focus on smallholder farmers aligns with the objectives of investors like ARAF, which prioritize fostering agricultural resilience through sustainability-driven investments. By bolstering the financial health of smallholder farmers, IBISA contributes significantly to economic stability and growth in these vulnerable regions. This mission is particularly critical as climate-related risks continue to escalate globally. In providing a safety net for these farmers, IBISA helps ensure that they can continue their agricultural activities even in the face of adverse weather events, thus preventing a downward spiral of poverty and economic hardship.

Technological Innovations Driving Success

IBISA’s success can be attributed in large part to its utilization of state-of-the-art satellite and actuarial technologies. These technologies allow for real-time monitoring and accurate assessment of climatic events, facilitating swift and transparent payouts. This technological edge not only enhances the effectiveness of IBISA’s insurance products but also positions the company as a leader in technological innovation within the insurance sector.

By integrating cutting-edge technology with traditional insurance models, IBISA is able to offer a more precise and reliable form of coverage. This approach not only builds trust among policyholders but also sets a new standard for the industry, encouraging other players to adopt similar technological advancements. The use of satellite data allows IBISA to monitor weather conditions accurately and in real-time, making the prediction models highly reliable. This marriage of technology and insurance offers a futuristic look at how climate risks can be managed more effectively.

Regional Presence and Market Penetration

IBISA, a frontrunner in the Climate InsurTech industry, has secured $3 million in funding to expand its game-changing parametric insurance solutions. This infusion of capital will allow IBISA to bolster climate resilience in regions that are highly vulnerable to weather risks, with a primary focus on Asia and Africa. The new funding will aid smallholder farmers, financial institutions, and other key stakeholders in better managing the financial impacts of extreme weather events.

This $3 million boost is vital for IBISA’s mission to deliver efficient and affordable insurance products tailored for areas frequently hit by climate shocks. The funding will be pivotal in scaling up IBISA’s operations, enabling the firm to provide more comprehensive coverage through its parametric insurance models. Unlike traditional insurance, parametric insurance offers quicker and more predictable payouts based on predefined criteria, bypassing lengthy loss assessments. This method ensures faster and more reliable compensation, addressing financial uncertainties that conventional insurance methods often overlook.