Introduction

Imagine a world where millions of people, constrained by unstable local currencies and limited banking access, can save, spend, and invest with the stability of digital dollars using just a smartphone. This scenario is no longer a distant dream but a tangible reality with the emergence of innovative fintech solutions. The growing need for accessible and secure financial tools has never been more critical, especially in regions plagued by high inflation and economic uncertainty.

This FAQ article aims to explore how a pioneering fintech platform is addressing these challenges by making digital finance more inclusive. Readers can expect to gain insights into the purpose, features, and broader implications of this transformative app, as well as answers to key questions about its impact on global financial access.

The scope of this discussion will cover the platform’s unique approach, its target audience, and the systemic issues it seeks to resolve. By delving into specific aspects of its functionality and relevance, the content will provide a comprehensive understanding of how digital dollars are becoming a practical tool for everyday users.

Key Questions or Key Topics Section

What Is the Core Mission of Rizon in Digital Finance?

The central mission of Rizon revolves around democratizing access to digital dollars through a stablecoin app, making financial tools available to a global audience. This is particularly significant in a landscape where traditional banking systems often exclude large populations due to geographic or economic barriers. The app’s purpose is to create an internet-native financial system that anyone with a smartphone can use for various financial activities.

By focusing on stablecoins like USDC and USDT, Rizon ensures that users have a reliable alternative to volatile local currencies. The platform is designed to be accessible in 110 countries, reaching beyond crypto enthusiasts to include everyday individuals who need a stable medium for saving or spending. This broad outreach addresses a critical gap in financial inclusion.

How Does Rizon Ensure Simplicity and User Control?

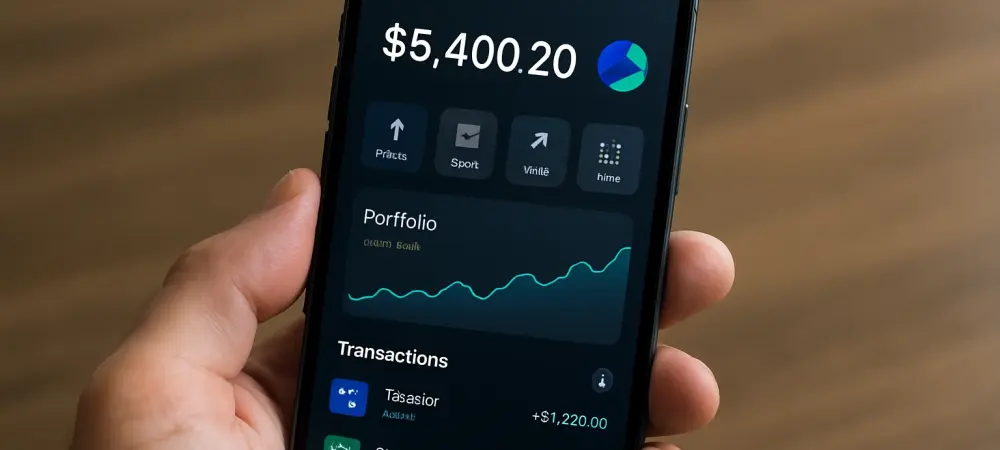

A standout feature of Rizon is its emphasis on user-friendliness and autonomy in managing funds. Many people hesitate to engage with cryptocurrency due to its perceived complexity, but Rizon tackles this challenge with a non-custodial architecture. This means users retain full control over their assets while the app handles the intricate details of stablecoin transactions seamlessly in the background.

The intuitive design mirrors the ease of traditional fintech platforms, lowering the entry barrier for those unfamiliar with digital currencies. Such an approach ensures that even novice users can navigate the app confidently, making digital finance less intimidating and more approachable for a diverse audience.

What Role Do Strategic Partnerships Play in Rizon’s Functionality?

Strategic collaborations with industry leaders significantly enhance Rizon’s operational capabilities and credibility. Partnerships with entities like Privy, Rain, Visa, and Circle provide robust infrastructure for wallet management, payment card issuance, compliance, and integration with trusted stablecoins. These alliances are crucial for delivering a seamless user experience.

Additionally, the app’s availability on both iOS and Android platforms, combined with minimal fees—no maintenance costs, free deposits, and a one-time $10 virtual card issuance fee—demonstrates a commitment to affordability. However, users should note that foreign transaction fees apply for non-USD spending, which is a minor limitation in an otherwise accessible framework.

How Does Rizon Address Financial Instability in Specific Regions?

Rizon holds particular value in regions with unstable local currencies, such as parts of Latin America, where high inflation erodes savings and purchasing power. By offering a stable digital alternative through stablecoins, the app provides a safeguard against currency volatility, empowering users to protect their financial resources in challenging economic climates.

This focus on economically vulnerable areas highlights Rizon’s role in addressing systemic financial issues. It serves as a lifeline for individuals who lack access to reliable banking services, enabling them to engage in global financial systems with greater confidence and security.

What Broader Trends Support Rizon’s Mission?

The rising popularity of stablecoins, as noted in a World Economic Forum report, aligns with Rizon’s objectives and underscores the timeliness of its launch. Stablecoins are increasingly seen as a viable solution for cross-border transactions and financial stability, gaining traction among users and regulators alike. Furthermore, recent legislative developments, such as the passing of the GENIUS Act in the US—the first federal law regulating stablecoins—bolster trust and mainstream acceptance of these digital assets. This regulatory progress validates Rizon’s mission, positioning it at the forefront of a growing movement toward digital financial inclusion.

Summary or Recap

This article highlights the transformative potential of Rizon in making digital finance accessible to a global audience through its stablecoin app. Key points include its mission to democratize digital dollars, the simplicity and user control embedded in its design, strategic partnerships that enhance functionality, and its relevance in regions with financial instability. The discussion also ties Rizon’s efforts to broader trends in stablecoin adoption and regulatory advancements. The main takeaway is that Rizon stands as a pivotal player in bridging the gap between complex cryptocurrency systems and everyday users. Its focus on accessibility, affordability, and stability addresses both technological and socioeconomic challenges in the financial landscape.

For those seeking deeper insights, exploring resources on stablecoin regulations or regional economic studies can provide additional context on how such platforms shape financial inclusion. Understanding these dynamics is essential for grasping the full scope of Rizon’s impact.

Conclusion or Final Thoughts

Looking back, the journey of Rizon illustrates a significant stride in redefining how digital finance can empower individuals across diverse economic backgrounds. The platform tackles real-world challenges by offering a stable, user-friendly alternative to traditional financial systems, setting a precedent for future innovations in the fintech space.

As a next step, readers are encouraged to evaluate how such tools can address personal or community financial needs, especially in areas affected by currency instability. Exploring stablecoin apps or engaging with educational resources on digital currencies offers a practical way to stay informed and potentially benefit from these advancements. Reflecting on this topic, it becomes evident that embracing accessible digital finance solutions holds the key to fostering greater economic resilience. The path forward involves staying updated on regulatory changes and technological developments to fully leverage the opportunities that platforms like Rizon present.