The transformative effect of blockchain technology on traditional money transfer systems, particularly focusing on the advantages it offers for transferring money from the UK to India, cannot be overstated. Blockchain technology has introduced a new paradigm in the global financial landscape by offering a more efficient, secure, and cost-effective means of transferring money across borders. In doing so, it addresses longstanding issues such as high fees, slow processing times, lack of transparency, and limited accessibility that accompany conventional money transfer methods. As the reliance on traditional financial systems wanes, blockchain-based solutions are proving invaluable in redefining how money moves internationally, providing substantial benefits to individuals and businesses alike.

The Drawbacks of Traditional Money Transfer Systems

Traditional money transfer systems have long relied on banks and financial intermediaries, but this dependence is laden with several significant drawbacks. One major downside is the high fees involved, with costs compounding as multiple intermediaries, such as banks, clearinghouses, and other third parties, add their charges to a single transaction. As each intermediary takes its cut, the final amount received by the recipient diminishes. Furthermore, processing times in conventional money transfers can be exceedingly slow, often taking several business days to complete. This delay is due to the various stages and time zone differences involved, causing inefficiencies and inconveniences for both the sender and recipient.

Transparency issues further complicate traditional money transfers. Hidden fees and unclear exchange rates frequently make it challenging for users to predict the actual cost and the final amount the recipient will receive. This lack of transparency leaves consumers in the dark, causing dissatisfaction and distrust, especially when unexpected fees arise. Additionally, limited accessibility in certain regions, particularly those with inadequate banking infrastructure, further hampers the process. In regions where traditional banking services are either scarce or unreliable, transferring money can become a cumbersome and often unrealistic task. The systemic limitations of traditional money transfer methods necessitate a more innovative and efficient solution.

Blockchain Technology: A Solution to Traditional Transfer Issues

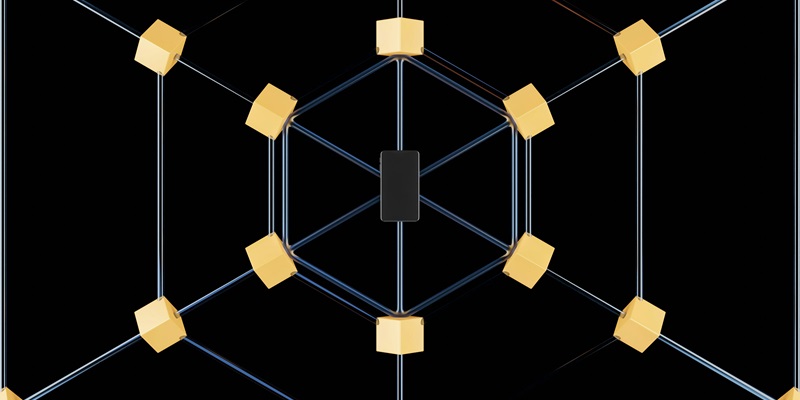

Blockchain technology steps in to resolve these inherent challenges with its decentralized digital ledger system. Blockchain’s revolutionary aspects enable peer-to-peer networks, significantly cutting down on the need for intermediaries. This decentralized approach brings about several key benefits, including lower transaction costs, faster processing times, enhanced transparency, and increased security. Traditional transfers, laden with fees from multiple intermediaries, stand in stark contrast to blockchain transactions, which process directly on the network and thus eliminate many of those intermediary fees. For example, using a blockchain-based platform to transfer money from the UK to India proves to be substantially cheaper than conventional bank or remittance services.

The efficiency of blockchain technology also shines through its ability to execute near-instant transactions, irrespective of the amount or destination. By continuously operating without the delays associated with traditional methods, blockchain technology circumvents the multiple steps and various time zones that typically slow down transfers. This feature is particularly advantageous for urgent payments to India, ensuring recipients can access funds almost immediately. Enhanced transparency is another critical advantage, as every transaction logged on a blockchain is recorded on a public ledger accessible to all participants. This transparency eliminates hidden fees and provides a clear understanding of the costs and amounts received, instilling a sense of trust and reliability.

Platforms Leveraging Blockchain for Money Transfers

Several innovative platforms have capitalized on blockchain technology to provide efficient money transfer services, exemplifying its potential in practical applications. Ripple (XRP) is a prominent example, focusing on enabling fast and low-cost international transactions. Many financial institutions have adopted Ripple’s technology to enhance cross-border payments, benefitting from its ability to facilitate quick and affordable transfers. This makes Ripple an appealing option for sending money from the UK to India. Similarly, Stellar (XLM) aims to facilitate low-cost financial transactions, with a particular focus on developing markets. By connecting people, banks, and payment systems, Stellar simplifies the process of transferring money across borders, making it an accessible and user-friendly alternative.

In addition to dedicated platforms like Ripple and Stellar, well-known cryptocurrencies such as Bitcoin and Ethereum are being utilized for peer-to-peer money transfers as well. Though primarily recognized as digital currencies, their global accessibility and quick processing times provide a decentralized alternative to traditional banking systems. Users benefit from having more control over their funds, bypassing traditional financial institutions altogether. Stablecoins, such as USDT (Tether) and USDC (USD Coin), also play a significant role. Being pegged to fiat currencies, stablecoins minimize volatility, ensuring the value of transferred funds remains stable. Increasingly, these are employed for international money transfers, offering not only stability but also efficiency in transactions.

The Impact of Blockchain on Remittances to India

Blockchain technology has profound implications for remittances to India, which is one of the largest recipients of global remittances. By significantly lowering transaction fees, especially for smaller transfers, blockchain ensures that more money reaches families who rely on these funds. This proves particularly beneficial in India, where even small amounts can make a substantial difference in daily living conditions for many households. Moreover, blockchain fosters financial inclusion by providing access to funds for users who may not have traditional bank accounts, utilizing blockchain-based wallets and applications to facilitate transactions.

Businesses also stand to gain from blockchain technology, especially in managing cross-border payments. For instance, companies can pay suppliers and freelancers in India more rapidly and cost-effectively. The streamlined nature of blockchain transactions enables businesses to engage in real-time payments without the lengthy delays and high costs associated with traditional methods. Thus, blockchain not only benefits individuals but also propels economic activity by enhancing the ease of doing business internationally. Despite these advantages, the widespread adoption of blockchain in remittances and business transactions does face several obstacles that need to be addressed.

Challenges to Blockchain Adoption

The path to widespread blockchain adoption is not without its challenges. Regulatory uncertainty remains a significant hurdle, as governments worldwide are still developing policies around blockchain and cryptocurrencies. This evolving regulatory landscape can potentially slow down the adoption process, as businesses and consumers await clearer guidelines. Additionally, technical barriers exist, particularly for users unfamiliar with blockchain technology. Onboarding requires a certain level of technical knowledge, which can be a deterrent for some. Educational initiatives and user-friendly platforms will be crucial in overcoming these technical challenges, ensuring broader accessibility and understanding.

Another concern in blockchain technology is the volatility associated with cryptocurrencies. While stablecoins offer a solution to this issue, the broader market for major cryptocurrencies can be volatile, which can deter users who seek stability in their transactions. Addressing these concerns is essential for ensuring trust and adoption. In spite of these challenges, the progress in blockchain technology continues, with ongoing improvements in awareness, infrastructure, and regulatory frameworks. As adoption grows, so too will the development of more sophisticated and user-friendly blockchain applications, paving the way for a more robust future.

The Future of Blockchain-Based Money Transfers

Blockchain technology addresses traditional financial system challenges with its decentralized digital ledger. Its peer-to-peer networks minimize the need for intermediaries, offering key benefits like reduced transaction costs, quicker processing times, increased transparency, and enhanced security. Unlike traditional transfers bogged down by intermediary fees, blockchain transactions occur directly on the network, eliminating many of these costs. For instance, transferring money from the UK to India via a blockchain platform is considerably cheaper than using conventional bank or remittance services.

The technology’s efficiency is evident in its capability for near-instant transactions, regardless of amount or destination. Operating continually, blockchain avoids delays tied to traditional methods’ multiple steps and time zones, making it ideal for urgent payments to India where recipients need immediate access to funds. Enhanced transparency is another significant benefit; every transaction is recorded on a public ledger available to all participants. This transparency removes hidden fees and gives clarity on costs and received amounts, fostering trust and reliability in the process.