Unveiling a Seamless Payment Revolution

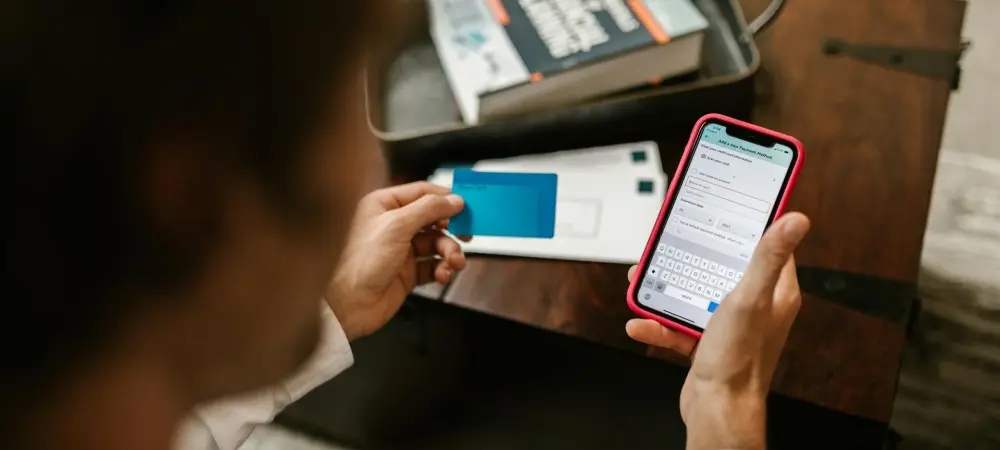

Imagine completing an online purchase in mere seconds, with payment options tailored to fit any budget, all without leaving the checkout page. This is the reality for U.S. shoppers thanks to the groundbreaking partnership between Affirm, a leading payment network, and Google Pay, integrated with Chrome autofill. This collaboration revolutionizes the e-commerce experience by offering speed, security, and unmatched convenience at checkout, addressing the modern shopper’s need for efficiency.

The significance of flexible and transparent payment solutions cannot be overstated in today’s digital marketplace, where consumers demand control over their finances. Affirm’s integration with Google Pay through Chrome autofill allows users to access pay-over-time options effortlessly, ensuring a hassle-free transaction process. This enhancement streamlines online shopping by minimizing steps and maximizing trust in payment security.

By focusing on user needs, this partnership sets a new standard for online payments, promising benefits that resonate with millions of daily users. Shoppers gain access to customized plans without hidden fees, while merchants enjoy increased checkout efficiency. The following sections delve into how this integration works and why it marks a pivotal shift in digital transactions.

The Growing Demand for Digital Payment Innovation

In an era where online shopping dominates consumer behavior, the expectation for secure and efficient payment methods has reached unprecedented heights. With Google platforms facilitating over a billion searches daily, the need for seamless checkout solutions is clear. The integration of Affirm with Google Pay via Chrome autofill addresses this demand by simplifying transactions on a massive scale.

Affirm, listed on NASDAQ under the ticker AFRM, champions transparency in financial services, offering payment plans free of late or hidden fees. This mission aligns perfectly with the evolving digital payment landscape, where consumers prioritize clarity and trust. The partnership with Google Pay leverages cutting-edge technology to meet these expectations, enhancing the shopping experience across numerous platforms.

Moreover, the collaboration reflects a broader trend toward consumer-centric payment innovations. As digital wallets and autofill features become staples of e-commerce, solutions like this empower users with faster, safer options. This synergy not only benefits shoppers but also supports merchants by reducing cart abandonment and fostering customer loyalty in a competitive market.

Breaking Down the Affirm and Google Pay Integration Process

Step 1: Accessing Affirm via Chrome Autofill

The first step for U.S. shoppers to utilize this innovative payment method involves selecting Affirm through Chrome autofill on desktop. During checkout on participating websites, users can spot Affirm under the “Pay over time options” in the autofill dropdown menu. This feature eliminates the need for manual input, speeding up the process significantly.

Ensuring Compatibility with Eligible Websites

A key advantage of this integration is its automatic activation on select merchant sites. No additional setup is required for either shoppers or merchants, ensuring a smooth rollout. This compatibility enhances accessibility, allowing users to benefit from Affirm’s options without technical barriers or delays at checkout.

Step 2: Quick Eligibility Check for Payment Plans

Once Affirm is selected, shoppers undergo a swift eligibility assessment to determine their qualification for payment plans. This process is designed to be user-friendly, taking only moments to complete. It ensures that consumers can proceed with confidence, knowing their financial suitability is evaluated promptly.

Transparency in Approval Decisions

Affirm places a strong emphasis on clarity during this stage by providing immediate feedback on eligibility without affecting credit scores for the initial check. This transparent approach builds trust, as users are informed of their status upfront. Such openness sets Affirm apart in the realm of digital payments, prioritizing consumer understanding.

Step 3: Customizing Payment Terms

After approval, shoppers can tailor their payment plans to suit individual needs, with options ranging from biweekly to monthly installments. Purchases between $35 and $30,000 qualify, with terms extending up to 24 months and interest rates starting at 0% APR. This variety ensures that financial commitments align with personal budgets.

Flexibility for Diverse Budgets

The ability to customize payment schedules caters to a wide array of financial situations, empowering consumers with control. Whether managing smaller purchases or significant investments, users can select terms that prevent strain on their finances. This adaptability underscores the user-focused design of Affirm’s offerings through Google Pay.

Step 4: Linking Affirm with Google Pay for Future Ease

To enhance future transactions, shoppers have the option to connect their Affirm account with Google Pay. This linkage streamlines subsequent purchases, reducing the steps needed at checkout. It creates a more cohesive experience, allowing users to access payment plans with minimal effort on return visits.

Boosting Security with Seamless Integration

The integration with Google Pay adds a robust layer of protection to transactions, leveraging Google’s secure infrastructure. This ensures that personal and financial data remain safeguarded during linked purchases. The combination of speed and security makes this feature a valuable tool for consistent online shoppers.

Key Takeaways from the Affirm and Google Pay Collaboration

- Seamless access to Affirm’s pay-over-time options via Chrome autofill on desktop.

- Transparent payment plans with no late or hidden fees, starting at 0% APR.

- Wide purchase range ($35 to $30,000) with flexible biweekly or monthly terms.

- Automatic activation on select websites, benefiting both shoppers and merchants.

- Enhanced speed and security by linking Affirm with Google Pay for future use.

Shaping the Future of E-commerce with User-Centric Solutions

The integration of Affirm with Google Pay through Chrome autofill signals a transformative shift in digital payments, prioritizing convenience and consumer empowerment. This partnership aligns with current trends toward streamlined, accessible financial tools that enhance the online shopping journey. It redefines how transactions are conducted by placing user needs at the forefront of innovation.

For merchants, the benefits are equally compelling, as increased checkout efficiency translates to higher customer satisfaction and reduced cart abandonment. The automatic activation on participating sites ensures scalability, enabling businesses to adopt this solution without operational disruptions. This mutual advantage strengthens the e-commerce ecosystem, fostering growth for all stakeholders.

Looking ahead, the potential for broader adoption across additional platforms remains a promising prospect, though challenges such as data privacy must be addressed in scaled integrations. The focus on secure, transparent systems will likely drive further innovations in payment technology. As these solutions evolve, they continue to shape a future where online shopping is both effortless and trustworthy.

Empowering Your Online Shopping Journey

Reflecting on the journey, the collaboration between Affirm and Google Pay through Chrome autofill provides a transformative approach to online payments, delivering flexibility, transparency, and ease to countless transactions. Each step, from accessing payment options to securing future purchases, streamlines the checkout process for U.S. shoppers. The impact of tailored plans without hidden costs reshapes financial management for many.

As a next step, exploring Affirm on compatible websites for upcoming purchases offers a practical way to experience these benefits firsthand. Staying informed about advancements in payment technologies also proves valuable, ensuring users remain ahead of emerging trends. This partnership lays a foundation for smarter shopping decisions, encouraging continued engagement with innovative solutions.

Beyond immediate use, considering how such integrations could influence broader financial habits opens new perspectives. Evaluating personal budgeting strategies in light of flexible payment terms becomes a worthwhile endeavor. Ultimately, this collaboration highlights the power of technology to enhance everyday transactions, setting a precedent for future e-commerce developments.