In today’s digital era, where cash transactions are becoming increasingly obsolete, digital payment solutions have emerged as pivotal players in bridging the global financial inclusion gap. Among these, Google Pay stands out as a dominant participant in the worldwide digital payments sector. By integrating with multiple Google services and devices, Google Pay provides users with a comprehensive and user-friendly payment experience. In this article, we will delve into the revolutionary impact of Google Pay on financial accessibility, its history, and its expanding presence in Europe and the Asia-Pacific region.

Comprehensive Payment Experience

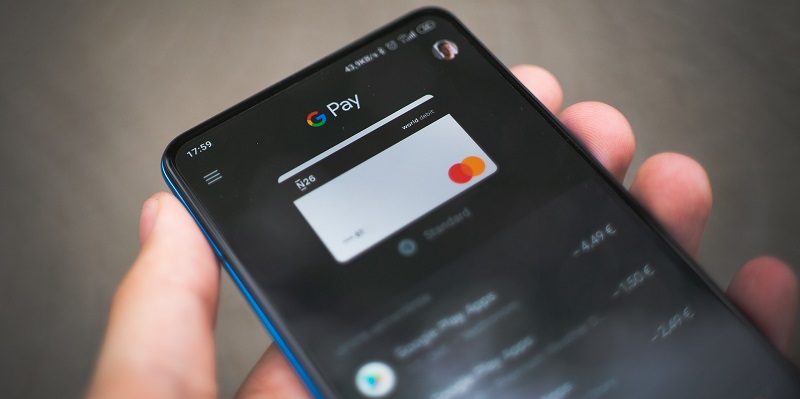

Google Pay’s seamless integration with a wide range of Google services and devices offers users a truly comprehensive payment experience. Whether it’s making online purchases, sending money to friends, or utilizing contactless payments in stores, Google Pay simplifies the payment process. By combining features like Google Wallet, Android Pay, and Google Assistant, users can effortlessly manage their finances and make secure transactions. This comprehensive approach sets Google Pay apart in the evolving landscape of digital payment solutions.

Revolutionizing Financial Accessibility

The advent of fintech solutions, such as Google Pay, has revolutionized financial accessibility. By eliminating the need for physical currency or traditional banking methods, Google Pay has made payments more convenient and accessible for users. With just a few taps on their smartphones, individuals can make transactions anytime, anywhere. Additionally, Google Pay’s integration with various banking services fosters financial inclusion, especially for unbanked populations. This empowerment to participate in the digital economy is helping to bridge the global financial inclusion gap, opening up opportunities for economic growth and development.

History of Google Pay

Google Pay was initially introduced to the United States in 2015 as Android Pay. The platform gained significant popularity, fueling its success and widespread acceptance in North America. Empowered by secure transactions and convenient payment methods, users quickly embraced Google Pay as a reliable digital payment solution. The positive reception and success in the United States paved the way for the expansion of Google Pay to other regions.

Expansion to Europe

Building upon its achievements in North America, Google Pay expanded its services to numerous European nations. The platform’s presence in the European market continuously grew, providing consumers with a convenient and secure payment solution. Through partnerships with major financial institutions and retailers, Google Pay gained acceptance in various industries and established its position as a reliable digital payment method. The convenience of Google Pay empowered European consumers to move away from traditional payment methods, fueling its further growth and integration into the daily lives of individuals.

Importance of the Asia-Pacific Market

The Asia-Pacific region plays a vital role in Google Pay’s global expansion. With its vast population and rapidly growing digital economy, this region presents immense opportunities for digital payment solutions. Recognizing this potential, Google Pay expanded its presence from North America to the Asia-Pacific, offering consumers a secure and frictionless payment experience. By tailoring its services to cater to the diverse needs of Asian countries, Google Pay has successfully positioned itself as a key player in the region.

Google Pay has emerged as a dominant force in the worldwide digital payments sector. With its robust and user-friendly platform, Google Pay has revolutionized financial accessibility and bridged the global inclusion gap. Starting as Android Pay in the United States, Google Pay has gained widespread acceptance, expanded to Europe, and ventured into the promising Asia-Pacific market. As Google Pay continues to evolve and innovate, it reaffirms its commitment to providing consumers with a secure and frictionless payment experience, paving the way for a cashless future where financial transactions are convenient, accessible, and effortless for users worldwide.