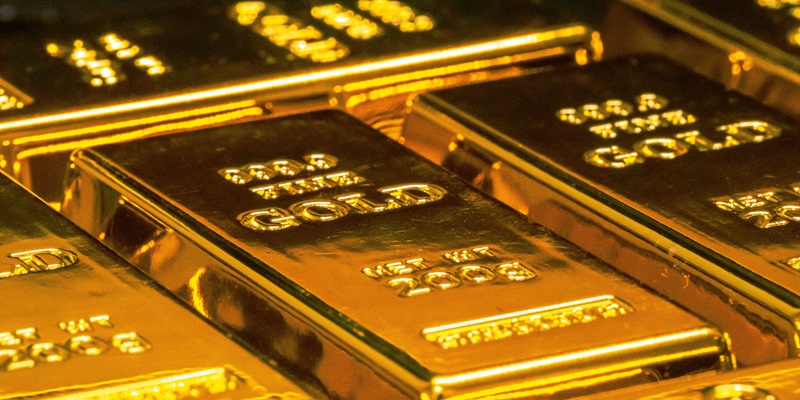

In a groundbreaking move, IPMB brings centuries of gold expertise to the blockchain, offering a stable entry point into the cryptocurrency market. By combining the trusted foundation of physical gold with the innovative power of blockchain technology, IPMB has created a unique ecosystem for investors. This article will explore the IPMB project, highlighting its utility token, secure and trusted resource, value for crypto skeptics, and how it bridges the gap between stability and flexibility in the digital currency landscape.

The IPMB utility token plays a pivotal role in the project, enabling holders to benefit from the stability of physical gold without the need for storing and securing physical gold bars. This feature provides investors with a hassle-free and convenient method to diversify their portfolios while minimizing the risks associated with managing physical assets. With the IPMB token, holders can enjoy the potential for long-term value appreciation and a stable investment alternative.

Creating a Secure and Trusted Resource

The IPMB ecosystem creates a community-based environment where owners can have liquidity, save, and earn on their holdings. This inclusive approach ensures that users have access to a secure and trusted resource backed by gold. By placing a strong emphasis on environmental, social, and governance (ESG) compliance, IPMB ensures that its operations align with sustainable practices. Additionally, offering product certification and adhering to international quality standards further bolsters the ecosystem’s reliability.

Onboarding Users with Concerns

Gold-backed tokens have proven to be an attractive proposition for individuals who have concerns regarding the volatility of cryptocurrencies. By introducing IPMB as a stable entry point, the project aims to ease the transition for potential users who may be skeptical about digital assets. By leveraging the inherent stability of physical gold, IPMB provides a tangible and secure foundation, reassuring prospective investors.

Building a Bridge between Stability and Flexibility

Blockchain technology serves as the backbone of the IPMB ecosystem, enabling it to build a secure and trusted bridge between the stability of traditional gold and the flexibility of digital tokens. By utilizing blockchain, IPMB ensures transparent transactions, immutability, and security. This fusion allows users to experience the benefits of gold’s stability without sacrificing the advantages that come with digital tokens.

Solution for Stable Entry into the Crypto Market

One of the prominent advantages of the IPMB project is its ability to offer a stable means for individuals to enter the crypto market. For those seeking a reliable and less volatile investment option, IPMB provides direct access to the underlying asset with the security of 100% physical gold backing. This eliminates the anxiety associated with sudden market fluctuations, providing a safer entry point for newcomers.

Eliminating Management Costs and Risks

Unlike traditional gold-based finance products, the IPMB project aims to eliminate significant management costs and counterparty risks. By leveraging blockchain technology, the reliance on intermediaries and associated costs is reduced, increasing the efficiency and accessibility of gold-backed investments. This streamlined approach offers a compelling alternative to traditional finance products, enhancing accessibility and attracting a wider range of investors.

In the rapidly evolving world of cryptocurrencies, IPMB stands out as an innovative project that seeks to bridge the gap between the stability of traditional gold and the flexibility of digital tokens. By leveraging blockchain technology to provide a secure and trusted ecosystem, IPMB offers a solution for individuals seeking a stable entry point into the crypto market. With its utility token, secure resources, potential to attract skeptics, and elimination of management costs and risks, IPMB paves the way for a new era of gold-backed investments in the digital age.