The challenge of instilling financial literacy in a generation that has never known a world without smartphones has forced a fundamental rethinking of how banking relationships are initiated and nurtured. This review explores the evolution of digital youth banking platforms, a significant advancement in the financial technology sector, examining their key features, performance metrics, and the profound impact they have on community banking and financial education. The purpose of this analysis is to provide a comprehensive understanding of this technology, its current capabilities, and its trajectory for future development.

The Evolution of Youth Banking

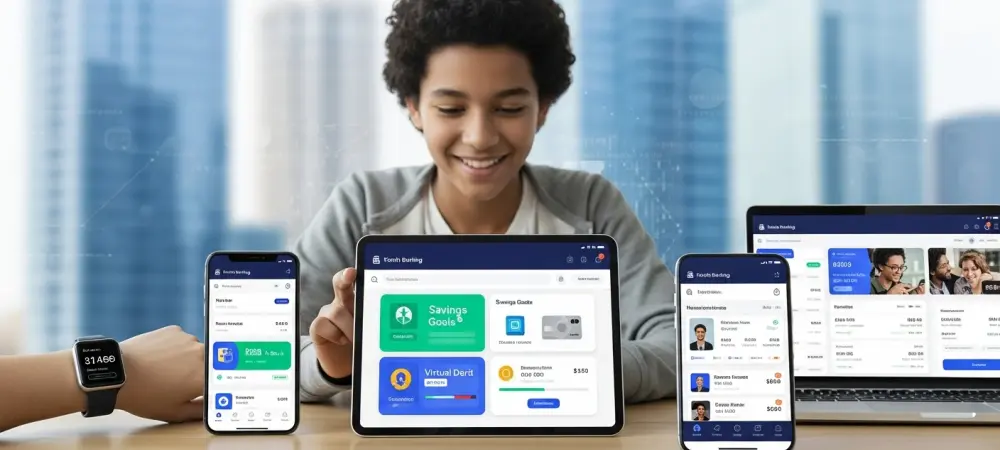

Digital youth banking platforms have emerged as a direct response to the shortcomings of traditional financial outreach, which often fails to resonate with digital-native generations like Gen Z. At their core, these platforms are mobile-first educational tools designed not just to hold money but to teach fundamental principles of financial literacy in an accessible, interactive format. Their development was driven by the clear need for financial institutions to engage a demographic that expects seamless digital experiences in every aspect of life.

The relevance of these platforms extends beyond simple engagement; they represent a strategic necessity for community banks and credit unions. By offering a compelling product for children and teens, these institutions can attract young members early, thereby building family-wide relationships that can last a lifetime. This approach secures a future customer base and positions the institution as an integral part of a family’s financial journey, ensuring long-term growth and relevance in an increasingly competitive market.

Key Features and Platform Components

Engagement Through Gamification

A central tenet of modern youth banking platforms is the strategic use of gamification to transform money management from a chore into an engaging and educational experience. These systems incorporate features designed to capture the attention of young users, such as customizable savings goals complete with visual progress trackers that make saving for a desired item tangible and rewarding.

Moreover, these platforms often integrate chore and grade-based reward systems, allowing parents to tie allowances and bonuses to real-world responsibilities and academic achievements. This is complemented by in-app achievements, badges, and milestones that celebrate positive financial behaviors. By embedding these game-like mechanics, the platforms effectively turn the process of learning about earning, saving, and spending into an interactive journey rather than a passive lesson.

Comprehensive Parental Oversight

While designed to empower youth, these platforms are built upon a foundation of robust parental oversight, ensuring a secure and controlled environment for early financial exploration. A key component is the suite of tools available to parents and guardians, which provides peace of mind and facilitates guided learning. These features typically include the ability to set precise debit card spending limits, preventing overspending and teaching the importance of budgets.

Furthermore, parents can monitor all transactions in real-time, offering opportunities for timely conversations about spending habits. The platforms also enable parents to approve or deny fund requests and automate recurring allowances, which simplifies the process of providing consistent financial support. This comprehensive control ensures that children can experience financial independence within a safe, supervised framework.

Practical Financial Education Tools

Beyond simple transactions, leading youth banking platforms incorporate features that deliver hands-on financial education. These tools are designed to teach complex concepts through practical application. Integrated budgeting planners, for instance, help young users categorize their spending and visualize where their money is going, laying the groundwork for responsible financial planning in adulthood. A particularly innovative feature is the inclusion of parent-managed loans, where a child can borrow money from a parent with an adjustable interest rate set within the app. This function provides a safe, low-stakes environment to learn critical concepts about borrowing, interest, and the importance of timely repayment. These practical tools are instrumental in facilitating meaningful conversations between parents and children about responsible money management.

Current Trends and Strategic Innovations

The youth banking space is continually evolving, with a significant current trend being the shift toward deep integration with an institution’s core digital banking infrastructure. Unlike early standalone apps that created a disjointed user experience, modern platforms are increasingly offered as a seamless extension of the parent’s primary banking app. This approach provides a unified experience for the entire family and allows institutions like United Financial Credit Union (UFCU) to maintain full control over their member data and deposits.

Another strategic innovation gaining traction is the emphasis on community-focused initiatives. Financial institutions are leveraging these platforms not just as a product but as a tool for community enrichment. This is often supported by financial education grants, such as the one from the Michigan Credit Union Foundation that aided UFCU’s launch of its ‘SmartStart’ platform. Such partnerships enable institutions to enhance local youth programs and solidify their role as community pillars.

Application in Community Banking

The real-world application of this technology is powerfully illustrated by the partnership between UFCU and fintech provider Nuuvia to launch the ‘SmartStart’ platform. For community-focused institutions, deploying such a platform is a strategic move to attract and retain the next generation of members. It addresses the critical challenge of engaging a younger demographic that might otherwise gravitate toward larger national banks or standalone fintech apps.

By offering a modern, feature-rich youth banking solution, community banks and credit unions can strengthen their relationships with existing members and their families. This strategy not only helps in retaining deposits but also enhances the institution’s brand as a forward-thinking, family-oriented financial partner. It allows them to offer a competitive, high-tech product while preserving the personal touch and community focus that define their value proposition.

Challenges and Implementation Hurdles

Despite their potential, the adoption of digital youth banking platforms is not without its challenges. A significant technical hurdle is the integration of these modern fintech solutions with the often-outdated legacy core banking systems that many community institutions still operate. This process can be complex, costly, and time-consuming, requiring careful planning and execution to ensure seamless functionality.

On the regulatory front, these platforms must navigate a stringent legal landscape, particularly concerning compliance with child data privacy laws like the Children’s Online Privacy Protection Act (COPPA). Ensuring the security and privacy of minors’ data is paramount and adds a layer of complexity to development and deployment. Moreover, market obstacles persist, as community institutions must compete with the massive marketing budgets of large national banks and the agility of established fintech companies that already offer popular youth-focused products.

Future of Youth Financial Technology

Looking ahead, the future of youth financial technology points toward even greater sophistication and personalization. Future developments will likely include the integration of introductory investment tools, allowing teens to learn about stocks, ETFs, and long-term wealth building in a controlled environment. The use of artificial intelligence could also become more prevalent, with AI-driven financial literacy tips and personalized guidance tailored to a user’s specific saving and spending patterns. The long-term impact of these platforms could be transformative, potentially cultivating a more financially savvy generation capable of making informed decisions from a young age. For community financial institutions, embracing these evolving technologies will be crucial for reshaping their role. They can transition from being mere service providers to becoming lifelong financial wellness partners for families, securing their relevance and growth for decades to come.

Summary and Overall Assessment

This review determined that digital youth banking platforms represented a critical technological and strategic asset for modern financial institutions. The analysis found that their strength resided in a tripartite approach: engaging young users through intuitive, gamified interfaces; empowering parents with comprehensive oversight and educational tools; and providing community banks and credit unions with a powerful mechanism to foster lifelong member relationships.

The successful implementation by institutions like UFCU demonstrated that these platforms were not merely a supplementary product but a core component of a forward-looking strategy. They allowed smaller institutions to compete effectively, maintain control over their data and deposits, and reinforce their commitment to financial education. Ultimately, this technology has had a significant impact by bridging the gap between traditional banking and the digital-native generation, positioning community institutions as indispensable partners in building a financially literate future.