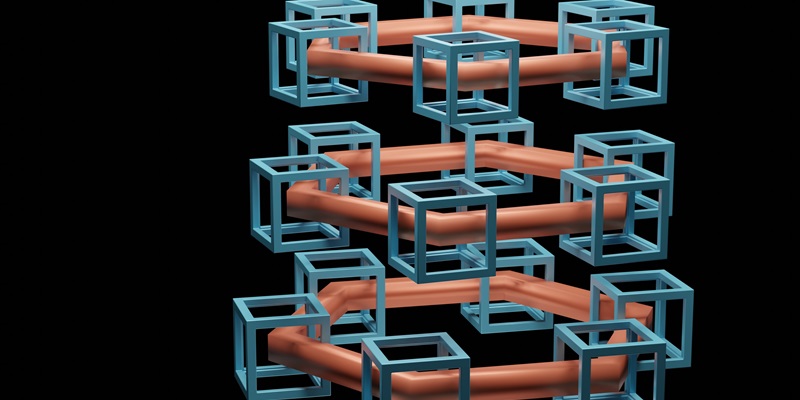

Decentralized Finance, often referred to as DeFi, is a blockchain-based financial system that operates without traditional intermediaries such as banks. This innovative approach to finance is gaining rapid momentum and disrupting the traditional banking paradigm. By leveraging blockchain technology, DeFi offers users a more inclusive and accessible alternative to the conventional financial system.

Definition of DeFi

Decentralized Finance, or DeFi, refers to a system that enables users to engage in financial transactions directly, without the involvement of intermediaries. This decentralized nature is made possible through the use of smart contracts on blockchain networks. These contracts are self-executing, tamper-proof, and transparent, ensuring the integrity and efficiency of transactions.

Removal of Traditional Intermediaries

One of the most compelling aspects of DeFi is its potential to foster financial inclusion. Traditional financial systems often exclude individuals who lack access to banks or face high fees and barriers. DeFi aims to address this issue by providing a platform where anyone with a smartphone and an internet connection can participate in financial activities.

Financial Inclusion in DeFi

DeFi protocols leverage smart contracts to facilitate transactions directly between users, cutting out the middleman and reducing fees associated with intermediaries. This approach promotes financial inclusion by eliminating the need for traditional banking infrastructure and allowing individuals to access financial services on a global scale. It empowers underserved populations and opens up opportunities for economic growth and prosperity.

Utilization of Smart Contracts in DeFi

DeFi protocols rely on smart contracts, which are self-executing contracts with the terms of the agreement directly written into the code. These contracts automatically execute transactions once predefined conditions are met. By eliminating the need for human intermediaries, DeFi platforms ensure transparency, efficiency, and security in financial transactions. Smart contracts also enable the creation of innovative financial products and services that were previously unimaginable.

Cutting out Intermediaries and Reducing Fees

One of the key advantages of DeFi is the elimination of intermediaries, such as banks or payment processors, who often charge high fees for their services. By conducting transactions directly between users, DeFi platforms significantly reduce transaction costs and improve the speed of transactions. This reduction in fees makes financial services more accessible to individuals who were previously marginalized by the traditional financial system.

Cross-border Transactions in DeFi

DeFi, operating on blockchain networks, enables users to engage in seamless and rapid cross-border transactions without the need for multiple intermediaries. Traditional international transfers can be slow, expensive, and prone to errors. In contrast, DeFi leverages the decentralized nature of blockchain technology to facilitate instant and low-cost cross-border transactions. This global accessibility fosters a more efficient and inclusive financial ecosystem.

Importance of Transparency and Security in Financial Transactions

Transparency and security are paramount in financial transactions. DeFi platforms address these concerns by providing a transparent and auditable ledger of all transactions on the blockchain. This transparency ensures accountability and reduces the risk of fraud or manipulation. Additionally, the robust security features of blockchain technology provide users with a high level of protection for their funds and personal information.

Disrupting the Traditional Banking Sector with DeFi

DeFi platforms offer decentralized lending and borrowing, disrupting the traditional banking sector’s loan origination process. Instead of relying on banks for loans, individuals can directly lend or borrow funds from other users on DeFi platforms. Using smart contracts, borrowers can offer collateral, and lenders can provide funds, eliminating the need for complex approval processes and intermediaries. This peer-to-peer lending model democratizes access to credit and reduces costs for both borrowers and lenders.

Decentralized Exchanges in DeFi

DeFi introduces decentralized exchanges (DEX), allowing users to trade digital assets directly with each other. Unlike traditional centralized exchanges, decentralized exchanges do not hold users’ funds and rely on smart contracts to enable secure and transparent transactions. This peer-to-peer trading model enhances liquidity, eliminates the risk of hacks or theft from centralized exchanges, and offers users greater control over their assets.

Challenges in the Rise of DeFi

While the rise of DeFi presents unprecedented opportunities, it is not without its challenges. Regulatory bodies worldwide are grappling with the need to adapt existing frameworks to encompass the decentralized and borderless nature of these financial services. Striking the right balance between innovation and consumer protection is crucial to ensure the long-term sustainability and stability of the DeFi ecosystem.

The rise of decentralized finance is ushering in a new era of financial services, challenging the traditional banking paradigm and offering users a more inclusive and accessible alternative. DeFi allows individuals to participate in the global financial system without the need for traditional intermediaries. By leveraging blockchain technology, DeFi promotes financial inclusion, transparency, and security in transactions. However, navigating the regulatory landscape will be crucial to unlock the full potential of DeFi and ensure its responsible and sustainable growth. As DeFi continues to evolve, it has the potential to reshape the way we manage and access financial services, creating a more equitable and efficient global financial ecosystem.