In a digital age where financial cyber threats loom large, the advent of the Confirmation of Payee System marks a groundbreaking stride in consumer protection, representing a linchpin in the fight against financial fraud and fortifying the transaction landscape by ensuring the accuracy of payment details before funds are transferred. As financial institutions worldwide face increasing pressure to safeguard customer interactions, this system presents a potent solution, emerging as a vital component of comprehensive fraud prevention strategies.

Examination of the Core Features

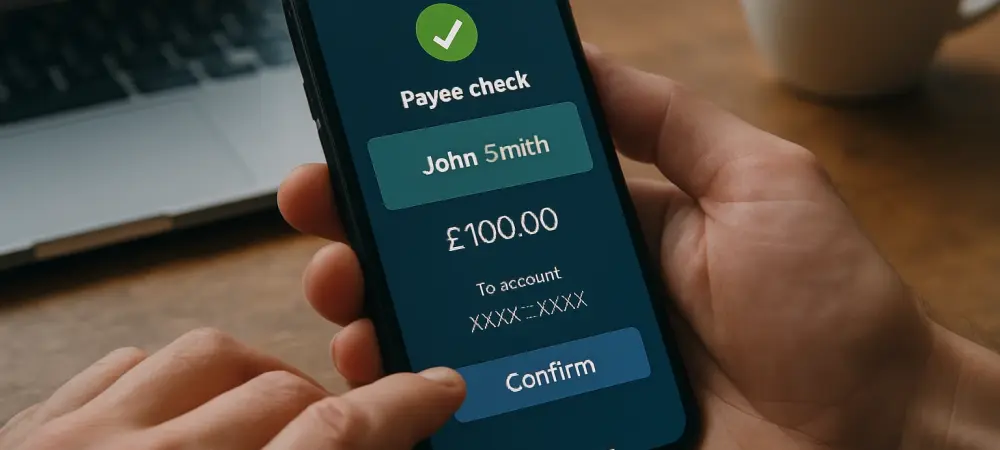

One of the most pivotal elements of the Confirmation of Payee System is its name-matching technology. This feature fundamentally alters the way transactions are authenticated by cross-referencing a recipient’s name with their bank information in real time. The system scrutinizes potential mismatches between the name, BSB, and account number supplied by a sender against those held by the receiver’s bank. By verifying these details before allowing transactions to proceed, it significantly reduces the likelihood of error or malicious interception. This rigorous verification instills confidence among users and forms the backbone of the system’s reliability. In a broader scope, the integration of the Confirmation of Payee System across the banking industry has propelled it to become a cornerstone of secure payment processes. With seamless implementation across various banking platforms, this system lends itself to agile deployment and efficient scalability. As financial institutions integrate it into their existing infrastructures, they find that it not only enhances security measures but also boosts consumer trust, ultimately bolstering their reputations within the market.

Recent Developments and Adaptations

The landscape of financial security continues to evolve, prompting ongoing developments in the Confirmation of Payee System to address emerging threats effectively. Recent years have witnessed the introduction of more advanced algorithms and machine learning enhancements that refine the system’s accuracy and adaptability. This progress aligns with shifts in consumer behaviors, where digital banking grows increasingly prevalent and necessitates superior security measures. The system’s ability to adapt to these changes reflects an industry-wide commitment to innovate and stay ahead of malicious actors.

A consistent trend is the increasing collaboration among international banking bodies to establish unified security protocols and share insights on combating fraud more effectively. Such collective efforts amplify the system’s effectiveness, as cross-border cooperation ensures the formulation of comprehensive strategies against ever-evolving cyber threats.

Real-World Impact and Applications

The Confirmation of Payee System is not just a theoretical advancement but has demonstrated tangible benefits in real-world applications. Its deployment in various countries, including Australia and the United Kingdom, has resulted in measurable reductions in fraud cases, illustrating its practical efficacy. Financial sectors, from consumer banking to business transactions, have leveraged the system to safeguard their operations and enhance customer assurance.

Moreover, unique implementation strategies, such as awareness campaigns like “Check the Name. Spot the Scam,” amplify its effectiveness by educating users on the importance of vigilance during transactions. Such campaigns empower users, fostering a proactive approach toward their financial security.

Challenges and Limitations

Despite its accomplishments, the system faces hurdles that could impede its extensive adoption and effectiveness. Technical challenges such as the integration with legacy systems and ensuring comprehensive compatibility across diverse banking environments demand ongoing attention and investment. Regulatory considerations also pose hurdles, as uniform compliance requirements necessitate negotiation among various local and international authorities.

Nevertheless, industry stakeholders remain committed to overcoming these barriers, with continued research and development efforts poised to bolster the technology’s resilience against new threats. Partnerships between technology firms and financial institutions play a pivotal role in addressing these challenges, promoting a synergy that enhances the system’s robustness.

Future Trajectory and Innovations

Looking forward, the Confirmation of Payee System is poised for further evolution as it incorporates emerging technologies such as artificial intelligence and blockchain. These innovations present opportunities to enhance the system’s security layers, making it more resistant to fraud attempts and more transparent for participants. The potential future integration with biometric verification could further elevate its fraud prevention capabilities by ensuring that the authentication process begins at the user level.

While the technology’s current iteration already marks significant progress, continual advancements promise to reshape its scope and impact, extending its protective reach across more sectors. As more institutions adopt these technologies, the financial industry stands to benefit from increased security and strengthened consumer trust.

Reflection on Current Achievements

In reflecting on the Confirmation of Payee System, it is evident that the technology has played a transformative role in modern financial security frameworks. The name-matching function, alongside seamless integration across financial platforms, underscores a fundamental shift in how transactions are secured. Furthermore, the system’s global adoption and demonstrable impact on reducing fraud cases affirm its legitimacy as an innovative solution.

While challenges remain, the ongoing collaborations and technological advancements signal a promising trajectory for the system’s continued evolution. It remains a vital tool for maintaining the integrity and security of financial transactions, a testament to the industry’s resolve in confronting fraud and paving the way for a safer monetary future.