Shocking Catalysts in Crypto: Tragedy as Market Fuel

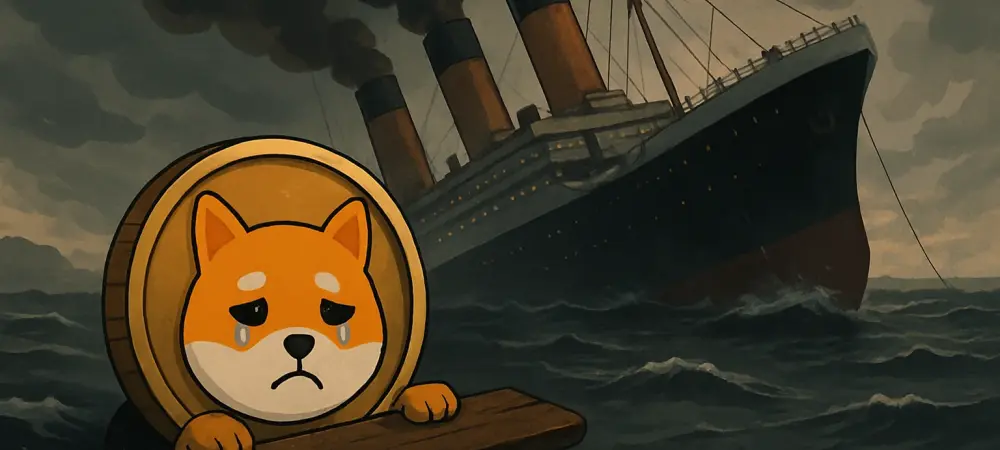

In the volatile realm of cryptocurrency, few events have sparked as much controversy as the rapid emergence of meme coins following the tragic death of a prominent conservative activist on September 10, which not only shook the political landscape but also ignited an unexpected speculative wave in the digital asset market. A fatal shooting at a public event in Utah led to tokens tied to this somber incident surging in value by over 10,000% within hours, amassing multi-million-dollar market caps and exposing a troubling intersection of grief and greed. This analysis delves into the mechanics of such hype-driven markets, examining current trends, financial risks, and ethical dilemmas while forecasting the potential trajectory of meme coins in an unregulated space. The purpose is to provide clarity on how real-world tragedies are being monetized and to underscore the urgent need for investor caution and market accountability.

Dissecting the Meme Coin Surge: Trends and Data Insights

Rapid Token Creation: A Speculative Gold Rush

The cryptocurrency market has long been a breeding ground for speculative assets like meme coins, often born from internet culture or viral moments. Platforms such as Solana’s pump.fun have lowered the barrier to entry, allowing nearly instantaneous token launches with minimal oversight. Following the Utah tragedy, tokens like “Justice for Charlie” and “RIPCharlieKirk” emerged within hours, capitalizing on emotional resonance to drive massive trading volumes. Data from analytics tools reveals staggering growth, with some tokens reaching peak valuations in mere days before inevitable crashes. This pattern highlights a recurring trend: the exploitation of high-profile events for quick profits, often disregarding long-term sustainability or ethical implications in favor of short-term hype.

Financial Metrics: Profits and Perils

Delving into the numbers, the financial allure of these meme coins is undeniable yet deceptive. Reports indicate that certain creators earned up to $300,000 in fees within an hour of launching tragedy-themed tokens, showcasing the lucrative potential of such ventures. However, analytics platforms have flagged suspicious activities, including the creation of over 700 new wallets tied to these assets, suggesting manipulative practices like bundling or insider trading. Historical parallels, such as tokens linked to other emotionally charged events, show developers netting millions before orchestrating rug pulls—schemes where prices are inflated before projects are abandoned, leaving investors with worthless holdings. This volatility underscores the high-risk nature of speculative investments, particularly those fueled by real-world crises.

Market Behavior: Emotional Hype Versus Rational Investment

Beyond raw data, the behavior of market participants offers critical insight into the meme coin phenomenon. Social media platforms like X reveal a polarized response, with some traders chasing quick gains while others decry the moral bankruptcy of profiting from tragedy. This emotional divide drives erratic trading patterns, as hype often outpaces fundamentals, leading to rapid boom-and-bust cycles. Industry observers note that less-regulated markets and varying levels of investor education exacerbate these issues, with newer participants more susceptible to scams. The lack of oversight in decentralized finance amplifies the challenge, as bad actors exploit sentiment-driven surges, often overshadowing legitimate blockchain innovations with predatory tactics.

Ethical Undercurrents and Regulatory Gaps

Moral Backlash: A Community in Conflict

A significant undercurrent in this market surge is the ethical outrage it has provoked. The act of tying digital assets to a tragic loss has been widely criticized as a grotesque form of opportunism, with public sentiment on social platforms reflecting deep unease. This backlash transcends political lines, uniting voices in condemnation of using human grief as a financial springboard. The crypto community faces a reckoning, as the drive for profit clashes with basic decency, raising questions about the values shaping this nascent industry and whether self-regulation can address such profound moral lapses.

Scam Warnings: Navigating a Minefield of Fraud

Financial risks compound the ethical concerns, as meme coins tied to tragedies often exhibit hallmarks of fraud. Crypto watchdogs have issued alerts about classic scam indicators, such as sudden price spikes followed by developer exits, leaving retail investors stranded. Comparative cases from recent market history reveal developers pocketing substantial sums—sometimes millions—before tokens collapse entirely. These patterns emphasize the need for investor vigilance, as the promise of exponential returns frequently masks the reality of orchestrated deceptions in a space with minimal accountability mechanisms.

Systemic Issues: The Unregulated Wild West

Zooming out, this phenomenon reflects broader systemic challenges within the cryptocurrency ecosystem. The absence of robust regulatory frameworks enables the proliferation of speculative and potentially fraudulent tokens, particularly during emotionally charged events. Regional disparities in adoption and oversight further complicate the landscape, with some markets more prone to exploitation due to lax protections. Industry analysis suggests that without standardized guidelines, the tension between innovation and ethics will persist, risking the alienation of mainstream investors who prioritize trust and stability over unchecked speculation.

Projections: The Future of Meme Coins in a Scrutinized Market

Emerging Trends: Tragedy as a Persistent Catalyst

Looking ahead, the intersection of real-world tragedies and meme coin surges appears poised to continue as a troubling trend. As digital platforms enable faster token creation, the likelihood of similar speculative waves tied to news cycles remains high. Market forecasts indicate that from the current year to 2027, the volume of such assets could increase unless curbed by technological or regulatory interventions. Blockchain analytics advancements may offer tools to detect scam patterns early, but their adoption lags behind the pace of market opportunism, suggesting a near-term persistence of hype-driven investments.

Regulatory Horizons: A Push for Oversight

On the regulatory front, growing scrutiny from global authorities could reshape the meme coin landscape. Governments and financial bodies are increasingly aware of the risks posed by unregulated digital assets, particularly those exploiting sensitive events. Potential frameworks might include stricter guidelines for token launches or enhanced transparency requirements on trading platforms. While these measures could temper fraudulent activity, they may also stifle innovation if overly restrictive, creating a delicate balance for policymakers to navigate in the coming years.

Investor Sentiment: Shifting Toward Caution

Finally, investor sentiment is likely to evolve as awareness of meme coin risks spreads. Educational initiatives and community-driven efforts to highlight ethical concerns could steer participants away from speculative traps. Market projections suggest a gradual shift toward more stable crypto investments, though emotional catalysts will continue to test resolve. The industry’s ability to foster trust through self-imposed ethical standards or external oversight will be pivotal in determining whether meme coins remain a fringe gamble or mature into a more credible asset class.

Reflections and Strategic Pathways Forward

Reflecting on the detailed examination of meme coin surges following a high-profile tragedy, the market analysis reveals a stark reality of speculative fervor clashing with ethical boundaries. The data paints a picture of immense short-term profits for some creators, contrasted by significant financial losses for uninformed investors caught in rug pulls and volatile crashes. Ethical outrage dominates public discourse, while systemic gaps in regulation allow such trends to flourish unchecked. Looking back, the rapid rise of tokens tied to human loss underscores a critical vulnerability in the crypto space that demands attention. Moving forward, strategic recommendations include fostering investor education to combat speculative hype, urging platforms to implement stricter token creation protocols, and advocating for balanced regulatory measures that deter fraud without hampering innovation. These actionable steps aim to rebuild trust and steer the market toward a more responsible future, ensuring that tragedy no longer serves as a catalyst for unchecked greed.