For many Tesla owners, the paradox of paying higher insurance premiums for a vehicle packed with some of the most advanced safety features on the market has been a persistent source of frustration. The very technology designed to prevent accidents—from sophisticated sensors to autonomous driving capabilities—often leads to costlier repairs, causing traditional insurers to raise their rates. However, a new approach powered by artificial intelligence is challenging this status quo, suggesting that a car’s most advanced feature could become the key to a significantly lower insurance bill.

The Insurance Paradox of Autonomous Technology

Traditional auto insurance models are built upon decades of data analyzing human driver behavior, making them ill-equipped to accurately assess the risk profile of a vehicle operating autonomously. These systems excel at predicting the likelihood of human error but fall short when the driver is a sophisticated AI. This disconnect has created a significant challenge for the industry as it grapples with the shift toward self-driving technology.

Consequently, many Tesla owners discover that their vehicle’s cutting-edge safety features result in higher, not lower, insurance premiums. While features like automatic emergency braking and lane-keeping assist can reduce the frequency of accidents, the high cost of repairing or replacing the complex sensors, cameras, and computers embedded in the vehicle drives up the overall cost of a claim. Insurers have historically struggled to balance the reduced risk of AI-assisted driving against these increased repair expenses, often defaulting to higher rates.

How a New AI Model Is Rewriting the Rules

In response to this challenge, a new generation of usage-based insurance is emerging, specifically designed for the AI era. The “Lemonade Autonomous Car” policy, for example, directly addresses the shortcomings of legacy models by introducing a dynamic pricing structure. The core innovation is a per-mile rate that can drop by approximately 50% the moment a driver engages their Tesla’s Full Self-Driving (FSD) system, rewarding the shift from human to machine control in real time.

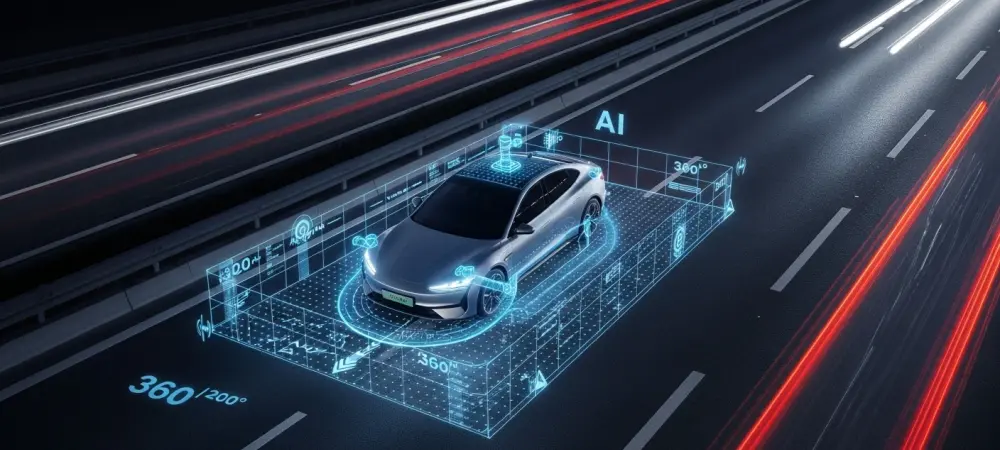

This model is made possible through a deep technical collaboration with Tesla, which allows for direct data integration. Instead of relying on generalized statistics, the insurer analyzes specific FSD software versions, sensor precision, and real-time driving modes. This granular data feeds a proprietary risk-prediction algorithm that accurately distinguishes between human-driven and AI-driven miles, creating a far more precise assessment of risk than ever before. For practicality, the policy also supports households with a mix of vehicles, allowing a Tesla and a non-FSD car to be covered under a single, cohesive plan.

An Expert’s Take on the Flaw in Traditional Models

According to Shai Wininger, a co-founder of Lemonade, treating an AI driver and a human driver as equivalent risks is a fundamental mistake. Traditional insurance fails to recognize that an autonomous system operates on an entirely different set of principles. The core argument rests on the inherent advantages of the technology: a system with 360-degree vision that never gets tired, distracted, or impaired is, by its nature, a lower-risk entity than its human counterpart.

This perspective promises continuous improvement and adaptation. A key commitment of this new insurance model is the pledge to lower rates as Tesla’s FSD software becomes demonstrably safer over time. With each software update that improves performance and reduces accident frequency, the risk model is adjusted, and the savings are passed on to the policyholder. This creates a direct financial incentive for consumers to adopt the safest available technology.

How Tesla Owners Can Take Advantage

The initial rollout of such AI-driven policies began in states like Arizona and Oregon, with a broader expansion planned as regulatory frameworks adapt. For Tesla owners in these regions, obtaining a quote is a streamlined process, often completed in minutes through a mobile app or website without the need for lengthy phone calls or paperwork.

This innovative approach also allows for stacking discounts. The primary savings from FSD engagement can be combined with other benefits, such as rewards for safe human driving habits when FSD is not active. Furthermore, policyholders can often achieve additional rate reductions by bundling their auto insurance with other products like homeowners, renters, or pet insurance, maximizing their overall savings.

The advent of AI-powered insurance marks a significant turning point for owners of technologically advanced vehicles. By fundamentally rethinking how risk is calculated, this model moves beyond the limitations of traditional underwriting. It establishes a direct link between the use of autonomous safety features and lower insurance costs, offering a solution that aligns the interests of the driver, the automaker, and the insurer in a way that has not been possible before.