Bolt and Checkout.com have united in a strategic partnership that stands to revolutionize the online retail sphere. By integrating Bolt’s cutting-edge one-click checkout solution with Checkout.com’s robust payment platform, this alliance aims to deliver unparalleled ease and efficiency in e-commerce transactions. This symbiosis prioritizes the needs of merchants while greatly simplifying the shopping experience for consumers. With both firms dedicated to providing secure, streamlined, and user-friendly purchase processes, their combined efforts promise to offer a new benchmark for how e-commerce businesses facilitate payments across the digital marketplace. Such a union anticipates a future where shopping online is as effortless as a single click, with the reassurance of secure payment technology backing every transaction. This joint venture is thus poised to redefine the standards of e-commerce convenience and reliability for retailers and shoppers alike.

One-Click Innovation Meets Payment Mastery

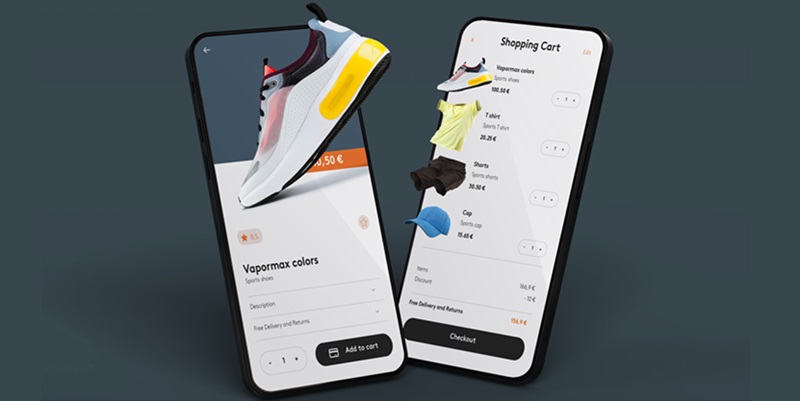

Bolt’s one-click checkout solution transforms the online shopping experience by offering speed and reducing cart abandonment for merchants. Its integration with Checkout.com combines rapid transactions with top-notch security, likely to increase both conversion rates and customer trust. This is critical in the digital domain where convenience is paramount.

The collaboration between Bolt and Checkout.com enhances the online purchasing process. Bolt’s swift and user-friendly checkout pairs with Checkout.com’s diverse payment options, delivering a seamless and efficient system. By addressing common e-commerce pain points, this partnership elevates consumer satisfaction and encourages loyalty.

This synergy is poised to streamline online transactions, ensuring merchant success and improving the overall shopping experience. It reflects the evolving needs of the modern consumer, who values both quick service and secure payment methods when shopping on the web.

Expanding the Payments Landscape

Bolt and Checkout.com have teamed up with a vision that focuses on creating a platform centered around the needs of merchants and offers a wide array of payment options. Bolt’s innovative checkout solutions, combined with its shopper network, enhance merchants’ reach. Meanwhile, Checkout.com provides diverse payment processing options, essential for Bolt’s merchant network.

This partnership tailors e-commerce solutions, matching Bolt’s one-click checkout prowess with Checkout.com’s range of payment services to offer a flexible platform suitable for various merchants and evolving consumer payment preferences. This strategic alliance not only meets the current demands of the online marketplace but also paves the way for ongoing growth and innovation within the fintech sector. The collaboration promises scalability and adjustment for merchants, representing an impressive stride in checkout and payment advancements.