What happens when a tropical paradise known for its ancient temples and lush landscapes becomes a testing ground for cutting-edge travel tech? Bali, Indonesia’s crown jewel, is transforming the way global visitors experience tourism with a bold shift toward cashless payments. Picture this: stepping off the plane at I Gusti Ngurah Rai International Airport, grabbing a digital payment pack, and exploring iconic spots like Uluwatu Temple without ever touching a single rupiah. This isn’t just a convenience—it’s a glimpse into the future of travel. The significance of this shift cannot be overstated. Bali, welcoming millions of international tourists each year, has rolled out the Indonesia Tourist Travel Pack (ITTP), an initiative spearheaded by Bank Indonesia. This program isn’t merely about ditching cash; it’s about redefining accessibility and safety for travelers while positioning Indonesia as a leader in tourist-friendly innovation. As digital transactions become the norm worldwide, Bali’s experiment could set a precedent for destinations everywhere, making this story one to watch closely.

Why Cashless Tourism in Bali Deserves Attention

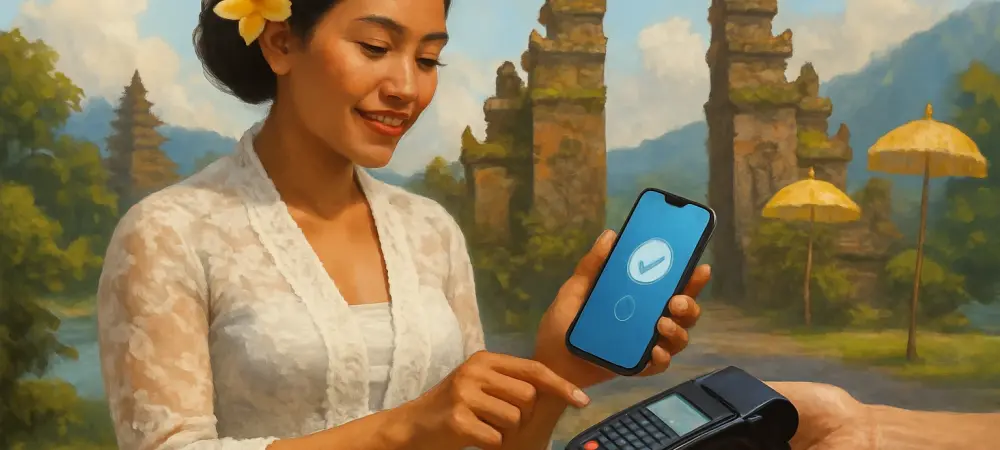

The concept of cashless tourism might sound like a niche trend, but in Bali, it’s addressing real pain points for visitors. No more fumbling with unfamiliar currency or stressing over exchange rates at local markets. The ITTP provides a seamless alternative, allowing tourists to pay for everything from beachside meals to temple entry fees with a quick scan of their smartphones. This initiative taps into a growing demand for simplicity in an era where travel is rebounding stronger than ever.

Beyond convenience, this move aligns with global shifts toward digital economies. Studies indicate that over 60% of travelers now prefer digital payments for their speed and security, a trend amplified post-pandemic. Bali’s adoption of cashless systems reduces risks like theft or loss of physical money, offering peace of mind to those exploring vibrant spots like Tegalalang Rice Terraces. It’s a strategic step that caters to tech-savvy globetrotters while elevating the island’s appeal.

The Global Context of Digital Travel Solutions

Zooming out, Bali’s push for cashless tourism reflects a broader movement across the globe. As destinations compete to attract visitors, simplifying transactions has become a key focus. Countries like Singapore and Sweden have already embraced near-cashless societies, with digital payments accounting for over 80% of transactions in some regions. Bali’s initiative, while still in its early stages, mirrors this momentum by prioritizing efficiency and safety for its millions of annual guests.

This digital pivot also responds to modern traveler expectations. With smartphones as essential travel companions, tourists increasingly expect payment systems to integrate seamlessly into their journeys. Bali’s adoption of the Quick Response Code Indonesian Standard (QRIS) system positions it as a forward-thinking hub, potentially inspiring other destinations to follow suit. Understanding this context highlights why Indonesia is emerging as a trailblazer in reshaping travel experiences.

Unpacking Bali’s Innovative Payment System

At the core of Bali’s cashless revolution lies the Indonesia Tourist Travel Pack, a comprehensive toolkit launched by Bank Indonesia. Available at I Gusti Ngurah Rai International Airport, the ITTP equips visitors with an Indonesian SIM card for internet access and chip-based electronic money tied to an e-wallet. This setup enables QR-code payments through the QRIS system, usable at a wide array of locations, from hotels to local eateries near Mount Batur.

Supporting this system is a dedicated Tourism Information Center at the airport, designed to guide tourists through the process. Visitors receive the QRIS Nusantara Tourism Guidebook, a handy resource listing businesses and attractions like Tanah Lot Temple that accept digital payments. Though cash remains an option, this infrastructure offers a hassle-free alternative for those eager to embrace technology while soaking in Bali’s cultural riches. The reach of this initiative is already notable, with thousands of vendors across the island adopting QRIS compatibility since its rollout. From bustling markets to serene beachfront cafes, the system ensures that international travelers can navigate transactions with ease. This blend of accessibility and innovation marks a significant milestone in making Bali a more connected destination for all.

Real Stories: Feedback from Travelers and Experts

Hearing directly from those on the ground paints a vivid picture of Bali’s cashless experiment. Bank Indonesia representatives have described the ITTP as a “pivotal advancement in tourism infrastructure,” underscoring its potential to redefine visitor experiences. Their optimism is backed by data showing a steady increase in QRIS-enabled merchants, with adoption rates climbing by 25% in key tourist areas over the past year.

Travelers, too, are singing its praises. A British visitor shared, “I paid for a guided tour at Tanah Lot with just a scan—it was so smooth compared to digging out cash.” Such firsthand accounts reveal how the system empowers tourists to focus on exploration rather than logistics. From dining in Seminyak to shopping in Ubud, these stories highlight the tangible benefits of going digital in a destination as dynamic as Bali.

Even with early success, some challenges remain, as not all vendors have adopted the technology yet. Feedback from a Canadian tourist noted occasional hiccups in remote areas where cash still reigns supreme. Despite these growing pains, the consensus leans positive, with many seeing this as a stepping stone toward a fully integrated payment landscape across the island.

Tips to Navigate Bali’s Cashless Landscape

For those planning a trip to Bali, tapping into this digital payment system is straightforward with a few key steps. Start by visiting the Tourism Information Center upon arrival at the airport to collect the ITTP, which includes the SIM card and e-wallet setup. Staff are on hand to assist, ensuring a smooth onboarding process for even the least tech-savvy travelers.

Next, download the necessary e-wallet app and link it to the provided electronic money for QRIS transactions. Use the accompanying guidebook to locate participating spots, whether dining at a warung or visiting cultural landmarks like Uluwatu Temple. Keeping a small amount of cash as a backup is advisable for areas not yet on the digital grid, blending the best of both worlds for a stress-free journey.

Preparation is key to maximizing this system’s benefits. Ensure your smartphone is charged and the app is updated before heading out to explore. With these tools in hand, navigating Bali becomes less about managing money and more about immersing in its timeless beauty, from sacred sites to hidden beaches, all with the ease of a quick scan.

Reflecting on Bali’s Digital Journey

Looking back, Bali’s venture into cashless tourism stood as a bold experiment that reshaped how visitors engaged with the island. The Indonesia Tourist Travel Pack had proven itself as more than a novelty; it became a lifeline for seamless travel, bridging the gap between tradition and technology. Its impact echoed through the experiences of countless tourists who navigated the island with newfound ease. For future travelers, the takeaway was clear: embrace the digital tools available at arrival to unlock a smoother journey. Destinations like Bali had set a benchmark, and the challenge now rested on others to adapt or risk falling behind. As the world continued to digitize, staying informed about such innovations became essential for anyone eager to explore with confidence and curiosity.