Imagine a world where online shopping is as effortless as a tap on your phone, where checkout delays and security concerns no longer stand between customers and their purchases. In today’s fast-paced e-commerce landscape, reducing friction at the point of sale is critical, with studies showing that nearly 70% of online carts are abandoned due to cumbersome payment processes. Apple Pay, a digital payment solution, has emerged as a transformative force in addressing these challenges. This review delves into the integration of Apple Pay on Transaction Junction’s (TJ) online platform, exploring its features, performance, and broader implications for merchants and consumers in the ever-evolving digital marketplace.

Overview of Apple Pay in E-Commerce

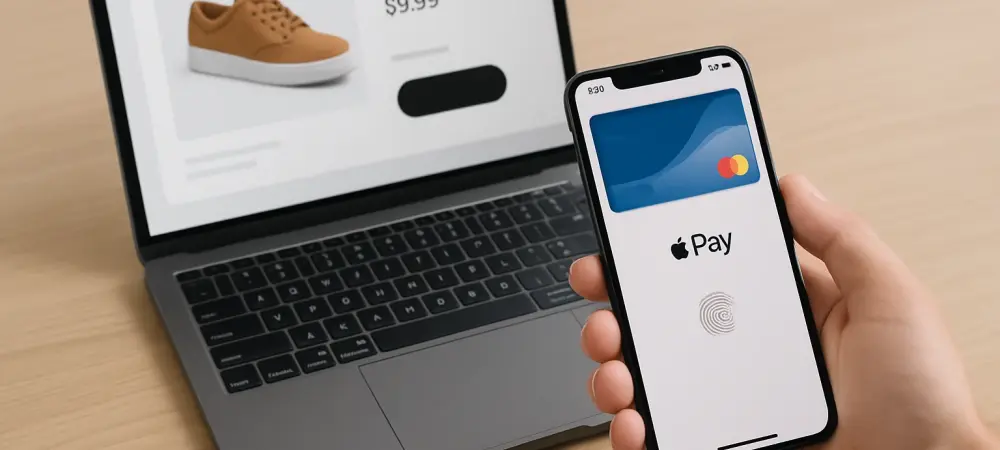

Apple Pay, launched as a contactless payment system, has redefined how transactions occur in the online shopping realm. Compatible with a wide range of Apple devices, including iPhones, iPads, and Macs, it allows users to make payments with a simple tap or glance using biometric authentication. Its core functionality lies in tokenization, replacing sensitive card information with a unique code for each transaction, thus enhancing security. This technology has positioned Apple Pay as a game-changer by streamlining the payment process and aligning with the modern demand for quick, hassle-free experiences.

The significance of Apple Pay extends beyond mere convenience, addressing critical pain points in digital transactions. As consumers increasingly prioritize speed and safety, traditional checkout methods involving manual data entry often fall short, leading to frustration and abandoned purchases. Apple Pay’s ability to minimize these barriers has made it a vital tool in meeting evolving expectations, ensuring that e-commerce platforms remain competitive in a crowded market.

Key Features and Benefits on TJ’s Platform

Speed and Efficiency at Checkout

One of the standout advantages of Apple Pay on TJ’s platform is its ability to drastically reduce checkout times. Transactions that once took minutes, bogged down by form-filling and verification steps, can now be completed in mere seconds with a single tap. This efficiency is especially impactful for mobile users who often shop on the go and expect instantaneous results.

This rapid process has a direct effect on reducing cart abandonment, a persistent issue for online merchants. By eliminating tedious steps, Apple Pay ensures that customers are more likely to finalize their purchases, thereby boosting conversion rates. For businesses integrated with TJ, this translates into tangible growth and improved revenue streams.

Seamless Convenience via Apple Wallet

Apple Pay’s integration with Apple Wallet further enhances its appeal by securely storing payment and shipping details. Customers no longer need to input card numbers or addresses manually during each transaction, as the system retrieves pre-saved information effortlessly. This feature simplifies the purchasing journey, making it more intuitive for users.

The convenience factor plays a significant role in elevating the overall shopping experience on TJ’s platform. Shoppers can focus on selecting products rather than navigating complex payment forms, fostering a sense of ease. For merchants, this streamlined approach often leads to repeat business, as satisfied customers are more likely to return.

Robust Trust and Security Measures

Security remains a cornerstone of Apple Pay, instilling confidence in users through advanced protective features. With Touch ID and Face ID for authentication, alongside unique transaction codes for each payment, the system ensures that sensitive data is never exposed. Merchants never receive actual credit card details, adding an extra layer of protection against fraud.

This emphasis on trust addresses a major concern in online transactions where data breaches can deter potential buyers. By prioritizing user safety, Apple Pay not only safeguards personal information but also builds a reliable reputation for platforms like TJ. Customers feel secure knowing their financial details are handled with the utmost care.

Trends in Frictionless Payment Solutions

The e-commerce sector is witnessing a surge in demand for seamless payment options, driven by consumer expectations for efficiency and simplicity. Apple Pay aligns perfectly with this trend, offering a user-friendly alternative to traditional methods that often involve multiple steps. Its adoption reflects a broader shift toward technologies that prioritize the customer experience.

Consumer behavior is also evolving, with a clear preference for faster checkouts and heightened security. The industry’s focus on reducing cart abandonment has spurred innovations like Apple Pay, which tackle these issues head-on. As digital shopping continues to dominate, solutions that minimize friction are becoming indispensable for staying relevant. This trend underscores a critical insight: payment systems are no longer just transactional tools but integral components of customer satisfaction. Platforms integrating Apple Pay, such as TJ, are well-positioned to meet these modern demands, setting a benchmark for competitors. The push for frictionless experiences is reshaping how online businesses approach sales strategies.

Impact on Merchants and Customers

For online merchants using TJ’s platform, Apple Pay integration offers measurable benefits, particularly in boosting conversion rates. By simplifying the payment process, businesses see fewer abandoned carts and higher completion rates, directly impacting their bottom line. This advantage is especially pronounced in mobile shopping scenarios where speed is paramount.

Customers, on the other hand, gain a smoother and more reliable shopping experience. The ability to pay quickly without compromising security fosters trust and loyalty, encouraging them to engage more frequently with merchants on TJ’s platform. Specific use cases, such as impulse purchases during sales events, highlight how Apple Pay caters to immediate buying decisions.

Beyond individual transactions, the broader impact lies in enhancing overall satisfaction for both parties. Merchants benefit from competitive transaction fees offered by TJ, ensuring profitability isn’t sacrificed for innovation. Meanwhile, customers appreciate the consistency and ease, reinforcing the value of adopting such cutting-edge payment methods.

Challenges and Limitations in Adoption

Despite its strengths, Apple Pay integration faces certain hurdles, notably its exclusivity to Apple device users. This limitation excludes a significant portion of customers who rely on other operating systems, potentially narrowing the reach for merchants on TJ’s platform. Addressing this gap remains a key challenge for wider adoption.

Technical and market barriers also exist, particularly for merchants operating outside TJ’s ecosystem. Compatibility issues or lack of awareness can hinder implementation, slowing the technology’s penetration in diverse markets. Efforts to expand accessibility, such as partnerships or educational campaigns, are essential to overcoming these obstacles.

Additionally, the reliance on specific hardware and software configurations can pose integration complexities for some businesses. While TJ mitigates this with hassle-free setup, the broader industry must work toward inclusive solutions that cater to varied technological environments. These challenges highlight areas for improvement in the ongoing evolution of digital payments.

Future Prospects in Online Transactions

Looking ahead, Apple Pay holds immense potential for expanding its footprint in e-commerce. Efforts to support additional platforms or devices could bridge current gaps, making the technology accessible to a broader audience over the coming years, from 2025 to 2027. Such developments would further solidify its role in the payment landscape.

The long-term implications for online transactions are profound, with Apple Pay poised to set new standards for speed and security. As it gains traction, it may influence consumer expectations, pushing other payment systems to innovate similarly. This ripple effect could redefine how digital commerce operates on a global scale.

Moreover, the integration of Apple Pay into diverse sectors beyond retail, such as services or subscriptions, signals untapped opportunities. Its ability to adapt to emerging needs will likely shape future payment trends, encouraging platforms like TJ to stay ahead of the curve. The trajectory suggests a pivotal role in the ongoing transformation of transactional experiences.

Final Thoughts and Verdict

Reflecting on the evaluation, Apple Pay’s integration into Transaction Junction’s platform proves to be a significant step forward in enhancing the e-commerce checkout process. Its blend of speed, security, and convenience addresses longstanding friction points, delivering measurable benefits to both merchants and customers. The technology demonstrates a clear edge in improving conversion rates and fostering trust.

For merchants seeking to optimize their online presence, the next step involves leveraging this integration to attract a tech-savvy audience while exploring complementary solutions to cater to non-Apple users. Collaborating with platforms like TJ to refine payment strategies emerges as a practical approach to maximizing returns. Staying attuned to evolving consumer preferences also becomes crucial for sustained success.

Beyond immediate gains, the broader consideration is how Apple Pay could inspire innovation across the payment industry. Merchants and platforms alike are encouraged to monitor its expansion and adapt to emerging standards over time. This review concludes that Apple Pay stands as a powerful tool, with the potential to drive lasting change if paired with inclusive growth strategies.