Apple has recently announced the discontinuation of its in-house Buy Now, Pay Later (BNPL) service, Apple Pay Later, less than a year after its launch. Introduced in the fall, Apple Pay Later enabled users to split transactions up to $1,000 into four interest-free payments. While the service showed promise and generated initial excitement among consumers, Apple faced significant challenges that made its continuation untenable. This article delves into the multiple facets of why Apple made this decision, the impact on its broader fintech objectives, and what the future holds for the company in the BNPL space.

Introduction to Apple Pay Later’s Short Journey

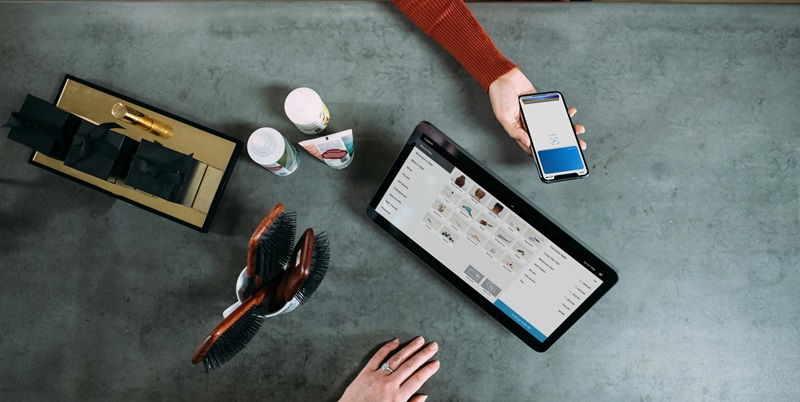

Apple Pay Later was launched with substantial fanfare, aiming to tap into the growing demand for interest-free installment payment options. The service promised to make high-ticket purchases more manageable by allowing users to spread the cost over four interest-free payments. This concept quickly attracted attention, not only for its convenience but also because it integrated smoothly with Apple’s existing ecosystem, including Apple Pay. However, the promising start was short-lived as Apple encountered several significant hurdles. The operational and regulatory issues encountered underscore the complexity of managing financial products, even for a tech giant like Apple. This brief but turbulent journey highlights the challenges that can arise when a tech company ventures into the realm of financial services.

Throughout its brief existence, Apple Pay Later showcased both the potential and the pitfalls of such an offering. Users were offered the convenience and flexibility that are hallmarks of successful BNPL services. However, behind the scenes, Apple was grappling with the intricate details of running a financial service. These barriers proved insurmountable in Apple’s current operational framework, leading to the decision to pivot the company’s strategy. This shift illuminates the difficulties faced by technology companies when they try to extend their reach into heavily regulated financial sectors.

Operational and Regulatory Challenges

One of the primary reasons behind Apple’s decision to discontinue Apple Pay Later lies in the complex operational challenges the company faced. Managing a BNPL service internally requires significant resources and specialized expertise in financial services. Apple had to handle credit checks, manage loan decisions, and oversee the entire financial operation through a fully-owned subsidiary. The extensive requirements and complexities involved in this setup quickly became apparent, putting a considerable strain on Apple’s resources. This complexity necessitated a reassessment of whether managing a BNPL service internally was the best strategic choice for Apple moving forward.

Additionally, the company faced a substantial regulatory burden that added to the operational challenges. The Consumer Financial Protection Bureau (CFPB) recently introduced an interpretive rule that treats BNPL services like credit cards, subjecting them to stricter regulatory scrutiny. The added compliance requirements further complicated Apple’s efforts to offer the service under its terms. Balancing these regulatory demands while trying to sustain an effective and user-friendly BNPL service proved to be a formidable challenge. This evolving regulatory environment played a decisive role in Apple’s choice to exit the in-house BNPL market. As regulatory pressures continued to mount, it became increasingly clear that the operational and compliance costs were too significant to justify continuing the service internally.

Competitive Landscape and Market Dynamics

The market for BNPL services is intensely competitive, with well-established players like Klarna and Affirm leading the space. These companies offer a variety of financing options that provide them with a competitive edge over new entrants. Apple Pay Later, despite its initial excitement, struggled to carve out a significant share of the market due to its relatively limited scope and features. The intense competition meant that Apple would need to invest heavily to bring its BNPL service on par with the offerings of these established providers. While Apple is no stranger to competition, the unique challenges of the BNPL sector required a different approach.

Moreover, the fintech sector is characterized by rapid changes in market dynamics, driven by both new regulatory measures and shifting consumer preferences. Established BNPL providers have already navigated these complexities and adapted their offerings accordingly. For Apple, replicating this level of adaptability within its newly launched service would have been a daunting task, given the existing operational and regulatory hurdles. The continually evolving nature of the fintech landscape added another layer of complexity to Apple’s decision-making process. Staying competitive would require constant innovation and quick pivots, something that proved particularly challenging for a service still in its infancy.

Strategic Pivot: Embracing Partnerships

Given the numerous operational and regulatory challenges, Apple decided to shift its strategy to integrate BNPL services from third-party providers into the Apple Pay ecosystem. This strategic pivot allows the company to offer BNPL options without shouldering the burdens of managing such services internally. Partnerships with established BNPL providers, such as Affirm, enable Apple to leverage the expertise and infrastructure of these specialized entities. By doing so, Apple can continue to provide BNPL solutions to its users while mitigating the risks and complexities associated with managing financial services directly.

This approach not only helps Apple alleviate operational and regulatory challenges but also broadens its reach and enhances the user experience. By combining forces with well-established BNPL providers, Apple can offer a more comprehensive and competitive set of financing options. This partnership-centric model is a more sustainable way for Apple to continue participating in the BNPL market. The focus shifts from direct competition with specialized financial service providers to a more collaborative framework that benefits from the best of both worlds: Apple’s strong brand and ecosystem and the financial expertise of its partners.

Expanding Apple Pay Ecosystem

Apple’s decision to discontinue its in-house BNPL service is a part of a broader strategy aimed at expanding its payment ecosystem. By incorporating BNPL services from third-party providers into Apple Pay, the company can extend its service offerings and remain competitive in the rapidly evolving fintech space. This integration is expected to be featured in the forthcoming iOS update, marking a significant advancement in Apple’s payment strategy. By deciding to integrate these services under the Apple Pay umbrella, Apple can continue to provide users with flexible payment options without the operational and regulatory stresses of running a BNPL service internally.

Moreover, Apple aims to support a broader range of devices, including Google Chrome and Windows, further extending the reach of its payment services. This inclusive approach is designed to capture a larger market share and enhance Apple Pay’s utility beyond the confines of the Apple ecosystem. By making Apple Pay more versatile and accessible, Apple can attract a more diverse customer base, including those who do not exclusively use Apple devices. This strategy not only helps in broadening Apple’s reach but also solidifies its position as a key player in the digital payment landscape.

Broader Implications for Apple’s Fintech Aspirations

Apple has recently revealed the discontinuation of its in-house Buy Now, Pay Later (BNPL) service, Apple Pay Later, less than a year after its initial rollout. Introduced in the fall, Apple Pay Later allowed users to break down transactions up to $1,000 into four interest-free installments. Although the service generated considerable excitement and showed early promise among users, Apple encountered substantial challenges that rendered its continuation impractical. These issues included operational hurdles and increased competition in the BNPL sector. This article explores the myriad reasons behind Apple’s decision, the implications for its broader fintech ambitions, and the potential future strategies the company might employ in the BNPL arena. This move raises questions about Apple’s ability to sustain its competitive edge in the fast-evolving financial technology landscape, and what their exit from this sector might mean for consumers and competitors alike.